Search Results

7/8/2025, 5:24:39 PM

>>509827954

There are 2 types of fiat currency:

1. Physical cash and coins printed, minted or coined by the central banks (or for them by private businesses under exclusivity contracts with the central banks).

2. Money of account. This is fictional cash and coins which don't exist physically and are just promises to pay cash or coins, in the same nominal amount, to the holder, on demand. They exist on the ledgers of the banking system.

Banks have been granted the right to "legally" deceive the entirety of society that the second type of fiat currency is the same as the first or that it doesn't exist, with the implication being that the second type of fiat currency is actually the first type when it really isn't. The proof that these two are not the same type of fiat currency, and also the proof that there is *A LOT* more of the second type in existence than the first, is that banks can run out of the first type of fiat currency to honour "withdrawal" requests against the second type, by depositors who think they're the same thing, and to avoid that happening, there are laws on the books in every country to force private individuals and businesses to store their physical fiat currency notes and coins, above a meagre amount, in banks and thus only use the second type of fiat currency for their larger transactions. In addition to this, convenience and online purchases ensure that most people prefer the second type of fiat currency.

While only central banks control the creation and issuance into circulation in the economy of the first type of fiat currency, any non-central bank anywhere can issue more of the second type of fiat currency into circulation. They do this by pretending to "lend" the first type of fiat currency to willing borrowers. But in actual fact, they just create more of the second type of fiat currency when they approve the "loan" (which is actually credit and not a loan) and issue it to the borrower. Or a credit card holder pays for something with it.

There are 2 types of fiat currency:

1. Physical cash and coins printed, minted or coined by the central banks (or for them by private businesses under exclusivity contracts with the central banks).

2. Money of account. This is fictional cash and coins which don't exist physically and are just promises to pay cash or coins, in the same nominal amount, to the holder, on demand. They exist on the ledgers of the banking system.

Banks have been granted the right to "legally" deceive the entirety of society that the second type of fiat currency is the same as the first or that it doesn't exist, with the implication being that the second type of fiat currency is actually the first type when it really isn't. The proof that these two are not the same type of fiat currency, and also the proof that there is *A LOT* more of the second type in existence than the first, is that banks can run out of the first type of fiat currency to honour "withdrawal" requests against the second type, by depositors who think they're the same thing, and to avoid that happening, there are laws on the books in every country to force private individuals and businesses to store their physical fiat currency notes and coins, above a meagre amount, in banks and thus only use the second type of fiat currency for their larger transactions. In addition to this, convenience and online purchases ensure that most people prefer the second type of fiat currency.

While only central banks control the creation and issuance into circulation in the economy of the first type of fiat currency, any non-central bank anywhere can issue more of the second type of fiat currency into circulation. They do this by pretending to "lend" the first type of fiat currency to willing borrowers. But in actual fact, they just create more of the second type of fiat currency when they approve the "loan" (which is actually credit and not a loan) and issue it to the borrower. Or a credit card holder pays for something with it.

7/8/2025, 2:39:21 PM

>>509825684

Is this... the power of GeeDeePee?

Is this... the power of GeeDeePee?

7/7/2025, 3:00:32 PM

>>509722568

When you go to the bank or the ATM to withdraw cash, you're actually asking to have your fictional cash and coins, which only exist as digits on the digital ledger of your bank, exchanged for physical cash and coins.

Regardless of your opinion on central banks, all non-central banking is legalised fraud because non-central banks issue (create and introduce into circulation) fictional cash and coins by pretending to "lend" it to willing borrowers, who then spend it into the economy, and lying to everyone in society that that fictional cash and coins actually physically exists or is backed by existing physical cash and coins in the same actual amount. Not the case. And this is all somehow ((("legal"))) because jews lying to non-jews and deceiving them and robbing them is perfectly fine as far as jews are concerned.

However, although most banks, in most places, will allow you to exchange your fictional fiat currency notes and coins for physical fiat currency notes and coins, they will put a daily limit on how much of the first type of fiat currency you can exchange for the latter. Or, if you want to exchange large amounts, they'll make you schedule the withdrawal days to weeks in advance. And in some of the most pozzed and jewed jew world order shitholes, which are the 5 eyes countries, banks are starting to outright refuse to allow you to withdraw your cash (actually exchange your fictional cash and coins for physical ones) as steps are being taken to get rid of cash altogether there.

Without cash, bank runs aren't possible because there is no physical cash and coins you can request to have your fictional cash and coins exchanged for when you try and "withdraw" some of your cash you think exists in the bank vault. With bank runs being impossible, every non-central bank becomes its own central bank, with no limit on digital fiat currency creation. Especially combined with de facto or (in the case of the US, de jure since 2020) zero reserve requirements.

When you go to the bank or the ATM to withdraw cash, you're actually asking to have your fictional cash and coins, which only exist as digits on the digital ledger of your bank, exchanged for physical cash and coins.

Regardless of your opinion on central banks, all non-central banking is legalised fraud because non-central banks issue (create and introduce into circulation) fictional cash and coins by pretending to "lend" it to willing borrowers, who then spend it into the economy, and lying to everyone in society that that fictional cash and coins actually physically exists or is backed by existing physical cash and coins in the same actual amount. Not the case. And this is all somehow ((("legal"))) because jews lying to non-jews and deceiving them and robbing them is perfectly fine as far as jews are concerned.

However, although most banks, in most places, will allow you to exchange your fictional fiat currency notes and coins for physical fiat currency notes and coins, they will put a daily limit on how much of the first type of fiat currency you can exchange for the latter. Or, if you want to exchange large amounts, they'll make you schedule the withdrawal days to weeks in advance. And in some of the most pozzed and jewed jew world order shitholes, which are the 5 eyes countries, banks are starting to outright refuse to allow you to withdraw your cash (actually exchange your fictional cash and coins for physical ones) as steps are being taken to get rid of cash altogether there.

Without cash, bank runs aren't possible because there is no physical cash and coins you can request to have your fictional cash and coins exchanged for when you try and "withdraw" some of your cash you think exists in the bank vault. With bank runs being impossible, every non-central bank becomes its own central bank, with no limit on digital fiat currency creation. Especially combined with de facto or (in the case of the US, de jure since 2020) zero reserve requirements.

7/6/2025, 12:08:56 PM

>>509645189

Capitalism is a jewish scam which runs on perpetual geometric expansion of the fiat currency supply and inevitably periodically fails through either hyperinflation or massive depression and cancellation of large swaths of the fiat currency supply, where the working class have their fiat savings cancelled in bank "failures" or "bail-ins", like in the Cyprus banking crisis.

Capitalism cannot afford to purchase its own aggregate internal production at a price which it is profitable to produce that output at, unless the money needed to constitute the profits is continually added to the system, such as by creating fiat currency (or more of it than is already in existence) or allowing counterfeiting or debasing of sound money such as silver coins, such as by reducing the purity or the weight of the coins.

However, the fiat creation needs to be continuous to enable continued capitalist production and the rate at which new fiat is created needs to accelerate (the growth needs to be geometric) or the rate of expansion of the fiat currency supply gradually approaches 0% of the already existing amount over time, as the supply grows, and so does the average possible rate of profit. Expanding the fiat supply from $10 trillion to $11 trillion within a year is a yearly growth of 10% but expanding it further, from $11 trillion to $12 trillion in the subsequent year is only a growth of 9.(09)%. For the fiat supply to grow another 10% in the second year, it needs to grow from $11 trillion to $12.1 trillion instead of just $12 trillion.

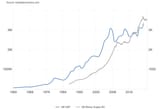

GDP is not economic activity but the estimated and inferred rate of spending of fiat per year.

Inflation, including due to scarcity - which forces people to spend their fiat savings into circulation, inflates the GDP. Deflation, including due to abundance, contracts the GDP.

Fiat currency is not wealth but merely claims on wealth.

Wealth is what you spend fiat currency on, not fiat currency itself.

Capitalism is not a closed loop or system.

Capitalism is a jewish scam which runs on perpetual geometric expansion of the fiat currency supply and inevitably periodically fails through either hyperinflation or massive depression and cancellation of large swaths of the fiat currency supply, where the working class have their fiat savings cancelled in bank "failures" or "bail-ins", like in the Cyprus banking crisis.

Capitalism cannot afford to purchase its own aggregate internal production at a price which it is profitable to produce that output at, unless the money needed to constitute the profits is continually added to the system, such as by creating fiat currency (or more of it than is already in existence) or allowing counterfeiting or debasing of sound money such as silver coins, such as by reducing the purity or the weight of the coins.

However, the fiat creation needs to be continuous to enable continued capitalist production and the rate at which new fiat is created needs to accelerate (the growth needs to be geometric) or the rate of expansion of the fiat currency supply gradually approaches 0% of the already existing amount over time, as the supply grows, and so does the average possible rate of profit. Expanding the fiat supply from $10 trillion to $11 trillion within a year is a yearly growth of 10% but expanding it further, from $11 trillion to $12 trillion in the subsequent year is only a growth of 9.(09)%. For the fiat supply to grow another 10% in the second year, it needs to grow from $11 trillion to $12.1 trillion instead of just $12 trillion.

GDP is not economic activity but the estimated and inferred rate of spending of fiat per year.

Inflation, including due to scarcity - which forces people to spend their fiat savings into circulation, inflates the GDP. Deflation, including due to abundance, contracts the GDP.

Fiat currency is not wealth but merely claims on wealth.

Wealth is what you spend fiat currency on, not fiat currency itself.

Capitalism is not a closed loop or system.

Page 1