Anonymous

(ID: jf0bjWcu)

8/6/2025, 6:17:36 AM

No.23061446

>>23067945

>>23113155

8/6/2025, 6:17:36 AM

No.23061446

>>23067945

>>23113155

/CMMG/ Commodities, Mining, and Macro General

Things are happening edition.

Anonymous

(ID: dzEdss0n)

8/6/2025, 6:26:28 AM

No.23061479

>>23061639

8/6/2025, 6:26:28 AM

No.23061479

>>23061639

The two weeks is over

Simon Salva

!tMhYkwTORI

(ID: dIMO3Jvj)

8/6/2025, 6:27:11 AM

No.23061484

>>23061506

>>23061773

>>23062350

>>23062459

>>23101946

8/6/2025, 6:27:11 AM

No.23061484

>>23061506

>>23061773

>>23062350

>>23062459

>>23101946

Why is this here in the first place? Why not on /biz/ or smth?

Anonymous

(ID: jf0bjWcu)

8/6/2025, 6:35:55 AM

No.23061506

8/6/2025, 6:35:55 AM

No.23061506

>>23061484

I think people kept getting banned or something

Anonymous

(ID: taxoKnVa)

8/6/2025, 7:16:35 AM

No.23061639

8/6/2025, 7:16:35 AM

No.23061639

Anonymous

(ID: taxoKnVa)

8/6/2025, 7:24:57 AM

No.23061650

>>23061778

>>23064782

8/6/2025, 7:24:57 AM

No.23061650

>>23061778

>>23064782

2026 WAGMI

Lagoon to $5

Galleon to $20

Snowline to $100

Bayhorse to $0.60

Anonymous

(ID: mhhlQzrj)

8/6/2025, 8:41:35 AM

No.23061773

8/6/2025, 8:41:35 AM

No.23061773

>>23061484

This used to be on /biz/ but there was a change where users had to register their e-mail addresses to be able to post. That caused some of the regular threads to move here for awhile.

Anonymous

(ID: 7KmcKpmH)

8/6/2025, 8:43:54 AM

No.23061778

>>23061796

>>23061836

8/6/2025, 8:43:54 AM

No.23061778

>>23061796

>>23061836

>>23061650

Stop posting the same sloppy picks and provide new options.

Impact silver (IPT) looks cushy and so does Gold Royalty (GROY), but neeeds to drop a bit for a buy.

Royalties might be a nice cushy place to be in years to come.

Anonymous

(ID: LY8OJ8Fk)

8/6/2025, 8:55:52 AM

No.23061796

8/6/2025, 8:55:52 AM

No.23061796

>>23061778

IPT is a shitco. Royalties are safe picks. RGLD is still on sale while they're acquiring Sandstorm

Anonymous

(ID: jf0bjWcu)

8/6/2025, 9:19:56 AM

No.23061836

>>23061849

8/6/2025, 9:19:56 AM

No.23061836

>>23061849

>>23061778

>Gold Royalty

Their CEO seems like such a sleazeball. And G&A for these royalty companies are out of control. US$10M+ per year, for what? and then the used car salesman CEO is talking about how he can scale up the business with the same G&A, how about you cut 90% of that G&A right now, doofus? management of these companies must literally be doing nothing all day and then once in a while check out some project. Best job ever.

Anonymous

(ID: LY8OJ8Fk)

8/6/2025, 9:30:45 AM

No.23061849

>>23061859

>>23061864

8/6/2025, 9:30:45 AM

No.23061849

>>23061859

>>23061864

>>23061836

Royalty companies operate pretty much like banks. They get the big bucks for financing other companies' projects and then sitting neatly on their asses. Margins north of 90% when the only costs are general & administrative in nature. Some royalty companies like Elemental Altus also generate new royalties. One of the best businesses in the world. I think Wheaton only employs like two dozen people?

Anonymous

(ID: LY8OJ8Fk)

8/6/2025, 9:34:40 AM

No.23061859

>>23061863

>>23061869

8/6/2025, 9:34:40 AM

No.23061859

>>23061863

>>23061869

>>23061849

never mind Wheaton employs a bit over 50 people. Franco-Nevada has 40 employees. Triple Flag and Altius employ 19 people. Sandstorm and Osisko employ less than 20 respectively

Anonymous

(ID: LY8OJ8Fk)

8/6/2025, 9:35:39 AM

No.23061863

8/6/2025, 9:35:39 AM

No.23061863

>>23061859

>Sandstorm and Osisko employ less than 20 respectively

less than 30*

Anonymous

(ID: jf0bjWcu)

8/6/2025, 9:35:44 AM

No.23061864

>>23061905

8/6/2025, 9:35:44 AM

No.23061864

>>23061905

>>23061849

I know what a royalty company is finnbro. But let's break it down, $500k max listing costs. How many employees do you really need? especially for a small royalty company I would say 3 people should be able to run it easily. $500k per person would be a nice salary for what is not a lot of work. That's $2M/y. How the hell do you spend $10M?

Anonymous

(ID: jf0bjWcu)

8/6/2025, 9:38:27 AM

No.23061869

>>23061910

>>23064004

8/6/2025, 9:38:27 AM

No.23061869

>>23061910

>>23064004

>>23061859

The big royalty companies also spend too much, but it's a much smaller percentage of revenue so not that big of a deal.

The management teams of the smaller royalty players are all competing to be the ones consolidating their competitors, and still they just spend like drunken sailors, burning a huge chunk of their cash flow.

Anonymous

(ID: LY8OJ8Fk)

8/6/2025, 9:39:55 AM

No.23061905

>>23061913

8/6/2025, 9:39:55 AM

No.23061905

>>23061913

>>23061864

I don't know what company we're talking about exactly, but I doubt three people would suffice. Pay is high for high performing people even if the job isn't that hard. Executive compensation can be very lucrative if you are the right person in the right place. Plenty of people get paid millions a year in many companies. Fair? Not really but it is what it is

Anonymous

(ID: jf0bjWcu)

8/6/2025, 9:42:07 AM

No.23061910

8/6/2025, 9:42:07 AM

No.23061910

>>23061869

One to watch for is Summit Royalty that's going public by taking out Eagle Royalties. Pretty cheap valuation in Eagle, I think the Banyan project will eventually get built. Couldn't invest due to it being on CSE though, hopefully they uplist to TSX.

I'm also invested in the best royalty company TNR gold, so I know. They only spend $1M canadian per year and us shareholders are still in revolt.

Anonymous

(ID: jf0bjWcu)

8/6/2025, 9:44:42 AM

No.23061913

>>23061938

8/6/2025, 9:44:42 AM

No.23061913

>>23061938

>>23061905

Talking about GROY, and they are down 50% since 2021 so I wouldn't exactly call them high performing. The deals they have made literally anyone could have and every time they do something their stock price goes down lol.

Why don't you think 3 people could run it? one CEO, one CFO and one technical guy and then you have some directors. They are barely doing any deals, it's not like a big bank doing tons of business every day. They have no operations to tend to.

Anonymous

(ID: LY8OJ8Fk)

8/6/2025, 9:57:37 AM

No.23061938

8/6/2025, 9:57:37 AM

No.23061938

>>23061913

I don't know anything about GROY, maybe they are a poorly managed company and you're right.

I think all these royalty companies are already quite tightly knit companies. Two or three dozen people is one office single space worth of people. I think they are probably actively doing due dilligence and deals and that requires time and people. One CFO could suffice for just bookkeeping but you will probably need one more to keep track of a bigger headcount. Somebody needs to be CEO of course but decisions and work ends up being made with more people than that. One technical guy could maybe evaluate a handful of projects a year or risk doing shoddy due dilligence. These companies fly around the world in data rooms and doing site visits, there's millions and billions on the line depending on the size of the boutique. Maybe a small royalty company could make do with three people but a billion dollar enterprise, no way Jose. Even smaller equity research firms easily employ several dozen people.

Anonymous

(ID: VNgwK7xZ)

8/6/2025, 1:34:14 PM

No.23062281

>>23062374

8/6/2025, 1:34:14 PM

No.23062281

>>23062374

Anonymous

(ID: VNgwK7xZ)

8/6/2025, 1:55:44 PM

No.23062330

8/6/2025, 1:55:44 PM

No.23062330

Anonymous

(ID: VNgwK7xZ)

8/6/2025, 1:56:31 PM

No.23062331

8/6/2025, 1:56:31 PM

No.23062331

Anonymous

(ID: 9osSmJzT)

8/6/2025, 2:06:31 PM

No.23062350

>>23067196

>>23070591

8/6/2025, 2:06:31 PM

No.23062350

>>23067196

>>23070591

>>23061484

Muh sekrit club syndrome

Anonymous

(ID: LY8OJ8Fk)

8/6/2025, 2:33:38 PM

No.23062374

>>23062428

>>23062462

>>23080182

8/6/2025, 2:33:38 PM

No.23062374

>>23062428

>>23062462

>>23080182

>>23062281

interesting historical piece, nothing happening as usual though. Remember when we thought Tariff Man would actually audit Fort Knox?

Anonymous

(ID: VNgwK7xZ)

8/6/2025, 3:33:22 PM

No.23062428

8/6/2025, 3:33:22 PM

No.23062428

>>23062374

We got bamboozled with Fort Knox

Anonymous

(ID: VNgwK7xZ)

8/6/2025, 3:49:01 PM

No.23062439

>>23071848

8/6/2025, 3:49:01 PM

No.23062439

>>23071848

/pmg/ 2020 pick from PANMAN and maybe "Silver Miner Anon" too has awoken

>5 year chart

https://www.youtube.com/watch?v=wJqOtMQYkXU

Anonymous

(ID: GEO6WhMi)

8/6/2025, 4:08:54 PM

No.23062459

>>23062524

8/6/2025, 4:08:54 PM

No.23062459

>>23062524

>>23061484

I'm not going back.

Also not checking my accounts this month.

Anonymous

(ID: GEO6WhMi)

8/6/2025, 4:13:02 PM

No.23062462

>>23062530

8/6/2025, 4:13:02 PM

No.23062462

>>23062530

>>23062374

fort knox is frequently independently audited, but it's fun to rile idiots up by saying it's not had an internal audit in years. maybe the gold is all gone you guys!!!

Anonymous

(ID: mtqWiL0m)

8/6/2025, 5:10:29 PM

No.23062524

8/6/2025, 5:10:29 PM

No.23062524

>>23062459

September.....I'm holding cash until September.

Anonymous

(ID: LY8OJ8Fk)

8/6/2025, 5:13:54 PM

No.23062530

8/6/2025, 5:13:54 PM

No.23062530

>>23062462

Trump made a big deal out of it. Still waiting for public info on that. Of course it was all political theatre as usual.

Anonymous

(ID: mtqWiL0m)

8/6/2025, 6:41:23 PM

No.23062763

>>23062780

>>23062856

8/6/2025, 6:41:23 PM

No.23062763

>>23062780

>>23062856

Posted for the deaftards in the back row

Anonymous

(ID: ZKWR3rFx)

8/6/2025, 6:46:00 PM

No.23062780

>>23062880

8/6/2025, 6:46:00 PM

No.23062780

>>23062880

>>23062763

i don't even uinderstand the implications

Anonymous

(ID: LY8OJ8Fk)

8/6/2025, 7:18:12 PM

No.23062856

>>23068215

8/6/2025, 7:18:12 PM

No.23062856

>>23068215

>>23062763

did this ever get approved? afaik this was big news when it was proposed but I don't think I ever heard of it being given the green light.

Anonymous

(ID: GEO6WhMi)

8/6/2025, 7:24:10 PM

No.23062880

>>23063177

>>23072993

8/6/2025, 7:24:10 PM

No.23062880

>>23063177

>>23072993

>>23062780

massively bearish gold

Anonymous

(ID: ZKWR3rFx)

8/6/2025, 7:34:05 PM

No.23063177

8/6/2025, 7:34:05 PM

No.23063177

>>23062880

i see, ty

GEO ID

Anonymous

(ID: LY8OJ8Fk)

8/6/2025, 7:46:26 PM

No.23063208

8/6/2025, 7:46:26 PM

No.23063208

imagine being long OBE lol

Anonymous

(ID: 7KmcKpmH)

8/6/2025, 10:35:46 PM

No.23064004

>>23064167

8/6/2025, 10:35:46 PM

No.23064004

>>23064167

>>23061869

Agree on the consolidation aspect, it's anyones bet who is gona eat whom but the game is on for consolidation to conclude in the next 4 maybe 5 years.

It's all about picking the winners.

Spending wise - of course, it's hard to justify lifestyle companies behaviour and that is one of things to keep very keen eye on.

Tossed some names to keep conversation goining which seems to have provoked discussion and that's welcome.

TNR seems like a micro cap for royalty.

Anonymous

(ID: jf0bjWcu)

8/6/2025, 11:25:06 PM

No.23064167

8/6/2025, 11:25:06 PM

No.23064167

>>23064004

>TNR seems like a micro cap for royalty.

It's tiny yeah, but best value in the space right now. They have a royalty that will pay out half their current market cap every year for probably many decades, starting 2029. We are working on pushing a sale through, I think we will get 40c/share within 12 months.

Anonymous

(ID: FQLfiINy)

8/6/2025, 11:37:50 PM

No.23064229

>>23064254

>>23067837

>>23101936

8/6/2025, 11:37:50 PM

No.23064229

>>23064254

>>23067837

>>23101936

Anonymous

(ID: FQLfiINy)

8/6/2025, 11:44:11 PM

No.23064254

>>23067600

>>23067837

8/6/2025, 11:44:11 PM

No.23064254

>>23067600

>>23067837

>>23064229

Finally, a quarter where Hecla doesn't drop after earnings, wagmi

Anonymous

(ID: FQLfiINy)

8/7/2025, 12:26:36 AM

No.23064771

8/7/2025, 12:26:36 AM

No.23064771

Anonymous

(ID: Rhn7VI1F)

8/7/2025, 12:29:18 AM

No.23064782

8/7/2025, 12:29:18 AM

No.23064782

>>23061650

which of those mines were owned by Graeme?

Anonymous

(ID: BuZXZc5u)

8/7/2025, 4:53:32 AM

No.23066032

>>23066736

8/7/2025, 4:53:32 AM

No.23066032

>>23066736

When is gold going to finally break out?

Anonymous

(ID: erbEC6Wz)

8/7/2025, 7:52:42 AM

No.23066736

8/7/2025, 7:52:42 AM

No.23066736

>>23066032

Friday perhaps? Gold miners leading the way.

We were supposed to get 500% sanctions against Russian oil/uranium/pgms announced on Friday, but that's been deferred as Putin and Trump have agreed to meet in person next week. Worried that gold might dump if the meeting results in a peace deal, as cold as that may sound.

Anonymous

(ID: v6aRCDur)

8/7/2025, 7:52:59 AM

No.23066737

>>23066779

>>23067056

8/7/2025, 7:52:59 AM

No.23066737

>>23066779

>>23067056

Which copper ETF should I invest in for long-term profit?

Anonymous

(ID: erbEC6Wz)

8/7/2025, 8:09:07 AM

No.23066779

8/7/2025, 8:09:07 AM

No.23066779

>>23066737

I think the bull market in general equities ends in 2-3 months. Buy copper next year after the bust has unfolded. We're playing gold, silver and uranium miners right now.

Anonymous

(ID: LY8OJ8Fk)

8/7/2025, 11:00:49 AM

No.23067056

8/7/2025, 11:00:49 AM

No.23067056

>>23066737

COPX or whatever idk they are all the same more or less

Anonymous

(ID: gq4MmB2Z)

8/7/2025, 12:14:23 PM

No.23067191

>>23067596

8/7/2025, 12:14:23 PM

No.23067191

>>23067596

Simon Salva

!tMhYkwTORI

(ID: dIMO3Jvj)

8/7/2025, 12:16:24 PM

No.23067196

8/7/2025, 12:16:24 PM

No.23067196

Anonymous

(ID: OhAJHPrg)

8/7/2025, 4:07:14 PM

No.23067596

>>23067837

8/7/2025, 4:07:14 PM

No.23067596

>>23067837

>>23067191

Are we though?

Anonymous

(ID: UKTycwv+)

8/7/2025, 4:11:00 PM

No.23067600

>>23067837

>>23067967

8/7/2025, 4:11:00 PM

No.23067600

>>23067837

>>23067967

>>23064254

Allied Gold shitting the bed balances my Hecla gains quite well, fellow Cant Make Money General bros.

Anonymous

(ID: h9fXN/e/)

8/7/2025, 5:14:45 PM

No.23067837

>>23067895

>>23068251

>>23101936

8/7/2025, 5:14:45 PM

No.23067837

>>23067895

>>23068251

>>23101936

>>23064229

>>23064254

+17% HL looking great

>>23067596

SGD up over 2% on the news, not the homerun we wanted but for the first results of '25 very encouraging

>>23067600

I know the feel bro, Hecla finally running and now Fortuna has a Q2 miss and drops 11%

Anonymous

(ID: h9fXN/e/)

8/7/2025, 5:24:49 PM

No.23067848

8/7/2025, 5:24:49 PM

No.23067848

Look at little GGO go! Seems that Michael Gentile going in for 5%+ and doing some interviews is getting the story out

Anonymous

(ID: h9fXN/e/)

8/7/2025, 5:34:41 PM

No.23067860

8/7/2025, 5:34:41 PM

No.23067860

Scottie looking good too

Anonymous

(ID: /9J7ETUP)

8/7/2025, 6:03:02 PM

No.23067895

>>23067922

>>23068739

8/7/2025, 6:03:02 PM

No.23067895

>>23067922

>>23068739

>>23067837

Is it up 2% because the market rallying or because of the news?

Anonymous

(ID: h9fXN/e/)

8/7/2025, 6:09:16 PM

No.23067905

8/7/2025, 6:09:16 PM

No.23067905

Hopeful B2Gold announces a big Q2 today

Anonymous

(ID: h9fXN/e/)

8/7/2025, 6:19:24 PM

No.23067922

8/7/2025, 6:19:24 PM

No.23067922

>>23067895

fair point, tough to say, but the news does seem to be a net positive despite no monster headline hole. There is some pretty good looking vg pending in that new zone

Anonymous

(ID: GLrEVifa)

8/7/2025, 6:33:19 PM

No.23067945

>>23070750

8/7/2025, 6:33:19 PM

No.23067945

>>23070750

>>23061446 (OP)

Hello my fellow dane

Anonymous

(ID: h9fXN/e/)

8/7/2025, 6:48:20 PM

No.23067967

>>23069606

>>23073903

8/7/2025, 6:48:20 PM

No.23067967

>>23069606

>>23073903

>>23067600

Finbro, did you see the rumor that Agnico might buy Northern Star?

https://archive.is/vJmuy

Anonymous

(ID: 5Fj2E6BJ)

8/7/2025, 7:28:04 PM

No.23068215

8/7/2025, 7:28:04 PM

No.23068215

Anonymous

(ID: mhhlQzrj)

8/7/2025, 7:44:08 PM

No.23068251

>>23068338

8/7/2025, 7:44:08 PM

No.23068251

>>23068338

>>23067837

That is one very ugly long-term chart. It shows that Hecla is not a serious business. Its dividend is minimal and in 40 years, the stock price is lower today than it was then. It doesn't mean that one cannot make a profit owning the stock but it is not a stock that one can hold "forever" and expect to keep up or outpace inflation.

Anonymous

(ID: h9fXN/e/)

8/7/2025, 8:10:54 PM

No.23068338

>>23068718

>>23068854

>>23069766

8/7/2025, 8:10:54 PM

No.23068338

>>23068718

>>23068854

>>23069766

>>23068251

Hecla is kind of a turd and the chart dating back to 1891 is probably worse, but they just had a killer Q2 and it's the place where a ton of the FOMO money and institutional $ will go. Hecla is tough to beat for the generalist who is often terrified of the jurisdictional risk of the other silver miners

Anonymous

(ID: +hFr2O+H)

8/7/2025, 8:27:05 PM

No.23068718

>>23068743

>>23077673

>>23077783

8/7/2025, 8:27:05 PM

No.23068718

>>23068743

>>23077673

>>23077783

>>23068338

Snowline almost back at $10 bro!

Anonymous

(ID: h9fXN/e/)

8/7/2025, 8:30:40 PM

No.23068739

8/7/2025, 8:30:40 PM

No.23068739

>>23067895

It's now up almost 5% and heading back to $10, why? Because our destiny is large booba Japanese QTs

Anonymous

(ID: h9fXN/e/)

8/7/2025, 8:31:26 PM

No.23068743

8/7/2025, 8:31:26 PM

No.23068743

Anonymous

(ID: mhhlQzrj)

8/7/2025, 8:52:59 PM

No.23068854

>>23069034

8/7/2025, 8:52:59 PM

No.23068854

>>23069034

>>23068338

I don't disagree. In fact, I own shares of Hecla. However, I'm emphasizing that Hecla almost certainly is a stock one holds for a few years and then sells. Holding it longer is likely to be bad for one's economic well-being.

The international oil companies are also a resource extraction business but so long as one doesn't buy at the peak of a bubble, those are stocks that one can hold "forever" and keep up with or outpace the rate of inflation. The oil services companies are a different story and look more like Hecla albeit with weaker ramp-ups during booms.

Anonymous

(ID: 1R803V1a)

8/7/2025, 9:43:11 PM

No.23069034

>>23101936

8/7/2025, 9:43:11 PM

No.23069034

>>23101936

>>23068854

Well said bro, you sound like Rick Rule

Bateman, the hallucinogenic taking tech billionaire with a billion $ in physical silver is with us on HL

Anonymous

(ID: LY8OJ8Fk)

8/7/2025, 10:11:09 PM

No.23069606

>>23073903

8/7/2025, 10:11:09 PM

No.23069606

>>23073903

>>23067967

I think that would be a stellar acquisition for Agnico and one of the biggest mining deals ever. I own some AEM shares but I have a much larger position in NST. I think Agnico would be a natural home for those assets, if they were to pursue a takeover.

Anonymous

(ID: p68QfQgA)

8/7/2025, 10:49:47 PM

No.23069762

>>23077766

8/7/2025, 10:49:47 PM

No.23069762

>>23077766

REEEEE!!!!

My rollover check to my IRA should have gone out almost 3 weeks ago ,they fucked up, now it's still not there after10 days in the mail.

I'm missing out on the precious metals dip!!!!

Anonymous

(ID: p68QfQgA)

8/7/2025, 10:50:54 PM

No.23069766

>>23101936

8/7/2025, 10:50:54 PM

No.23069766

>>23101936

>>23068338

Bateman pumping HECLA on X today

Anonymous

(ID: 2V5AoM3V)

8/8/2025, 1:09:36 AM

No.23070591

8/8/2025, 1:09:36 AM

No.23070591

>>23062350

If you start a thread I will be there to shit in it

Anonymous

(ID: LY8OJ8Fk)

8/8/2025, 1:19:48 AM

No.23070664

8/8/2025, 1:19:48 AM

No.23070664

Spartan Delta poopmed above $5.

The jews don't want you to know it but money is literally free, you can just buy shares in the right companies and get free money.

Anonymous

(ID: jf0bjWcu)

8/8/2025, 1:30:10 AM

No.23070750

>>23071192

8/8/2025, 1:30:10 AM

No.23070750

>>23071192

>>23067945

Hej

Y'all saw MAI buying the old Fiore Pan mine for US$115M today? stock crashed due to big financing at lower price with full warrant, but probably still a decent deal imo. The Mexico assets are still a very uncertain. The stock was just overvalued before these US acquisitions.

Anonymous

(ID: LY8OJ8Fk)

8/8/2025, 2:21:23 AM

No.23071192

>>23071345

8/8/2025, 2:21:23 AM

No.23071192

>>23071345

>>23070750

I did see that. Good sale by Equinox, that asset wasn't really worth anything for them

Anonymous

(ID: jf0bjWcu)

8/8/2025, 2:48:00 AM

No.23071345

>>23072397

>>23072903

>>23073394

8/8/2025, 2:48:00 AM

No.23071345

>>23072397

>>23072903

>>23073394

>>23071192

I don't really like the idea of selling "non-core assets" just because they are smaller than other assets. I mean of course if you can get a very good price, but usually they sell them off cheap. $115M for Pan and the nearby development project was also cheap imo. At current gold price, Pan is making like $35M a year in post tax profit and they can probably extend mine life for many more years and then they have perhaps an even better project right beside it lined up.

Seems like laziness from management, not wanting to bother with small assets even though they are making good money. You don't really see this in other industries. Lots of companies have for example 100s or 1000s of stores they manage, or a large amount of other assets. The idea of "too many mines" is just retarded. You can't have too many mines, what you have is a poor organisational structure.

Zijin Mining is one of the best performing mining companies and they have 30+ mines. Having many mines should be an advantage not a problem, as you can leverage the knowledge base of your organisation and share learnings across operations.

Anonymous

(ID: p3hhc7g/)

8/8/2025, 3:54:28 AM

No.23071848

8/8/2025, 3:54:28 AM

No.23071848

>>23062439

It’s been twinned with poo lagoon, but continued to go up while poo got flushed.

I’m still long poo though, used to be a NIM holder.

Anonymous

(ID: qdnsv8r1)

8/8/2025, 5:21:09 AM

No.23072237

>>23072739

8/8/2025, 5:21:09 AM

No.23072237

>>23072739

I'm the only real commodities trader here.

Anonymous

(ID: qdnsv8r1)

8/8/2025, 5:25:43 AM

No.23072259

>>23072692

>>23073427

8/8/2025, 5:25:43 AM

No.23072259

>>23072692

>>23073427

why the fuck did copper got so cheap anyway?

all the crackhead is complaining

Anonymous

(ID: jf0bjWcu)

8/8/2025, 5:55:11 AM

No.23072397

8/8/2025, 5:55:11 AM

No.23072397

>>23071345

What they should have done was have a Nevada team that was responsible for the current operation and expanding that through other heap leach mines in the state. Gold price is at an all time high and investors want growth. This stagnation and even decline in production from the majors is the reason why their stocks have done terribly over the long term.

Haven't followed Agnico closely, but I don't believe they have a history of selling "non-core" mines, which is partly why they have done much better than peers. I believe they have some small circa 100koz mines they still operate, even though they also have a massive mine they are working on getting to 1Moz/y.

Management of these gold mining companies has been horrendous, particularly in Canada and probably North America in general. I think they are significantly better run in Australia.

Anonymous

(ID: p3hhc7g/)

8/8/2025, 7:18:09 AM

No.23072692

>>23072882

8/8/2025, 7:18:09 AM

No.23072692

>>23072882

>>23072259

A lot of future demand narratives got busted as of late. EV demand is very tepid and is now a 2040 plus thing, not 2030 as many CU bulls hoped. Still structurally a shortfall of supply though.

Anonymous

(ID: Rhn7VI1F)

8/8/2025, 7:34:29 AM

No.23072739

>>23072763

8/8/2025, 7:34:29 AM

No.23072739

>>23072763

>>23072237

Is that the Bayhorse state of the are ore processing facility where they sell to bags Ocean?

Anonymous

(ID: jf0bjWcu)

8/8/2025, 7:44:02 AM

No.23072763

8/8/2025, 7:44:02 AM

No.23072763

>>23072739

I think he sold that on craigslist

Anonymous

(ID: qdnsv8r1)

8/8/2025, 8:33:48 AM

No.23072882

8/8/2025, 8:33:48 AM

No.23072882

>>23072692

more like trump fake tariff nigga, he'll backpedal in a week

better buy whatever company process copper or something

Anonymous

(ID: LY8OJ8Fk)

8/8/2025, 8:46:45 AM

No.23072903

>>23072940

8/8/2025, 8:46:45 AM

No.23072903

>>23072940

>>23071345

Equinox got a good price for Pan I think. 3x after tax profit for a low quality asset is a good deal and they can use the proceeds into higher return investments. You bring up good points about Agnico and Zijin, true they are buyers and not sellers. But see how Newmont has been rewarded for getting rid of their extraneous assets. It's not a black and white thing, sometimes it makes sense to get rid of assets and trim off some fat.

Anonymous

(ID: ulOXGrKX)

8/8/2025, 8:51:36 AM

No.23072915

>>23072928

>>23072940

8/8/2025, 8:51:36 AM

No.23072915

>>23072928

>>23072940

serious question: why is this general not on /biz/?

Anonymous

(ID: LY8OJ8Fk)

8/8/2025, 8:55:54 AM

No.23072928

8/8/2025, 8:55:54 AM

No.23072928

>>23072915

because /biz/ mods and trannies. Tried to make anons give their emails to post normally. Also /biz/ is full of cryptojeet bots that are annoying

Anonymous

(ID: jf0bjWcu)

8/8/2025, 9:00:48 AM

No.23072940

>>23073256

8/8/2025, 9:00:48 AM

No.23072940

>>23073256

>>23072903

Newmont now has less gold production than they had before the Newcrest acquisition and at significantly higher AISC. Recent stock rally is probably just because of the gold price. They are also still below where they were in 2022. Pretty poor performer imo.

>>23072915

Bro you live in Chad, you have bigger things to worry about.

Anonymous

(ID: RT97E8OY)

8/8/2025, 9:33:37 AM

No.23072993

>>23073413

8/8/2025, 9:33:37 AM

No.23072993

>>23073413

>>23062880

They are just issuing certificates eith no real gold behind it.

Anonymous

(ID: LY8OJ8Fk)

8/8/2025, 10:14:27 AM

No.23073256

>>23073334

>>23076035

8/8/2025, 10:14:27 AM

No.23073256

>>23073334

>>23076035

>>23072940

Looking at the company's 10-K, in FY2023 Newmont's operating costs per ounce before D&A were $1,065/oz, and $991/oz less royalties. They produced 6.4Moz AuEq that year and finalized the Newcrest takeover in early November.

In FY2024 those same cost numbers were $1,145/oz and $1,051/oz respectively, but if we exclude the divested Telfer and the five other mines held for sale from those 2024 figures we get $954/oz costs before D&A and $869/oz less royalties. Even with the royalties kept in, the operating costs without those six non-core mines would have been lower in 2024 than the operating costs in 2023 with royalties subtracted, and that's when royalty costs were up 27% YoY.

For 2025 they are guiding 5.9Mozpa AuEq production, and 5.6Moz for the core portfolio. So production will come down by about 0.8Mozpa or 12.5% while operating costs are kept in check as we can see by looking at the FY2024 numbers while ruling out the impact of the non-core mines. You're right to point out that the company is leaving NAV and revenues on the table (which in a bull market might admittedly not be the beat strategy as margins are expanding) but you're wrong to focus solely on AISC since that number is largely dependent on the timing sustaining capital spend, and rising royalty costs need to be taken into account when considering the impact of dispositions on margins.

Anonymous

(ID: jf0bjWcu)

8/8/2025, 10:45:38 AM

No.23073334

>>23073453

8/8/2025, 10:45:38 AM

No.23073334

>>23073453

>>23073256

It's terrible.

Anonymous

(ID: p3hhc7g/)

8/8/2025, 11:31:06 AM

No.23073394

>>23075025

8/8/2025, 11:31:06 AM

No.23073394

>>23075025

>>23071345

Back to TNR, seems to have rallied quite a bit recently (more than gold itself).

Any chance it get back to 6 or 7 cents?

Anonymous

(ID: GEO6WhMi)

8/8/2025, 11:36:24 AM

No.23073413

8/8/2025, 11:36:24 AM

No.23073413

>>23072993

most investors don't know or care whether there's a real gold bar behind their etf holding. they just want exposure to the price of the commodity, a piece of paper is good enough.

Anonymous

(ID: GEO6WhMi)

8/8/2025, 11:38:54 AM

No.23073427

8/8/2025, 11:38:54 AM

No.23073427

>>23072259

US copper price went up on people front-running a series of tariff dates set by trump. once the tariff came into effect demand reversed and price crashes.

Anonymous

(ID: LY8OJ8Fk)

8/8/2025, 11:48:38 AM

No.23073453

>>23075025

8/8/2025, 11:48:38 AM

No.23073453

>>23075025

>>23073334

>muh AISC

low iq take tbqhfamalam

Anonymous

(ID: xAW2CuTJ)

8/8/2025, 1:49:59 PM

No.23073645

>>23104994

8/8/2025, 1:49:59 PM

No.23073645

>>23104994

WAGMI

Anonymous

(ID: xAW2CuTJ)

8/8/2025, 2:17:30 PM

No.23073684

8/8/2025, 2:17:30 PM

No.23073684

Anonymous

(ID: LY8OJ8Fk)

8/8/2025, 4:34:36 PM

No.23073896

8/8/2025, 4:34:36 PM

No.23073896

Guanajuato diluting again lol. Once a shitco always a shitco

Anonymous

(ID: xAW2CuTJ)

8/8/2025, 4:38:18 PM

No.23073903

8/8/2025, 4:38:18 PM

No.23073903

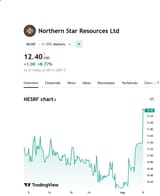

>>23067967

>>23069606

NESRF good start today, would love to see an Agnico deal, did pretty well holding Yamana when they were acquired by Agnico

Anonymous

(ID: xAW2CuTJ)

8/8/2025, 7:03:18 PM

No.23074179

8/8/2025, 7:03:18 PM

No.23074179

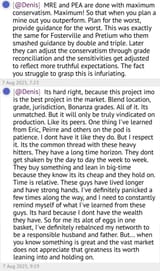

former President of NFG, Denis Laviolette, with some good hopium

Anonymous

(ID: jf0bjWcu)

8/8/2025, 9:44:24 PM

No.23075025

>>23076035

8/8/2025, 9:44:24 PM

No.23075025

>>23076035

>>23073453

Sustaining capital isn't lumpy when they have that many mines. Using the highest measure of cost is the most accurate because the total cost, all in cost, is of course what matters in the end. You don't want to get in an IQ battle with me finnbro, my IQ can't be beaten by any human or artificially created intelligence.

>>23073394

It could but I don't think it will. Not really a gold stock either despite it's name btw, the value is mainly in the Los Azules copper royalty (FS out later this quarter) and the Mariana lithium royalty which should start cash flowing later this year.

Anonymous

(ID: p3hhc7g/)

8/8/2025, 10:12:31 PM

No.23075690

8/8/2025, 10:12:31 PM

No.23075690

Whew GSVR lad

Anonymous

(ID: LY8OJ8Fk)

8/8/2025, 11:22:47 PM

No.23076035

>>23076079

>>23076085

8/8/2025, 11:22:47 PM

No.23076035

>>23076079

>>23076085

>>23075025

Of course AISC has to be considered (it's not as if sustaining capital spend doesn't exist) but you can get a much better view of the company's corporate costs per ounce when you strip out the sustaining capital, D&A and royalties. Sustaining capital is variable on a quarterly and annual basis, over the course of the mine life it smooths out to an average but when we're looking at annual numbers it can skew things. In addition legacy mines often get less sustaining capital spend which skews them into looking better when compared to better mines that companies are eager to spend more money on developing. D&A is a non-cash expense. Royalties are dependent on the gold price so obviously AISC will look high now compared to a year or two ago.

If you refer back to my post

>>23073256 you can see that the corporate costs without those non-core mines will actually be better when you strip out the variables and non-cash items out of the equation. It's all visible in the 10-K. Sure revenue is affected negatively by virtue of gold production coming down, that much is obvious. But margins are actually improving.

also I haven't really measured it but I'm pretty sure I have like 150iq

Anonymous

(ID: jf0bjWcu)

8/8/2025, 11:32:34 PM

No.23076079

>>23076423

>>23076451

8/8/2025, 11:32:34 PM

No.23076079

>>23076423

>>23076451

>>23076035

Sustaining capital is smoothed out when you have 10 mines so it is a relevant figure, more so than cash cost as it can vary widely what is put as sustaining capital cost or operating cost, so cash cost can easily be manipulated. Depreciation isn't part of AISC.

Anonymous

(ID: jf0bjWcu)

8/8/2025, 11:35:13 PM

No.23076085

>>23076423

>>23076451

8/8/2025, 11:35:13 PM

No.23076085

>>23076423

>>23076451

>>23076035

Also costs are not going down with AISC going up 25%, that is not just sustaining capital I can tell you that without opening a financial statement. Your IQ is probably like 120, so not bad lil bro, but you need more to challenge the king.

Anonymous

(ID: LY8OJ8Fk)

8/8/2025, 11:50:03 PM

No.23076423

>>23076470

8/8/2025, 11:50:03 PM

No.23076423

>>23076470

>>23076079

>>23076085

>Sustaining capital is smoothed out when you have 10 mines

That's debatable. Sometimes you get more sustaining capital spend in a year than in other years. Each of those mines has its own mine plan with variable sustaining capital guidance. Over the long run things do smooth out but there will still be variance on a quarterly and annual basis. Stripping out the sustaining capital spend helps in understanding the margins better.

>Depreciation isn't part of AISC.

I know, but that doesn't seem to bother Newmont since they seem to like including that? See pic related.

>Also costs are not going down with AISC going up 25%

You can look at this 2024 figure yourself, take the out the non-core mines out of the "costs applicable to sales" and witness an improvement in production costs. True, AISC includes a bit more than just sustaining capex, but sustaining capex accounts for the lion's share of the added costs in AISC.

Anonymous

(ID: LY8OJ8Fk)

8/8/2025, 11:55:44 PM

No.23076451

8/8/2025, 11:55:44 PM

No.23076451

>>23076079

>>23076085

note also the improvement in remediation & reclamation costs when you exclude the non-core mines. CC&V, Akyem and Telfer have disproportionately high R&R costs since they are legacy assets

Anonymous

(ID: MZU4y+dW)

8/8/2025, 11:56:04 PM

No.23076453

8/8/2025, 11:56:04 PM

No.23076453

Anonymous

(ID: jf0bjWcu)

8/9/2025, 12:00:00 AM

No.23076470

>>23076498

>>23076507

8/9/2025, 12:00:00 AM

No.23076470

>>23076498

>>23076507

>>23076423

CAS cost is expected to be $1200/oz this year, that is the same as AISC for 2022, CAS cost was probably around $950/oz for that year. So costs are going up bigly for sure, part may be that they lower cutoff when gold price goes up, but still a very large increase compared to competitors in a period where they are selling off "non-core" assets which should reduce cost.

D&A is included in their Total Production Cost but not in their AISC. So the TPC includes capitalised sustaining capital from previous years while AISC includes capital cost that will be depreciated in the coming years.

Anonymous

(ID: LY8OJ8Fk)

8/9/2025, 12:05:40 AM

No.23076498

>>23076507

8/9/2025, 12:05:40 AM

No.23076498

>>23076507

>>23076470

if we look at gold only then you'd be right but when we account for the byproducts we can see CAS has actually been flat over the past three years, and will likely improve as the non-core mines get divested.

>D&A is included in their Total Production Cost but not in their AISC. So the TPC includes capitalised sustaining capital from previous years while AISC includes capital cost that will be depreciated in the coming years.

makes sense

Anonymous

(ID: LY8OJ8Fk)

8/9/2025, 12:08:26 AM

No.23076507

8/9/2025, 12:08:26 AM

No.23076507

>>23076470

>>23076498

never mind I'm actually retarded and my IQ is 80. Looks like they are listing the byproducts costs themselves as a separate item and not the total AuEq costs.

Anonymous

(ID: xAW2CuTJ)

8/9/2025, 3:26:03 AM

No.23077673

8/9/2025, 3:26:03 AM

No.23077673

>>23068718

World-renowned legendary geologist discusses Snowline's incredible news release with first drill results of 2025:

https://vimeo.com/1108588731

dnonx

Anonymous

(ID: p68QfQgA)

8/9/2025, 3:39:38 AM

No.23077766

>>23077783

>>23080223

8/9/2025, 3:39:38 AM

No.23077766

>>23077783

>>23080223

>>23069762

Mr rollover came late today. What should I buy Monday morning.

Some HL? FSM? AG? SIL? B?

Anonymous

(ID: xAW2CuTJ)

8/9/2025, 3:44:04 AM

No.23077783

>>23078641

8/9/2025, 3:44:04 AM

No.23077783

>>23078641

>>23068718

World-renowned legendary geologist discusses Snowline's incredible news release with first drill results of 2025:

https://vimeo.com/1108588731

>>23077766

SNOWFLAKE GOLD

https://vimeo.com/1100835394

Anonymous

(ID: BuZXZc5u)

8/9/2025, 7:05:15 AM

No.23078641

>>23079871

>>23079925

>>23079940

8/9/2025, 7:05:15 AM

No.23078641

>>23079871

>>23079925

>>23079940

>>23077783

Amazing.

New discovery?

Are we actually unironically gonna make it?

Anonymous

(ID: wEVonAqX)

8/9/2025, 11:45:50 AM

No.23079871

>>23081185

8/9/2025, 11:45:50 AM

No.23079871

>>23081185

>>23078641

>Are we actually unironically gonna make it?

BIGLY

Anonymous

(ID: wEVonAqX)

8/9/2025, 12:29:22 PM

No.23079925

>>23079940

8/9/2025, 12:29:22 PM

No.23079925

>>23079940

>>23078641

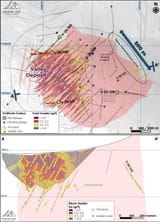

Pending hole 143 has over 20 instances of visible gold in a length over 200m in a new zone. Additional drilling in that area will probably add at least another 2Moz to the 9Moz they already have at Valley, maybe a lot more. WAGMI

Anonymous

(ID: wEVonAqX)

8/9/2025, 12:37:19 PM

No.23079940

>>23080166

>>23081185

8/9/2025, 12:37:19 PM

No.23079940

>>23080166

>>23081185

>>23078641

>>23079925

Hole 125 on the northern edge of Valley was a 233g-m intercept, the 3rd best drill hole of the week, adding oz. WAGMI

Anonymous

(ID: Z0RoVSfE)

8/9/2025, 4:01:18 PM

No.23080166

8/9/2025, 4:01:18 PM

No.23080166

>>23079940

Silber shortage canceled?

Anonymous

(ID: R7VRHoMI)

8/9/2025, 4:16:32 PM

No.23080182

>>23080191

8/9/2025, 4:16:32 PM

No.23080182

>>23080191

>>23062374

>Remember when we thought Tariff Man would actually audit Fort Knox?

Nobody with half a brain actually thought he would do it. I don’t know why you people believe anything this orange faggot says. You’re like battered wives for fucks sake

Anonymous

(ID: Z0RoVSfE)

8/9/2025, 4:24:31 PM

No.23080191

>>23081748

8/9/2025, 4:24:31 PM

No.23080191

>>23081748

>>23080182

Murricans never been famous for outstanding brain performance. Murricans been always famous for their love toward con men.

Anonymous

(ID: LY8OJ8Fk)

8/9/2025, 4:41:54 PM

No.23080223

8/9/2025, 4:41:54 PM

No.23080223

>>23077766

>What should I buy Monday morning.

Northern Star, Ivanhoe and Royal Gold are still on sale.

Anonymous

(ID: BuZXZc5u)

8/9/2025, 6:15:13 PM

No.23081185

>>23081192

>>23081334

8/9/2025, 6:15:13 PM

No.23081185

>>23081192

>>23081334

>>23079871

>>23079940

Amazing.

I'm invested with margin leverage.

My price target is $16. I bought in around $7.50. So I'm around 20% the way there.

At that point I will have $150k CAD and I can quit my job(at least for a few years).

Snowline is probably going to go a lot higher when they get bought out so I'm not going to sell except for personal expenses. My personal expenses are quite low so this isn't an issue.

Not having to wageslave is my dream.

When I eventually have to sell snowline I'm going to buy some less risky/established miners and ride the gold/silver mining bull market, either that or sell options to keep my money growing.

Anonymous

(ID: BuZXZc5u)

8/9/2025, 6:20:18 PM

No.23081192

>>23081334

8/9/2025, 6:20:18 PM

No.23081192

>>23081334

>>23081185

If Snowline gets to $24, I will have $280k.

:DDDDD

Anonymous

(ID: wEVonAqX)

8/9/2025, 6:57:36 PM

No.23081334

>>23083261

8/9/2025, 6:57:36 PM

No.23081334

>>23083261

>>23081185

>>23081192

I like that plan fren with no more wageslaving! Have been balls-deep in shitcos and having to juggle bills for 5 years myself but reached 33,000 SGD shares that I should be able to ride. Had some small wins along the way with Agnico, Yamana, Goliath that all went to adding more SGD. Hoping Snowline can reach 11Moz before a buyout and we get spinout shares to try again. WAGMI

Anonymous

(ID: IYAnI4pB)

8/9/2025, 8:31:08 PM

No.23081748

>>23082328

8/9/2025, 8:31:08 PM

No.23081748

>>23082328

>>23080191

It's audited independently since forever.

You are clinically retarded.

Seriously what are the best tickers to have in my portfolio to make it the next year or two.

-I didn't have any Agnico... they've done well

-Didn't have any Hecla

-Add more to NEM or B?

I think AG is due to turn but i'm already heave there

Should I just add more ETFs like SIL, GDX, SILJ, etc ?

Anonymous

(ID: LY8OJ8Fk)

8/9/2025, 9:54:34 PM

No.23082030

>>23082693

8/9/2025, 9:54:34 PM

No.23082030

>>23082693

>>23081750

just stick with whatever has a good track record and low risks. Agnico, royalty companies, world class discoveries.

Anonymous

(ID: GEO6WhMi)

8/9/2025, 9:56:27 PM

No.23082040

8/9/2025, 9:56:27 PM

No.23082040

>>23081750

all in on global atomic before they get their US government financing package next month.

Anonymous

(ID: LY8OJ8Fk)

8/9/2025, 10:50:32 PM

No.23082328

8/9/2025, 10:50:32 PM

No.23082328

>>23081748

>expectation

>reality

Anonymous

(ID: p68QfQgA)

8/10/2025, 12:24:55 AM

No.23082693

>>23083370

>>23084763

8/10/2025, 12:24:55 AM

No.23082693

>>23083370

>>23084763

>>23082030

Is Agnico a litte overbought though lately?

Anonymous

(ID: wEVonAqX)

8/10/2025, 1:40:09 AM

No.23083087

8/10/2025, 1:40:09 AM

No.23083087

kek

Anonymous

(ID: IYAnI4pB)

8/10/2025, 2:13:59 AM

No.23083163

8/10/2025, 2:13:59 AM

No.23083163

Anonymous

(ID: BuZXZc5u)

8/10/2025, 2:47:58 AM

No.23083261

>>23084765

8/10/2025, 2:47:58 AM

No.23083261

>>23084765

>>23081334

>and having to juggle bills for 5 years myself

The struggle is real bro.

>WAGMI

WAGMI!!!!!

Anonymous

(ID: LY8OJ8Fk)

8/10/2025, 3:11:58 AM

No.23083370

>>23083917

>>23084763

8/10/2025, 3:11:58 AM

No.23083370

>>23083917

>>23084763

>>23082693

maybe. Can always get more overbought though. It's a bull market.

Anonymous

(ID: p68QfQgA)

8/10/2025, 5:07:07 AM

No.23083917

8/10/2025, 5:07:07 AM

No.23083917

>>23083370

Guess Ill peruse more of Dan Duretts lists

Anonymous

(ID: DXdSuEzT)

8/10/2025, 10:11:39 AM

No.23084763

>>23084794

8/10/2025, 10:11:39 AM

No.23084763

>>23084794

>>23082693

>Agnico

>>23083370

In Q2 Tesla had around $200 million of free cash flow and trades at over a 1 trillion dollar valuation. Agnico Eagle had a record $1.3 billion in free cash flow for the same quarter and has a $68 billion valuation

Anonymous

(ID: DXdSuEzT)

8/10/2025, 10:13:02 AM

No.23084765

8/10/2025, 10:13:02 AM

No.23084765

>>23083261

The WAGMI will make all the pain worth it!

Anonymous

(ID: p68QfQgA)

8/10/2025, 10:29:15 AM

No.23084794

8/10/2025, 10:29:15 AM

No.23084794

>>23084763

A compelling argument.

I think Mike Maloney's old right hand man said you hang on to your winners and abandon the losers (stocks)

Anonymous

(ID: ABXI41ol)

8/10/2025, 5:49:58 PM

No.23085539

>>23085958

8/10/2025, 5:49:58 PM

No.23085539

>>23085958

>>23081750

Check out this new company called Bayhorse silver. It's the next big thing...

On a serious note I do think that silver shitcos will be the next to moon because they haven't really went up like the producers have. So if you are a gambling man and have some money to burn you might want to check out some speculative stocks. Also this is CMMG we are degenerate gamblers not etf buyers. This is coming from 390k poo chad.

Anonymous

(ID: JS3DFhkG)

8/10/2025, 5:59:22 PM

No.23085561

8/10/2025, 5:59:22 PM

No.23085561

>>23081750

>Should I just add more ETFs like SIL, GDX, SILJ, etc ?

Yes

Anonymous

(ID: BuZXZc5u)

8/10/2025, 7:22:35 PM

No.23085898

>>23085909

8/10/2025, 7:22:35 PM

No.23085898

>>23085909

>>23081750

>TFW I was going to put $20k in NEM calls in January but decided it was "too risky"

Anonymous

(ID: BuZXZc5u)

8/10/2025, 7:25:02 PM

No.23085909

8/10/2025, 7:25:02 PM

No.23085909

>>23085898

LEAPS I mean.

I was going to do 8 month leaps

I might have 5x'd my money for all I know.

Anonymous

(ID: DXdSuEzT)

8/10/2025, 7:39:33 PM

No.23085958

8/10/2025, 7:39:33 PM

No.23085958

>>23085539

>390k poo chad

Anonymous

(ID: p68QfQgA)

8/10/2025, 9:20:07 PM

No.23086795

>>23087165

8/10/2025, 9:20:07 PM

No.23086795

>>23087165

Iz we going up this week?

Anonymous

(ID: IYAnI4pB)

8/10/2025, 10:59:29 PM

No.23087165

8/10/2025, 10:59:29 PM

No.23087165

>>23086795

Going down. Then crabbing until September

Anonymous

(ID: 42vS91Yp)

8/10/2025, 11:14:42 PM

No.23087202

>>23087221

>>23087536

>>23087575

8/10/2025, 11:14:42 PM

No.23087202

>>23087221

>>23087536

>>23087575

Anonymous

(ID: 42vS91Yp)

8/10/2025, 11:19:11 PM

No.23087221

8/10/2025, 11:19:11 PM

No.23087221

>>23087202

88 is Don's target for the white metal

Anonymous

(ID: DXdSuEzT)

8/10/2025, 11:33:59 PM

No.23087280

>>23092096

8/10/2025, 11:33:59 PM

No.23087280

>>23092096

Snowline Chads WAGMI

Anonymous

(ID: DXdSuEzT)

8/11/2025, 12:35:44 AM

No.23087536

>>23087575

>>23087679

8/11/2025, 12:35:44 AM

No.23087536

>>23087575

>>23087679

>>23087202

Haven't seen "Mining Stock Education" dude since he gave everyone an education on how to lose 100% on Aurcana. Teaming up with flooded pit Great Panther is a 10-bagger Don is guaranteed to deliver unparalleled retardation

Anonymous

(ID: LY8OJ8Fk)

8/11/2025, 12:42:57 AM

No.23087575

8/11/2025, 12:42:57 AM

No.23087575

Anonymous

(ID: IYAnI4pB)

8/11/2025, 1:02:07 AM

No.23087679

8/11/2025, 1:02:07 AM

No.23087679

>>23087536

That wasn't a real ten bagger. Real ten bagger has never been tried

Anonymous

(ID: p68QfQgA)

8/11/2025, 4:25:53 AM

No.23088953

8/11/2025, 4:25:53 AM

No.23088953

My buys will be executed at the market 9:30 AM

Anonymous

(ID: p68QfQgA)

8/11/2025, 8:21:02 AM

No.23090318

8/11/2025, 8:21:02 AM

No.23090318

test

Anonymous

(ID: p68QfQgA)

8/11/2025, 9:42:47 AM

No.23090543

>>23090647

>>23090769

>>23090989

8/11/2025, 9:42:47 AM

No.23090543

>>23090647

>>23090769

>>23090989

I might be buying the dip at open...

Anonymous

(ID: BuZXZc5u)

8/11/2025, 10:31:15 AM

No.23090647

>>23090763

8/11/2025, 10:31:15 AM

No.23090647

>>23090763

>>23090543

Are we SERIOUSLY doing a quintuple top?

This is actually fucking embarrassing. Just go up already.

Anonymous

(ID: dKakEMfR)

8/11/2025, 11:59:52 AM

No.23090763

8/11/2025, 11:59:52 AM

No.23090763

>>23090647

Cup and handle and handle and handle and handle and handle and handle and handle and handle and handle up until there is no space to put even Trump's nanopenis inside next handle

Anonymous

(ID: dKakEMfR)

8/11/2025, 12:03:14 PM

No.23090765

8/11/2025, 12:03:14 PM

No.23090765

BTW nice Fresnillo performance. I guess everyone is entering before for dividend. Which Fresnillo have increased.

Anonymous

(ID: dKakEMfR)

8/11/2025, 12:09:53 PM

No.23090769

8/11/2025, 12:09:53 PM

No.23090769

>>23090543

You even are getting dips still? My holdings went up recently.

Anonymous

(ID: GEO6WhMi)

8/11/2025, 12:10:37 PM

No.23090770

>>23090774

8/11/2025, 12:10:37 PM

No.23090770

>>23090774

Niger nationalised a gold mine. Africans are figuring out the white man's game.

Anonymous

(ID: dKakEMfR)

8/11/2025, 12:15:42 PM

No.23090774

8/11/2025, 12:15:42 PM

No.23090774

>>23090770

How is five o'bonds market doing?

Anonymous

(ID: LY8OJ8Fk)

8/11/2025, 12:50:50 PM

No.23090790

>>23090819

>>23090851

8/11/2025, 12:50:50 PM

No.23090790

>>23090819

>>23090851

>Lifezone Metals Secures $60 Million Bridge Loan from Taurus Mining Finance

>Mr. Showalter stated: “This announcement further demonstrates the preparation and strategic steps Lifezone has taken in anticipation of consolidating 100% ownership of Kabanga Nickel Limited, which we completed last month. The support from Taurus, a respected and experienced mining finance partner, reflects the strength of our project and our team’s ability to deliver. With the Feasibility Study now complete, Taurus’s funding enables us to advance critical early-stage development while progressing the competitive process underway with Standard Chartered to select additional strategic investment partners. In parallel, we are advancing the project financing process with Societe Generale, as we work toward a comprehensive funding solution for the Kabanga Nickel Project.”

About 12% cost of capital on this loan so whenever I feel like doing the math I'll have to use a 12% discount rate for the DCF analysis. They still have to get a comprehensive $1B or so from Societe Generale to build this thing. The high interest rate is to be expected, but nice to see that these guys are actually able to attract some financing unlike shitcos like Global Atomic or Atlas Salt which have remained unfinanced for years.

Anonymous

(ID: g06bycoT)

8/11/2025, 1:24:00 PM

No.23090819

>>23090846

8/11/2025, 1:24:00 PM

No.23090819

>>23090846

>>23090790

>I'll have to use a 12% discount rate

You will never be a Bay Street analyst.

Anonymous

(ID: LY8OJ8Fk)

8/11/2025, 1:45:01 PM

No.23090846

8/11/2025, 1:45:01 PM

No.23090846

>>23090819

>you will never be a coke addict

good

Anonymous

(ID: aSFOD6jR)

8/11/2025, 1:49:49 PM

No.23090851

>>23090887

8/11/2025, 1:49:49 PM

No.23090851

>>23090887

>>23090790

Atlas looks very tasty on technical level, RSI almost rock bottom. Could see one more leg down to toughly 0.20 but still would be happy to buy at 0.40.

In fact very tempted to load up as we speak. Peak capitulation best time for shopping.

Tad torn tho to leave silver unloved.

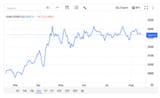

Gold looks like NEEDS to break out - 5th knock on resistance of 3400ish.

Anonymous

(ID: LY8OJ8Fk)

8/11/2025, 2:23:39 PM

No.23090887

8/11/2025, 2:23:39 PM

No.23090887

>>23090851

I need to see Atlas finance that project before I put a single cent into it.

Anonymous

(ID: g5mFz5CU)

8/11/2025, 3:27:48 PM

No.23090962

>>23090991

8/11/2025, 3:27:48 PM

No.23090962

>>23090991

Did the market overreact to Allied Gold temporary having higher costs or should I kneel before the African negro?

I'll say we have a sale.

Anonymous

(ID: XgfNP1vL)

8/11/2025, 3:51:16 PM

No.23090989

>>23090998

8/11/2025, 3:51:16 PM

No.23090989

>>23090998

>>23090543

The slurp sale I was hoping for isn't as big as I'd hoped, some of my shitcos are actually going up when I wanted them to drop 10%

Anonymous

(ID: LY8OJ8Fk)

8/11/2025, 3:52:34 PM

No.23090991

8/11/2025, 3:52:34 PM

No.23090991

>>23090962

looks like an overreaction to me. I'm still sitting with my overweight position

Anonymous

(ID: dKakEMfR)

8/11/2025, 3:58:09 PM

No.23090998

8/11/2025, 3:58:09 PM

No.23090998

>>23090989

Yea, that's the recurring "problem" recently

Anonymous

(ID: g06bycoT)

8/11/2025, 5:26:22 PM

No.23091146

8/11/2025, 5:26:22 PM

No.23091146

Active Crescat dumping

Anonymous

(ID: p68QfQgA)

8/11/2025, 6:59:40 PM

No.23091358

8/11/2025, 6:59:40 PM

No.23091358

Interesting day

Anonymous

(ID: VydSWje9)

8/11/2025, 10:00:45 PM

No.23092096

>>23093176

8/11/2025, 10:00:45 PM

No.23092096

>>23093176

>>23087280

Should I convert my Goliath into Snownigger bux

Anonymous

(ID: GEO6WhMi)

8/11/2025, 10:02:47 PM

No.23092106

>>23092661

>>23093352

8/11/2025, 10:02:47 PM

No.23092106

>>23092661

>>23093352

trump has apparently given alaska to russia to end the ukraine war. bullish or bearish?

Anonymous

(ID: p68QfQgA)

8/11/2025, 10:07:59 PM

No.23092122

>>23092646

>>23092652

8/11/2025, 10:07:59 PM

No.23092122

>>23092646

>>23092652

Is Keith Neumeyer the major problem at First Majestic?

Bad leadership? Bad communication? Bad results?

Anonymous

(ID: dKakEMfR)

8/11/2025, 11:02:39 PM

No.23092646

>>23092774

8/11/2025, 11:02:39 PM

No.23092646

>>23092774

>>23092122

What problem? Other then being a schizophrenic who few years ago been mumbling about "muh planned depopulation"?

Anonymous

(ID: dKakEMfR)

8/11/2025, 11:03:47 PM

No.23092652

8/11/2025, 11:03:47 PM

No.23092652

>>23092122

Depends on Canada's reaction.

Anonymous

(ID: dKakEMfR)

8/11/2025, 11:05:19 PM

No.23092661

8/11/2025, 11:05:19 PM

No.23092661

>>23092106

Depend's on Canadas reaction to Russkies entering Canadian sphere of influence.

Anonymous

(ID: p68QfQgA)

8/11/2025, 11:31:27 PM

No.23092774

>>23093174

8/11/2025, 11:31:27 PM

No.23092774

>>23093174

>>23092646

The problem of First Majestic not rising in price

Anonymous

(ID: dKakEMfR)

8/12/2025, 12:16:15 AM

No.23093174

8/12/2025, 12:16:15 AM

No.23093174

Anonymous

(ID: oTjGNV/E)

8/12/2025, 12:17:04 AM

No.23093176

8/12/2025, 12:17:04 AM

No.23093176

>>23092096

Can't say what the future holds but that's what I did back around Feb. SGD is far better de-risked and has an actual CEO that's not a shameless pumper. I grew to despise Rosmus after 3 years of holding GOT

Anonymous

(ID: LY8OJ8Fk)

8/12/2025, 1:09:33 AM

No.23093352

8/12/2025, 1:09:33 AM

No.23093352

>>23092106

do you often just make up random bs online?

Anonymous

(ID: p3hhc7g/)

8/12/2025, 3:54:50 AM

No.23094377

8/12/2025, 3:54:50 AM

No.23094377

Nice green day for a lot of small silver cos

Anonymous

(ID: p68QfQgA)

8/12/2025, 6:36:45 AM

No.23095023

>>23095025

8/12/2025, 6:36:45 AM

No.23095023

>>23095025

haha there's a nigger on the panel

Anonymous

(ID: p68QfQgA)

8/12/2025, 6:37:01 AM

No.23095025

8/12/2025, 6:37:01 AM

No.23095025

Anonymous

(ID: jf0bjWcu)

8/12/2025, 3:18:26 PM

No.23096294

>>23096318

>>23096440

>>23117116

8/12/2025, 3:18:26 PM

No.23096294

>>23096318

>>23096440

>>23117116

Y'all saw this hit by Seabridge?

Hole SN-25-25 intersects 729m of 0.48 gpt Au and 0.16% Cu including 254m of 0.77 gpt Au and 0.31% Cu.

Pretty juicy if gold stays strong. They already have a 500M tonnes resource on the project (Snip North) at very low grades, like 0.33 g/t and 0.09% cu.

https://www.juniorminingnetwork.com/junior-miner-news/press-releases/933-tsx/sea/185334-seabridge-gold-intersects-significant-porphyry-mineralization-at-snip-north.html

Anonymous

(ID: g06bycoT)

8/12/2025, 3:40:53 PM

No.23096318

>>23096325

8/12/2025, 3:40:53 PM

No.23096318

>>23096325

>>23096294

Residuals (65% of the hole) measure about the same as the current resource grade. The higher-grade section will be diluted for depth, loss, etc, if it's included in a future resource. The report is nothing special for this project.

Anonymous

(ID: jf0bjWcu)

8/12/2025, 3:44:50 PM

No.23096325

>>23096385

8/12/2025, 3:44:50 PM

No.23096325

>>23096385

>>23096318

The entire 729m would probably be milled in a mine scenario. With a big flotation mill, cutoff is only like 0.1% Cu or a bit more. It has 108ppm Mo as well which is like 0.04% Cueq. Mineralization is from 70m. If you assume gold stays above $3000, the value per tonne compares favorably to a lot of BC copper mines.

Anonymous

(ID: g06bycoT)

8/12/2025, 4:15:23 PM

No.23096385

8/12/2025, 4:15:23 PM

No.23096385

>>23096325

>mine scenario

I'm not prepared to wait 30 more years, if ever.

Anonymous

(ID: LY8OJ8Fk)

8/12/2025, 4:46:05 PM

No.23096440

>>23096453

8/12/2025, 4:46:05 PM

No.23096440

>>23096453

>>23096294

Nice intercept but yeah like the other guy points out this is a miniscule blip in the total resource and any future life of mine plan. Seabridge has a fuckhuge collection of deposits, the tonnage is probably in the top three of all undeveloped gold projects globally, and the gold and copper grades are pretty low. Additionally the metallurgy isn't great. The project will likely be built at some point though, the IRR should already be high enough to attract investment in the current gold price but majors will probably want to see the long term consensus gold price above $3k first if I had to guess

Anonymous

(ID: jf0bjWcu)

8/12/2025, 4:56:50 PM

No.23096453

>>23096455

>>23096775

8/12/2025, 4:56:50 PM

No.23096453

>>23096455

>>23096775

>>23096440

This is a different project from KSM, located 30 km away as the crow flies, would probably need own mill.

729m is huge, will depend on other holes nearby how big this part of the system is, but to put into perspective 1000m squared is like 3 billion tonnes.

Anonymous

(ID: jf0bjWcu)

8/12/2025, 4:57:22 PM

No.23096455

8/12/2025, 4:57:22 PM

No.23096455

>>23096453

>1000m squared

Or cubed or whatever, y'all know what i mean.

Anonymous

(ID: LY8OJ8Fk)

8/12/2025, 6:03:07 PM

No.23096775

>>23097036

8/12/2025, 6:03:07 PM

No.23096775

>>23097036

>>23096453

30km away from KSM counts as a satellite to me. Why build a separate mill when you could just truck the ore

Anonymous

(ID: jf0bjWcu)

8/12/2025, 7:47:22 PM

No.23097036

>>23097046

>>23097061

8/12/2025, 7:47:22 PM

No.23097036

>>23097046

>>23097061

>>23096775

30 km as the crow flies, in that terrain I'm guessing it would be more. You don't really want to truck 0.5 g/t ore 30km+. They also already have enough ore for 100 years at KSM.

Anonymous

(ID: LY8OJ8Fk)

8/12/2025, 7:51:30 PM

No.23097046

>>23097061

>>23097102

8/12/2025, 7:51:30 PM

No.23097046

>>23097061

>>23097102

>>23097036

There's a lot of options for a large scale project like this. They could choose to build the processing plant somewhere in the middle, or they could opt for a conveyor belt solution, they could even choose to relocate the processing plant during the life of mine plan. Usually building multiple processing plants that close to each other is a non-starter due to the upfront capital costs being unnecessarily high.

Anonymous

(ID: LY8OJ8Fk)

8/12/2025, 7:58:37 PM

No.23097061

>>23097102

8/12/2025, 7:58:37 PM

No.23097061

>>23097102

>>23097036

>>23097046

actually from what I remember, wasn't Seabridge already considering a conveyor belt solution for their project? Shouldn't be too difficult to include Snip into that plan right?

Anonymous

(ID: WuZ6MzK4)

8/12/2025, 8:06:13 PM

No.23097084

>>23102303

8/12/2025, 8:06:13 PM

No.23097084

>>23102303

Thoughts on getting a work and travel visa in Australia to do Fly In Fly Out work half a year for some mine as a 29 year old? Has anyone done this?

I have an engineering degree for what it's worth but I want to leave this place and my mom's basement.

Anonymous

(ID: jf0bjWcu)

8/12/2025, 8:15:24 PM

No.23097102

>>23097246

8/12/2025, 8:15:24 PM

No.23097102

>>23097246

>>23097046

>>23097061

A 30 km conveyor belt sounds like a stretch. KSM is going ahead as a standalone project with a 33 year mine life only restricted by current tailings capacity permit. They can keep mining at those deposits for a long, long time.

If this Iskut project goes ahead I'm pretty sure they are building another plant instead of waiting 100 years for the KSM mill to run out of ore. Usually you don't build two plants that close, but when you have this much ore and it's low grade, it makes sense.

Anonymous

(ID: LY8OJ8Fk)

8/12/2025, 9:09:03 PM

No.23097246

>>23097259

8/12/2025, 9:09:03 PM

No.23097246

>>23097259

>>23097102

should be doable, it's been done before.

Anonymous

(ID: 05GNRP4C)

8/12/2025, 9:09:47 PM

No.23097247

8/12/2025, 9:09:47 PM

No.23097247

Anonymous

(ID: jf0bjWcu)

8/12/2025, 9:11:43 PM

No.23097259

>>23097305

8/12/2025, 9:11:43 PM

No.23097259

>>23097305

>>23097246

Then they just need to wait 100 years for the mill to run out of KSM ore.

Anonymous

(ID: LY8OJ8Fk)

8/12/2025, 9:26:44 PM

No.23097305

>>23097340

8/12/2025, 9:26:44 PM

No.23097305

>>23097340

>>23097259

Sounds good, the upfront capital costs are high enough for one giant 1 million ounce a year processing plant. I can't imagine a mining company would want to pay for two in one century if they can help it.

What's stopping them from mining the highest grade parts of each of the deposits in the first, say, 20 years? They can pick and choose you know.

Anonymous

(ID: jf0bjWcu)

8/12/2025, 9:34:09 PM

No.23097340

>>23097349

>>23097354

8/12/2025, 9:34:09 PM

No.23097340

>>23097349

>>23097354

>>23097305

You can't high grade a porphyry, it's all low grade. The investment will probably have a payback of something like 3 years if gold prices remain strong, assuming there is a mine there. Worth building a mill if you have a 30+ year mine life. Cash flow 100 years into the future is discounted heavily of course.

Anonymous

(ID: LY8OJ8Fk)

8/12/2025, 9:36:40 PM

No.23097349

8/12/2025, 9:36:40 PM

No.23097349

>>23097340

Porphyries also have higher and lower grade zones. There's I think 4 different major deposits at KSM, plus one or two more at Snip? All of those have their own zones, some may be higher grade near surface. Even porphyry mines start by mining the easiest to access high grades they can, it gets the cash flows in earlier on in the mine life and improves return on investment.

Anonymous

(ID: jf0bjWcu)

8/12/2025, 9:38:08 PM

No.23097354

8/12/2025, 9:38:08 PM

No.23097354

>>23097340

And the cost of a mega long conveyor and the cost of transporting even using that will still dig seriously into the margin of such low grade ore and will make a lot of the deposit not worth mining compared to just building a mill right beside it.

Anonymous

(ID: GEO6WhMi)

8/12/2025, 11:11:42 PM

No.23098694

8/12/2025, 11:11:42 PM

No.23098694

Denison raising $250m with debt to develop their "full funded" Wheeler River project. Glad I trimmed heavily last month, down 10% after hours on the US listing.

Anonymous

(ID: p3hhc7g/)

8/13/2025, 3:02:28 AM

No.23100106

8/13/2025, 3:02:28 AM

No.23100106

ABRA just chuggin along towards a $1B market cap. Comfy times

Anonymous

(ID: Wa5ONdB0)

8/13/2025, 8:50:33 AM

No.23101500

>>23101951

8/13/2025, 8:50:33 AM

No.23101500

>>23101951

https://api.investi.com.au/api/announcements/svm/e212a49b-630.pdf

Still no news from Rio Tinto on their titanium assets.

Time in market beats timing the markets.

Anonymous

(ID: mwXWJOXg)

8/13/2025, 11:38:44 AM

No.23101936

>>23103408

8/13/2025, 11:38:44 AM

No.23101936

>>23103408

Simon Salva

!!h4wpIXR3ZRV

(ID: dIMO3Jvj)

8/13/2025, 11:43:48 AM

No.23101946

>>23101985

8/13/2025, 11:43:48 AM

No.23101946

>>23101985

>>23061484

Damn, this thread moves really slow. I made this post 7 days ago.

Anonymous

(ID: LY8OJ8Fk)

8/13/2025, 11:46:42 AM

No.23101951

>>23102621

8/13/2025, 11:46:42 AM

No.23101951

>>23102621

>>23101500

These kinds of deals can take multiple quarters to materialize. We're talking about a multi-billion dollar enterprise potentially changing hands. Good to see Sovereign keeps developing Kasiya regardless. Maybe they will end up going at it alone. I would hope for a JV at least though, for better cost of capital.

Anonymous

(ID: GEO6WhMi)

8/13/2025, 12:17:23 PM

No.23101985

8/13/2025, 12:17:23 PM

No.23101985

>>23101946

It's august we're all on expensive holidays

Anonymous

(ID: mwXWJOXg)

8/13/2025, 2:39:20 PM

No.23102177

>>23102214

8/13/2025, 2:39:20 PM

No.23102177

>>23102214

Anonymous

(ID: LY8OJ8Fk)

8/13/2025, 3:06:21 PM

No.23102214

8/13/2025, 3:06:21 PM

No.23102214

>>23102177

Even worse than $21.6M in cash, look at that working capital deficiency holy shit!! They're on the hook for over $260M in working capital, up over $200M since last year! As a cherry on top their discussions with the mining contractor broke down. Ascot is swiftly headed into bankruptcy.

Anonymous

(ID: tT6jqD9u)

8/13/2025, 4:03:46 PM

No.23102303

8/13/2025, 4:03:46 PM

No.23102303

>>23097084

Aussies won't extend white people work visas, so you're good to go.

Anonymous

(ID: 85rCkYOH)

8/13/2025, 4:59:50 PM

No.23102602

>>23102626

8/13/2025, 4:59:50 PM

No.23102602

>>23102626

>Minera Alamos has entered into an agreement with Stifel Canada, as lead underwriter and sole bookrunner (the "Lead Underwriter"), on behalf of a syndicate of underwriters (the "Underwriters"), in connection with a bought deal private placement offering of 309,860,000 subscription receipts (the "Subscription Receipts") at a price of C$0.355 per Subscription Receipt (the "Issue Price") for gross proceeds of approximately C$110 million (the "Offering"). The size of the Offering may be increased in certain circumstances by up to an additional C$25 million.

cant believe I got fucked again by dilution and warrants. Im sick of these vancouver shysters giving their buddies better deals than open market. 30 % haircut. plus the whole thesis of buying the juinior was for them to receive an open pit mine permit in mexico. Now they diluted me, put a ridiculous warrant price cap on the stock and bought a mine in nevada.

I'm out, selling my jr. miners and buying ai stocks.

Anonymous

(ID: UsE8nZGF)

8/13/2025, 5:07:38 PM

No.23102621

>>23103012

8/13/2025, 5:07:38 PM

No.23102621

>>23103012

>>23101951

Yes. I do not know exactly how the process would go but I would assume the company would announce something about it well ahead of time.

ARTG chads, we are printing money, plus debt refinancing just like management said.

Anonymous

(ID: jf0bjWcu)

8/13/2025, 5:11:41 PM

No.23102626

8/13/2025, 5:11:41 PM

No.23102626

>>23102602

Mexico has been cooked as a jurisdiction for at least 5 years, market has been sleeping completely on how shitty this jurisdiction is and still is today. Taxes are high as well and probably going higher if you even manage to get a mine built.

Anonymous

(ID: LY8OJ8Fk)

8/13/2025, 6:53:14 PM

No.23103012

8/13/2025, 6:53:14 PM

No.23103012

>>23102621

>tfw used to own ARTG at like $6 but sold out way too early

live and learn. Probably going higher too but I just cannot buy it now.

Anonymous

(ID: iUGJJSuN)

8/13/2025, 7:58:41 PM

No.23103408

>>23104206

>>23104276

8/13/2025, 7:58:41 PM

No.23103408

>>23104206

>>23104276

>>23101936

Wish I had longed Hecla a few years ago instead of First Majestic

Anonymous

(ID: HMRqB7cQ)

8/13/2025, 11:29:15 PM

No.23104206

>>23104276

>>23104588

8/13/2025, 11:29:15 PM

No.23104206

>>23104276

>>23104588

>>23103408

Tomorrow could be big for AG. Keith seems pretty excited about Q2 earnings, maybe he beats Hecla's $103.8M free cash flow

Anonymous

(ID: HMRqB7cQ)

8/13/2025, 11:44:39 PM

No.23104276

8/13/2025, 11:44:39 PM

No.23104276

Anonymous

(ID: TJSdFj2S)

8/14/2025, 12:29:33 AM

No.23104588

8/14/2025, 12:29:33 AM

No.23104588

>>23104206

I hope so, a lot of chart guys chattering on Twitter ...

Anonymous

(ID: HMRqB7cQ)

8/14/2025, 1:45:03 AM

No.23104994

>>23105384

8/14/2025, 1:45:03 AM

No.23104994

>>23105384

Anonymous

(ID: LY8OJ8Fk)

8/14/2025, 2:55:14 AM

No.23105384

>>23106393

>>23107396

8/14/2025, 2:55:14 AM

No.23105384

>>23106393

>>23107396

>>23104994

That's fantastic news for Galleon and a major vote of confidence! I'll be honest, I had long since written off the company and they project as shit. I was probably wrong.

Anonymous

(ID: TJSdFj2S)

8/14/2025, 3:17:39 AM

No.23105520

8/14/2025, 3:17:39 AM

No.23105520

This bullrun is painstakingly slow

Anonymous

(ID: tT6jqD9u)

8/14/2025, 5:12:45 AM

No.23106106

>>23106364

>>23107359

8/14/2025, 5:12:45 AM

No.23106106

>>23106364

>>23107359

Anybody seen shortfag? Did he anhero?

Anonymous

(ID: HMRqB7cQ)

8/14/2025, 6:13:39 AM

No.23106364

8/14/2025, 6:13:39 AM

No.23106364

>>23106106

Did Rana drive him do it?

Anonymous

(ID: HMRqB7cQ)

8/14/2025, 6:21:42 AM

No.23106393

>>23106528

8/14/2025, 6:21:42 AM

No.23106393

>>23106528

>>23105384

Yep, Galleon is basically Lagoon with 8x the gold proven, better share structure and no Poo CEO, but at $3300 gold price and PAAS with them they look pretty sweet. I wonder if they can go up 20%+ Thursday

Anonymous

(ID: TJSdFj2S)

8/14/2025, 7:06:33 AM

No.23106528

>>23107006

>>23107185