>>60588430

Thanks for the insightful response among we I agree with you on pretty much everything and assume we are ideologically aligned. I especially agree that bitcoin won’t die. Do you think in the future that the only people transacting on the base layer will be banks, state actors, and whales paying big fees?

> Imagine someone in 1994 trying to think of the all the businesses being built on the internet in 2025.

I totally agree with this and have similar thoughts. I’ve had epiphanies in the past where I get glimpses of the future of BTC and it scared me enough to go all in. I hold nothing else besides some gold The level of sovereignty we have as bitcoiners is basically unprecedented in human history.

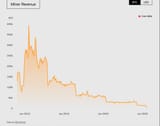

>5% growth in fee market

Does a growth in the fee market in sats terms actually have to happen? What if bitcoin continues to outperform everything else. Isn’t that enough?

> If a market for fee does not support a robust mining network that keeps Bitcoin safe then we're probably looking at a fork of the network

What would the fork look like? Removed hard cap, bigger block size, tail emissions, like the other anon said? Or something else?

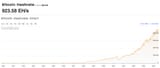

I also agree that bitcoin will be used to stabilize the grid, and much energy that is stranded or unusable on the market will be funneled into mining BTC.