>>60601632Kind of agree with this..

Remember the Silvergate bank collapse (there where a few others)? Rate rose fairly quickly, making the market value of pre-existing bonds trade lower. $100 million worth of treasury bonds yielding 0.5% are obviously not gonna sell for $100 million when you can buy treasury bonds at 5% yield, so in the case of silvergate where they were forced to sell their treasury bonds they sold at a loss.

If rates go significant lower, a lot of pre-existing bonds will begin to trade at a premium, the balance sheet of a lot of companies/banks will balloon overnight.

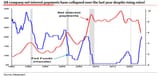

On the flipside (pic related), another interesting thing during the sudden rate hikes was that the net interest rate payment FELL as rates rose.. Why? Because limited new debt was issued during that time, meanwhile existing cash began to yield higher interest (Net interest payment is = income from interest minus expenditures on interest).

So my guess is a spike from the appreciation of outstanding bonds, followed by a return to status quo because of higher net interest payment.