Search Results

6/27/2025, 3:54:36 AM

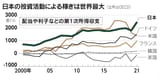

During the Strong Yen period (1985–2012), Japanese firms actively offshored production to China, ASEAN, Mexico, etc. This wasn't just cost-cutting, it was a currency risk hedge. Overseas affiliates send back, dividends, interest income, royalties and service fees. These don’t count as exports, but are huge for corporate profits.

Japan turned Strong Yen into a foreign-asset empire. Today, it earns like a rentier nation, not just from what it exports, but from what it owns. The thing is, Japan created "Another Japan" in foreign territories.

Japan turned Strong Yen into a foreign-asset empire. Today, it earns like a rentier nation, not just from what it exports, but from what it owns. The thing is, Japan created "Another Japan" in foreign territories.

6/20/2025, 2:47:49 PM

>>211926834

During the Strong Yen period (1985–2012), Japanese firms actively offshored production to China, ASEAN, Mexico, etc. This wasn't just cost-cutting, it was a currency risk hedge.

Overseas affiliates send back, dividends, interest income, royalties and service fees. These don’t count as exports, but are huge for corporate profits.

Japan turned a Strong Yen into a foreign-asset empire. Today, it earns like a rentier nation, not just from what it exports, but from what it owns. The thing is, Japan created "Another Japan" in foreign territories.

During the Strong Yen period (1985–2012), Japanese firms actively offshored production to China, ASEAN, Mexico, etc. This wasn't just cost-cutting, it was a currency risk hedge.

Overseas affiliates send back, dividends, interest income, royalties and service fees. These don’t count as exports, but are huge for corporate profits.

Japan turned a Strong Yen into a foreign-asset empire. Today, it earns like a rentier nation, not just from what it exports, but from what it owns. The thing is, Japan created "Another Japan" in foreign territories.

Page 1