>>60938126

>But there’s a world where gold gets revalued huge and silver goes to $65 or something pathetic like that.

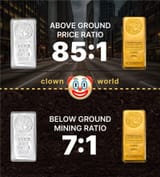

You won't see a world where the price ratio of silver to gold is 1000:1. Even 120:1 causes flow from gold to silver. Silver is produced at a 7:1 ratio to gold, and unlike gold, most silver production is actually consumed.

When they talk about "revaluing" gold, they are talking about a legal accounting fiction allowing the Treasury to arbitrarily declare the value of the US government gold holdings. Each $4000/oz price increment is worth $1 trillion based on the supposed 8500 tons the US claims to have.

Revaluing gold on the books to $24,000/oz would allow the Treasury to create $6 trillion free and clear that they could used to reduce their debt to GDP from the current 120% to maybe 80%, which if combined with some ruthless Yield Curve Control and some severe budget (entitlement) cutting, MIGHT allow the US government to dig herself out of the debt trap she is currently in.

The $6 trillion in new money would be inflationary, and would effectively devalue the existing debt as a bonus.

Will it happen? No politician who is involved in this scheme would ever get re-elected by the boomers.

Given that the only future of the US Federal Reserve Note is to monetize the debt, suppress real Treasury interest rates with YCC, and inflate away boomer entitlements, both gold and silver will be going up relative to Federal Reserve Notes until the dollar dies.

Given that silver is an essential element for many industries, some of which are price insensitive, the price of silver will likely always be bound to gold in some ratio, usually between 15:1 and 85:1.