Anonymous

(ID: 0oArgDFB)

6/23/2025, 3:57:40 PM

No.60537984

>>60538233

>>60538603

>>60538745

>>60538775

>>60539968

>>60540086

>>60543132

>>60543427

Its BAD

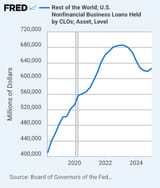

In 2008, cdo's (collateralized debt obligations) full of junk mortgages in disguise imploded. The aftermath is still felt to this day. As we speak. clo's (collateralized loan obligations) are being filled with junk crypto debt. SBF was a pioneer in this. SBF wasn't just another crypto scammer. He was running a 21st century equivalent of bear stearns cdo fraud. SBF wasn’t an outlier—he was the logical endpoint of a system that rewards:

>"Genius fakery" (Epstein/SBF)

>Regulatory bribes (Bear/FTX)

>Institutionalized gambling (CDOs/CLOs/crypto)

What does epstein have to do with this, you ask.... google where he worked after being a school tutor. bear fucking stearns. despite quiting, he had regular visits to the office until the end. guess who sbf hired as a lawyer? Same guy epstein had. Deustche bank, hired steven williams (ex-bear stearns CDO chief) and put him in charge of their CRYPTO division. Deustche was also laundering money with epstein, then ftx. Apollo, a company sbf bought shit tons of clo's from. a company that gave ftx 400 million months before collapse. Well, Leon Black gave epstein 153m for very vague reasons. He also participated in the bear stearns fraud. His son, "josh black" sat on the ftx advisory board. they are CURRENTLY doing bear level fraud with crypto CLO's. Imagine the 2008 recession but far worse, and all the normies blame YOUR coins for it. The next SBF is already trading ai tokens or climate derivatives, and it's you who's gonna pay the price when his junk explodes. Oh yeah and elons involved, he's filling clo's with his fucked up twitter debt

TLDR; cdo's never went anywhere they just changed name, and they can be used to pop your crypto bags like a balloon whenever. do your own research, and you'll see I'm right. 2008 but worse. you can probably pull off a modern-day big short from this, but I doubt it. Most likely just pain and suffering for us all

>"Genius fakery" (Epstein/SBF)

>Regulatory bribes (Bear/FTX)

>Institutionalized gambling (CDOs/CLOs/crypto)

What does epstein have to do with this, you ask.... google where he worked after being a school tutor. bear fucking stearns. despite quiting, he had regular visits to the office until the end. guess who sbf hired as a lawyer? Same guy epstein had. Deustche bank, hired steven williams (ex-bear stearns CDO chief) and put him in charge of their CRYPTO division. Deustche was also laundering money with epstein, then ftx. Apollo, a company sbf bought shit tons of clo's from. a company that gave ftx 400 million months before collapse. Well, Leon Black gave epstein 153m for very vague reasons. He also participated in the bear stearns fraud. His son, "josh black" sat on the ftx advisory board. they are CURRENTLY doing bear level fraud with crypto CLO's. Imagine the 2008 recession but far worse, and all the normies blame YOUR coins for it. The next SBF is already trading ai tokens or climate derivatives, and it's you who's gonna pay the price when his junk explodes. Oh yeah and elons involved, he's filling clo's with his fucked up twitter debt

TLDR; cdo's never went anywhere they just changed name, and they can be used to pop your crypto bags like a balloon whenever. do your own research, and you'll see I'm right. 2008 but worse. you can probably pull off a modern-day big short from this, but I doubt it. Most likely just pain and suffering for us all