>>60578174It’s game night at the Fed’s house, you keep crying “but according to the rules of bridge!” Bridge was two games ago, we’re playing hearts now.

Continued monetary expansion is all they care about as liquid assets will always inflate faster and more fully than the illiquid asset Labor, this is the mechanism behind oligarchal parasitism.

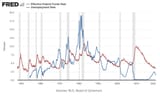

Pre-GFC monetary expansion was driven by falling rates, effectively a systemic credit kite.

GFC->2019 monetary expansion was driven by QE, Fed however was legally limited to the size of their balance sheet, and when they tried to run it down a wee little bit (as they were approaching their balance sheet limit) the repo market blew-up: Enter Scamdemic.

Corona was used to paper over the Sep ‘19 repo blow-up, remove what little restrictions the Fed had, and to intentionally drive up consumer prices (which is not inflation, inflation is expansion of money stock) to provide justification for long-term high rates.

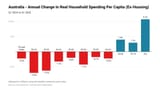

During the game Systemic Credit Kite yields were jacked-up when unemployment fall “too low” i.e. wagies started demanding their fair share. Jacking rates stressed the credit kite, leading to business failures and forcing the wagie back in the cagie.

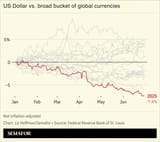

But we are no longer playing Systemic Credit Kite, bond yields stress nothing, bonds are always negative real yield, so don’t compete with equities et al for dollars. Going forward bond yield will drive monetary expansion, this is why the Fed is so reluctant to lower rates. The game has changed.