Anonymous

ID: g5itSJmM

8/4/2025, 8:44:24 PM No.60738207

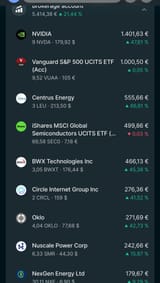

Assume a NEET has 20k and wants to grow it as fast as possible, but will rope if there is a significant loss.

I think I figured out how to combat the NAV erosion problems of yieldmax

Cycling divvies from SPYI + QQQI -> ULTY -> MSTY -> ULTY -> MSTY -> SPYI + QQQI

Then periodically stopping the loop to put all the profits into schd, schg, VOO etc. A stock with either dividend growth or share price growth.

The NEET won't need to worry about tax and the overall portfolio will grow despite the NAV erosion.

I feel like you can snowball 20k into 100k pretty quick and relatively risk controlled in 2-5 years.

I think I figured out how to combat the NAV erosion problems of yieldmax

Cycling divvies from SPYI + QQQI -> ULTY -> MSTY -> ULTY -> MSTY -> SPYI + QQQI

Then periodically stopping the loop to put all the profits into schd, schg, VOO etc. A stock with either dividend growth or share price growth.

The NEET won't need to worry about tax and the overall portfolio will grow despite the NAV erosion.

I feel like you can snowball 20k into 100k pretty quick and relatively risk controlled in 2-5 years.

Replies: