Anonymous

ID: hF3SUvK6

7/14/2025, 5:29:42 AM No.60622853

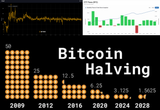

>tfw ETF demand already 2x monthly issuance

>halving in 2028 cuts supply in HALF again

>no one is ready for what happens when TradFi tries to buy 4x more BTC than exists

>450 BTC/day -> 225 BTC/day

>BlackRock alone will eat the float by breakfast

>mfw normies still think $118k is expensive

you had 15 years and you're still fucking early

>halving in 2028 cuts supply in HALF again

>no one is ready for what happens when TradFi tries to buy 4x more BTC than exists

>450 BTC/day -> 225 BTC/day

>BlackRock alone will eat the float by breakfast

>mfw normies still think $118k is expensive

you had 15 years and you're still fucking early

Replies: