Anonymous

ID: xzei5D3J

8/4/2025, 5:25:36 PM No.60737161

>Bullrun peak is often in the post-halving year and pre midterm election year

>FED barely lowered rates in % terms

>Usually FED cuts take 6 months for liquidity to hit the crypto market

>Cuts seem to be in order for september

Is this cycle different bros? Will we get a rally this fall like every past cycle?

I can already see people talking about supercycle and this bullrun taking longer to deflate.

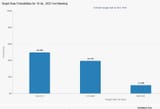

FED watch predicts three 25bps cuts by december 2025 but how is the bullrun going to be over if the FED keeps lowering rates into 2026-2027?

>FED barely lowered rates in % terms

>Usually FED cuts take 6 months for liquidity to hit the crypto market

>Cuts seem to be in order for september

Is this cycle different bros? Will we get a rally this fall like every past cycle?

I can already see people talking about supercycle and this bullrun taking longer to deflate.

FED watch predicts three 25bps cuts by december 2025 but how is the bullrun going to be over if the FED keeps lowering rates into 2026-2027?

Replies: