Anonymous

ID: 8BZHGpoc

8/6/2025, 8:42:23 AM No.512353105

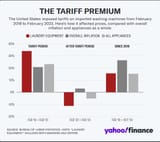

This is meant to be a serious question. Most economists say tariffs are a tax on US consumers, but is that really the case? If foreign producers need to compete on price in the US, they cannot just put 250% on their products, but need to cut their own profits, no? So if Trump gets 1 trillion in tariff income per year, he can balance the US budget and thus reduce prices for US citizens, no?

—-

By July 2025, tariffs had raised $108 billion in net revenue in the previous nine months, compared to $392 billion in corporate tax and $3.648 trillion in income tax, and comprised 5% of federal revenue compared to 2% historically. Goldman Sachs reported that tariff incidence so far had fallen about 49% on US consumers, 39% on US businesses, and 12% on foreign exporters.

—-

By July 2025, tariffs had raised $108 billion in net revenue in the previous nine months, compared to $392 billion in corporate tax and $3.648 trillion in income tax, and comprised 5% of federal revenue compared to 2% historically. Goldman Sachs reported that tariff incidence so far had fallen about 49% on US consumers, 39% on US businesses, and 12% on foreign exporters.

Replies: