>>515464242

Thanks for the link. The comments in Russian economic articles and videos are always top entertainment though I'm sure much of the humour is lost on Anglophones.

>>515464855

>extend moratorium

I really enjoy the language deployed by the Russian government to dance round these problems.

The side effect which isn't spoken about for prolonging bankruptcies, obviously in addition to the main consequences of low revenue and unpaid salaries .etc, is that all that bad credit - because it isn't written off - still exists as dodgy assets on banks' balance sheets or non-performing loans to use the financial lingo.

So the government isn't just manipulating the banking sector by making them buy government debt, lend cheaply to the military sector, and so on -

But by artificially blocking bankruptcies of companies with legal hurdles, banks don't just eat the losses of irrecoverable lent money but they can't even adjust their balance sheets accordingly because those terribad assets are still there on their accounts.

Under central bank regulations, having such a high volume of loans forces banks to keep higher amounts of capital stored as reserves with the central bank. These reserves earn zero interest btw. The central bank just sits on that money and it doesn't function as a deposit. So really Russian banks lose X% on that money every year where X is the rate of inflation. On top of their loan losses. So >100% losses on lent money.

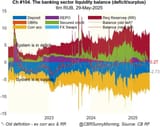

To spell it out: Banks are incurring losses on loans to failing companies but can't write them off so have to keep a % of that loan parked at the central bank which depreciates each year. To go back to our original posts, TsMAKP have said there is an ongoing liquidity crisis in the banking sector and urge the central bank to cut rates. But that won't really fix the problem. Companies need to be allowed to default and banks need to be able to write off debt, not just pay less interest. But this is intolerable for the government.

4chan Search

1 results for "8a178b95b4cfe5c8061e89e37fc6d7e7"