Search Results

ID: IorkQqaQ/biz/60559384#60560856

6/29/2025, 4:32:04 PM

Just a reminder to the

>WHY IS THE FED NOT CUTTING

guys

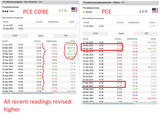

Here's PCE from last year vs this year. Only PCE is somewhat down. That's obviously because of Oil, but that will fade very soon if you look at the Oilchart.

Core PCE though is pretty much STUCK. Yes, the rates are lower now. But what if they were even lower? What if they lowered them now by another 0,75%? Would it then be ~2,7% again next year? It's 2,7% on top of 2,7-2,8% (one reading even 3% (revised)). The May 2025 reading was lower, because May 2024 was higher (2,8%). Jule, July and August 2024 were 2,6%, so the 2025 reading might end up higher (like it did just now with 2,7% (unrevised yet))

Likewise PCE was high in April and May 2024 with 2,7%. This helped having a lower yoy PCE. But from June 2024 onwards it goes down, increasing the risk of 2025 PCE being above 2,3%.

Inflation is at this level with rates above 4%. EU is at lower inflation with lower rates.

>WHY IS THE FED NOT CUTTING

guys

Here's PCE from last year vs this year. Only PCE is somewhat down. That's obviously because of Oil, but that will fade very soon if you look at the Oilchart.

Core PCE though is pretty much STUCK. Yes, the rates are lower now. But what if they were even lower? What if they lowered them now by another 0,75%? Would it then be ~2,7% again next year? It's 2,7% on top of 2,7-2,8% (one reading even 3% (revised)). The May 2025 reading was lower, because May 2024 was higher (2,8%). Jule, July and August 2024 were 2,6%, so the 2025 reading might end up higher (like it did just now with 2,7% (unrevised yet))

Likewise PCE was high in April and May 2024 with 2,7%. This helped having a lower yoy PCE. But from June 2024 onwards it goes down, increasing the risk of 2025 PCE being above 2,3%.

Inflation is at this level with rates above 4%. EU is at lower inflation with lower rates.

Page 1