Anonymous

6/14/2025, 1:58:41 AM No.1412850

https://www.nytimes.com/interactive/2025/06/12/upshot/gop-megabill-distribution-poor-rich.html

https://apnews.com/article/trump-tax-bill-hurts-poor-helps-rich-cbo-f3d9d46ca3e829d6b850dca30b91a2b6

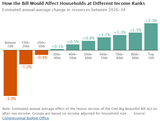

WASHINGTON (AP) — The Republican tax bill approved by the U.S. House of Representatives would cost the poorest Americans roughly $1,600 a year while increasing the income of the wealthiest households by an average of $12,000 annually, according to a new analysis released Thursday by the Congressional Budget Office.

Middle-income households would see a boost of roughly $500 to $1,000 per year under Republican President Donald Trump’s tax bill, the CBO found.

The cuts to the lowest-income households come from proposed cuts to social safety net programs including Medicaid and a food assistance program for lower-income people, known as Supplemental Nutrition and Assistance Program.

The bill also proposes expanding work requirements to receive food aid and new “community engagement requirements” of at least 80 hours per month of work, education or service for able-bodied adults without dependents to receive Medicaid. Some proposed tax breaks would be temporary, including a tax break on tips and overtime, car loan interest and a $4,000 increase in the standard deduction for seniors.

https://apnews.com/article/trump-tax-bill-hurts-poor-helps-rich-cbo-f3d9d46ca3e829d6b850dca30b91a2b6

WASHINGTON (AP) — The Republican tax bill approved by the U.S. House of Representatives would cost the poorest Americans roughly $1,600 a year while increasing the income of the wealthiest households by an average of $12,000 annually, according to a new analysis released Thursday by the Congressional Budget Office.

Middle-income households would see a boost of roughly $500 to $1,000 per year under Republican President Donald Trump’s tax bill, the CBO found.

The cuts to the lowest-income households come from proposed cuts to social safety net programs including Medicaid and a food assistance program for lower-income people, known as Supplemental Nutrition and Assistance Program.

The bill also proposes expanding work requirements to receive food aid and new “community engagement requirements” of at least 80 hours per month of work, education or service for able-bodied adults without dependents to receive Medicaid. Some proposed tax breaks would be temporary, including a tax break on tips and overtime, car loan interest and a $4,000 increase in the standard deduction for seniors.

Replies: