>>513501848>people probably just got bored of laughing at chinksExplain under what conditions that constitutes a failure.

>people get truthpilled>laughter stopsI keep posting truthpills and people get sober.

Pic rel, George Soros did the exact same thing to Asia in 1997.

South Korea lost. IMF turned them into the whore of babylon.

Hong Kong survived only because the Hong Kong Monetary Authority spent $1 billion dollars in 1997 money to defend the HKD.

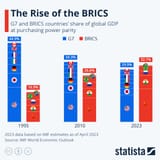

>In October 1997, the Hong Kong dollar, which had been pegged at 7.8 to the U.S. dollar since 1983, came under speculative pressure because Hong Kong's inflation rate had been significantly higher than the United States' for years. Monetary authorities spent more than $1 billion to defend the local currency. Since Hong Kong had more than $80 billion in foreign reserves, which is equivalent to 700% of its M1 money supply and 45% of its M3 money supply, the Hong Kong Monetary Authority (HKMA, effectively the region's central bank) managed to maintain the peg.[66]The global banking system predatorily extorts countries it's trying to neo-colonize by trying to catch them slipping if they don't maintain enough of foreign reserve currencies to defend against attacks on their local currencies, meaning you have to keep vast cash reserves effectively stagnant and not able to be spent on long-term investments or to improve the QoL of your own people. The only way to spend that surplus in foreign reserve currency is to buy foreign bonds, which means that money is basically pumped back into America/European countries, and America/Europe have effectively taken the resources from Africa AND the money Africa earned in selling them back for free in exchange for some small annual payment, and they can use the liquid money to invest.

![OB-XG630_bowrin_P_20130429105811[1]](/thumb/pol/1755649827225199.jpg)

![1729093028300913[1]_thumb.jpg](/thumb/pol/1749866158562551s.jpg)

![66ff79557391d[2]](/thumb/pol/1755650517752421.jpg)

![asian_financial_crisis_720x450[1]](/thumb/pol/1755652559427420.jpg)

![southern-hemisphere[1]](/thumb/pol/1755653063778795.png)