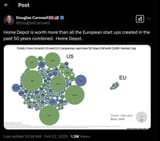

>>715453370

>Public

Issue #1. A lot of European companies, even rather big ones, are still family owned or otherwise not publicly listed

>Less than 50 years old

Issue #2. A lot of big European companies are OLD and then they just swallow up newcomers... also American and Chinese firms love to buy them out. So it's not that they don't exist, the problem is that as soon as their is a promising upstart, it quickly gets absorbed into a bigger, older entity (more protectionism is required here).

>Market cap

Issue #3. Market cap doesn't tell you shit about a company's productivity, just it's memetic value. More on that later.

>Lists T-Mobile as American

It's a German company. And it's probably not the only European company listed as American for some reason.

Also finally:

>Stock evaluation doesn't say a thing about how productive these companies ACTUALLY are.

Reminder folks: "GDP measures everything except that which makes life worthwhile" -Bobby Kennedy 1968.

In general a lot of these companies are valued so high simply because they are in the S&P500. Which now means every single pension fund across the globe will start investing into it. It's basically an automatic thing. S&P500 are considered untouchable (2008 has proven that), and because of that are considered the safest bet.

So the "value" of these stocks is not in their income, but in the fact that they contain large portions of the accumulated pensions for every single human being on earth.

SAP for instance is now technically older than 50 years old (53 to be exact) and has a market cap of $350 billion.