>>60612227

Yesterday the ETFs bought over 10,000 BTC.

Today the ETFs bought about 8750 BTC.

https://farside.co.uk/btc/

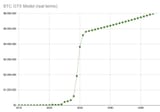

If you look at the long-term average inflow, assuming that it remains steady, the price will stabilize at $300K/BTC. I would expect that inflows will slow down as BTC rises, though, because people will say

>>60612188

>boomer gains at best

and slow down their buy-ins. So my prediction is $250K.

But that doesn't include the buys from "Bitcoin treasury" companies, which were larger than the ETFs last quarter (some news report a week or two ago), so it could be more.

However, if more state pension funds and national treasuries start looking at BTC, we could end up seeing long-term permanent DCAing inflows from these places. Michigan, Pennsylvania, Wisconsin, and I think also Florida have announced that they are buying, not in huge amounts but at least enough to learn the processes.

Anyway, add these companies and states and countries into the mix, and we're looking at enormous gains in the future.

Lastly, what has killed Bitcoin every cycle is massive fraud perpetrated by unregulated exchanges -- MtGox in 2013, the ICO and shitcoin boom in 2017, and FTX in 2021. This time, the buying is happening by and through heavily regulated entities that aren't going to steal all the money and use it to fund Democratic Party candidates. And because they're not doing that this time, and because the price action has been so subdued this time (no frothy parabolic blowoffs in sight yet), I don't see any reason for us to have a massive crash.