Search Results

7/18/2025, 11:53:13 PM

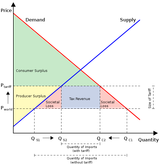

The tax incidence (who pays what proportion of the tax) depends on the price elasticity of supply and demand which depends on the each particular item imported. If consumers are less sensitive to price (more inelastic) they are won't reduce their demand much relative to the price increase and will end up paying a relatively larger portion of the tarrif. Examples of this type of good are things people need or really want and can't easily substitute something else for like gasoline or imported iPhones or RTX 5090s that nerds will buy at any price.

For goods like crap Chinese toys or some junk that can be easily substituted, tarrifs will me mostly borne by the producer but the consumer will still pay a portion of it.

If you study econ you will find that among the different methods of limiting imports, like tarrifs, quotas, price controls, etc. Tarrifs actually have the highest deadweight loss and harm society the most as a whole. Only the government and domestic producers benefit while consumers as a whole get fucked.

It's basic econ bros.

For goods like crap Chinese toys or some junk that can be easily substituted, tarrifs will me mostly borne by the producer but the consumer will still pay a portion of it.

If you study econ you will find that among the different methods of limiting imports, like tarrifs, quotas, price controls, etc. Tarrifs actually have the highest deadweight loss and harm society the most as a whole. Only the government and domestic producers benefit while consumers as a whole get fucked.

It's basic econ bros.

Page 1