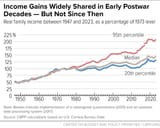

How do we fix this? In the 1950s joe could buy a house and make enough so that his wife can stay home with the kids on a single income. Now joe and his wife need 2x jobs and may never own a home, renting forever. This is not sustainable

A plague or extremely deadly war, followed by a revolution.

>>508433768 (OP)For us, it was boomera realising they could make a fortune investing in land and houses

1980 (as OP graph clearly shows) is when Financialization of the global economy began.

Speculative debt based instruments which never existed before, became the standard on wall street and in banking: credit default swaps, options, CDOs, derivatives, MBSs

Financialization is about making money off of money: Nothing else

The first phase of Financialization of the global economy became official with the 1999 repeal of Glass-Steagall, making the global investment banks into casinos.

The Money Deluge — must-watch 40 mins documentary

https://www.youtube.com/watch?v=t6m49vNjEGs

https://en.wikipedia.org/wiki/Financialization