Search Results

8/11/2025, 6:27:35 PM

>>512781006

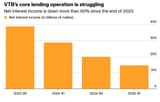

Russian banking is in torrid times. Liquidity is drying up, delinquent payments are soaring, and no-one sensible believes the 8T in reserves are sufficient for what's unfolding before our eyes.

Some choice quotes from this article about VTB, Russia's 2nd biggest bank:

>VTB’s official cost of risk, a key indicator of credit quality, rose to 0.8% from 0.6% year-on-year, and for individuals it roughly doubled from 1.2%. Non-payment of loans from individuals was up 32% in the year to date. That all suggests the bank is having difficulties with the repayment of retail loans at a time when mortgage delinquencies in particular are known to be rising.

>However, the officials have privately noted that when it comes to the corporate portfolio, loan restructurings and the lack of visibility on war-related debt means it is hard to get an accurate picture of the true state of the loan book.

https://www.bloomberg.com/news/articles/2025-08-11/russia-s-vtb-bank-sees-lending-income-collapse-amid-war-pressure

The gist of what's happening is that Russia has masked its economic recession from 2022 with an explosion of military spending and unreasonably cheap credit for everyone. Now that capital is drying up and loans are not being paid because it wasn't actually going anywhere productive (annexing bakhmut and avdiivka doesn't result in trillions of rubles being generated - big surprise) banks are teetering on the brink. If they don't have capital but loads of liabilities things start to enter meltdown.

There are still stores of emergency capital and so the availability and depths of these will likely be tested in the coming months.

Russian banking is in torrid times. Liquidity is drying up, delinquent payments are soaring, and no-one sensible believes the 8T in reserves are sufficient for what's unfolding before our eyes.

Some choice quotes from this article about VTB, Russia's 2nd biggest bank:

>VTB’s official cost of risk, a key indicator of credit quality, rose to 0.8% from 0.6% year-on-year, and for individuals it roughly doubled from 1.2%. Non-payment of loans from individuals was up 32% in the year to date. That all suggests the bank is having difficulties with the repayment of retail loans at a time when mortgage delinquencies in particular are known to be rising.

>However, the officials have privately noted that when it comes to the corporate portfolio, loan restructurings and the lack of visibility on war-related debt means it is hard to get an accurate picture of the true state of the loan book.

https://www.bloomberg.com/news/articles/2025-08-11/russia-s-vtb-bank-sees-lending-income-collapse-amid-war-pressure

The gist of what's happening is that Russia has masked its economic recession from 2022 with an explosion of military spending and unreasonably cheap credit for everyone. Now that capital is drying up and loans are not being paid because it wasn't actually going anywhere productive (annexing bakhmut and avdiivka doesn't result in trillions of rubles being generated - big surprise) banks are teetering on the brink. If they don't have capital but loads of liabilities things start to enter meltdown.

There are still stores of emergency capital and so the availability and depths of these will likely be tested in the coming months.

Page 1