>>60770803>Also, i understood the idea behind the modules, but an interactive tutorial for the research module will be needed anyways.Yeah, it's not done, just a mockup. I have to prioritize certain things, right now I sorta just play pretend and imagine my workflow when it's done. I just want to be able to work with any dataset (including a pre-computed signal database) and combine any strategies post-hoc with a suite of tested, robust code at the click of a button.

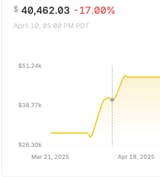

>i would also put a button above the chart to switch to some other charting tools providers (tradingview for example) unless you want to implement every charting tool that these other providers have available (there is nothing wrong with this i guess).I agree the monitor tab also needs work, I think it will 'figure itself out' as I begin using it, so I haven't budgeted much time to it. the charting software is actually from tradangview's lightweight chart library.

I just hope the notebook driven UI makes sense and is appealing enough some people, at worse I'll have a nice UI for myself. you can export the button driven UI to Jupyter notebook code, so I thought that was kinda cool. then users could make their own UI in that manner in the IDE, too. anyway, thx for the feedback. good luck on your journey m8