/smg/ - stock market general

Anonymous

(ID: ZBjAw0KU)

7/19/2025, 12:09:47 AM

No.60654234

I'm not KIND. I'm the Next Doctor.

Anonymous

(ID: MAKre5w7)

7/19/2025, 12:09:55 AM

No.60654236

>>60654679

>>60660453

>>60662471

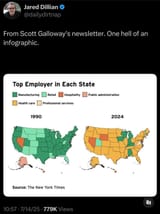

>>60654207 (OP)

The Midwest wins again

Anonymous

(ID: fWzGtvwF)

7/19/2025, 12:12:57 AM

No.60654256

>>60654260

>>60654273

>>60654643

>>60655407

xxloligroyper1488

!!LflHQRKcdXi

(ID: K4SCWIs9)

7/19/2025, 12:14:05 AM

No.60654260

Anonymous

(ID: UVtnzh03)

7/19/2025, 12:15:43 AM

No.60654273

>>60654863

>>60654256

no tail who cares

Anonymous

(ID: Qvx+JHsa)

7/19/2025, 12:15:48 AM

No.60654274

>>60654280

Trumps gonna cuck out on the tariffs before August 1st. Watch.

How did we get a spineless bitch ass as a president?

xxloligroyper1488

!!LflHQRKcdXi

(ID: K4SCWIs9)

7/19/2025, 12:16:49 AM

No.60654280

>>60654305

>>60654274

are you a bear

Anonymous

(ID: 4uqFnw8+)

7/19/2025, 12:16:53 AM

No.60654281

>>60654300

>>60654870

I've got about $17k sitting on the sideline. What stock shall be bought?

Anonymous

(ID: cA1Zq6Vq)

7/19/2025, 12:18:06 AM

No.60654294

>>60654311

>>60654321

I gigashorted Paramount

Anonymous

(ID: xJZtECIQ)

7/19/2025, 12:19:02 AM

No.60654300

Anonymous

(ID: Qvx+JHsa)

7/19/2025, 12:19:46 AM

No.60654305

>>60654280

Depends who’s asking

Anonymous

(ID: UVtnzh03)

7/19/2025, 12:21:03 AM

No.60654311

>>60654294

getting rid of dead weight is bullish

also colbert deserves everything after supporting the LOTR show

xxloligroyper1488

!!LflHQRKcdXi

(ID: K4SCWIs9)

7/19/2025, 12:22:20 AM

No.60654321

>>60654369

>>60655666

>>60654294

>I gigashorted Paramount

Anonymous

(ID: eYFKosgH)

7/19/2025, 12:22:26 AM

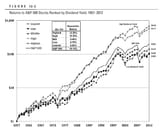

No.60654322

>>60654342

>>60655125

>>60655898

where are we on this chart?

xxloligroyper1488

!!LflHQRKcdXi

(ID: K4SCWIs9)

7/19/2025, 12:25:57 AM

No.60654342

>>60654389

>>60654322

There is a time to buy just bonds and a time to buy just commodities, but never a time to buy just stocks.

Anonymous

(ID: Oj/PE95P)

7/19/2025, 12:29:54 AM

No.60654369

>>60654321

where's skibidi biden

Anonymous

(ID: BE/zCFIY)

7/19/2025, 12:30:40 AM

No.60654375

>>60654207 (OP)

Import third world. Every industry fucked over except the one that benefits from mass influx of unskilled bodies. This is the reason I stuck a foot in the door of the healthcare circus show here in the leaf last fall. I consider it the safest for job security over the next 25 years before I (hope to god) am able to retire.

Anonymous

(ID: eYFKosgH)

7/19/2025, 12:33:23 AM

No.60654389

>>60654342

browsing a corporate site and one of the pics shows the guys getting absolutely heemed kek

Anonymous

(ID: +hzdEe5C)

7/19/2025, 12:43:14 AM

No.60654433

>>60654207 (OP)

>that image

Boomers did this.

Anonymous

(ID: p2/0xSNe)

7/19/2025, 12:47:56 AM

No.60654461

>>60654506

>>60654868

Release the epstein files or pump by bags

Anonymous

(ID: hNnTPPs/)

7/19/2025, 12:51:09 AM

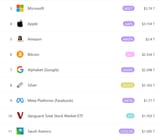

No.60654484

>>60654502

Behold my only investments in the whole world

Should I be DCAing more into schd or SPYI? QQQI I'm a little wary of because of how tech heavy it is

Anonymous

(ID: wSLzyMCR)

7/19/2025, 12:54:38 AM

No.60654502

>>60654484

Full port SOXL

Anonymous

(ID: T2wvAx9g)

7/19/2025, 12:55:18 AM

No.60654506

>>60654461

You and I both know what’s in those files

Anonymous

(ID: 9fFwt8Y1)

7/19/2025, 1:20:46 AM

No.60654643

>>60654256

Did you censor her toes, or did she?

Anonymous

(ID: 7zmsy+re)

7/19/2025, 1:23:52 AM

No.60654664

>>60654761

Please tell me Trump is Okay, he looks sick but I need him for 3,5 more years he's making us rich ffffuuack.

Anonymous

(ID: 0kRj/NBI)

7/19/2025, 1:26:46 AM

No.60654679

>>60659552

>>60654236

Minorities are perpetually seething over whites, at all times of the day

Anonymous

(ID: Of86YMIH)

7/19/2025, 1:42:16 AM

No.60654754

Ive been ridding the Yield max train for a while now and its absolutely amazing so far - what do yall think about it ? God bless the 4 years of bull market

Anonymous

(ID: U1c8VaoM)

7/19/2025, 1:44:12 AM

No.60654761

>>60654813

>>60654876

>>60654664

forgot who the VP was for a moment.

Anonymous

(ID: 7zmsy+re)

7/19/2025, 1:55:48 AM

No.60654813

>>60654876

>>60655069

>>60654761

Is there a VP?

Anonymous

(ID: 2HJV4LqE)

7/19/2025, 2:05:10 AM

No.60654856

Folks the play this week is so simple a toddler could do it. Why it’s as easy as ABC.

Or should I say the Alphabet & XYZ. GOOGL & Block folks & frens that’s all I have to shill for you nice people this fine Friday eve.

Anonymous

(ID: xf2JYK0O)

7/19/2025, 2:07:05 AM

No.60654863

>>60656256

>>60654273

>t. russian furry spy

Anonymous

(ID: W85hsald)

7/19/2025, 2:08:28 AM

No.60654868

>>60654461

Why would there be epstien files? If they did exist they were 1000% destroyed before orange man won, if not instantly when it originally happened

Anonymous

(ID: xf2JYK0O)

7/19/2025, 2:08:41 AM

No.60654870

>>60654281

ESPR

Sells actual product and not vaporware, big expansion and profitable, ridiculously tiny market cap for what it does. Has disproportionately large market share of its niche.

Anonymous

(ID: 9fFwt8Y1)

7/19/2025, 2:09:21 AM

No.60654876

>>60654880

>>60654761

>>60654813

How could you forget about the couch?

Anonymous

(ID: W85hsald)

7/19/2025, 2:10:39 AM

No.60654880

>>60654876

There is no couch, fell for it again award

Anonymous

(ID: bSaGiCq+)

7/19/2025, 2:22:42 AM

No.60654923

>>60655050

>>60655564

>>60654207 (OP)

HOLY SHIT

BETWEEN 1990 AND 2024, MAINE GOBBLED UP HALF OF NEW HAMPSHIRE

Anonymous

(ID: bSaGiCq+)

7/19/2025, 2:23:56 AM

No.60654931

>>60659406

>>60654207 (OP)

This chart is funny because it's boomers

>boomers when they were 40 years old

Worked in a factory making 30 dollars an hour no education

>boomers at 74 years old

Need nurses to wipe their asses, the nurses get paid 25 an hour.

Anonymous

(ID: bSaGiCq+)

7/19/2025, 2:27:47 AM

No.60654954

I got 3 webull shares for free at 12 bucks. I wish I had gone with 1000 bucks into webull a week ago.

Anonymous

(ID: Za89bVS2)

7/19/2025, 2:45:13 AM

No.60655018

>>60658144

>>60658312

>futures

Anonymous

(ID: VlPaW8hu)

7/19/2025, 2:52:44 AM

No.60655050

>>60654923

>AI slop or retarded graphic designer, call it

Anonymous

(ID: bSaGiCq+)

7/19/2025, 2:57:32 AM

No.60655069

>>60654813

Vance needs to lose 40 pounds and his gay beard (not his wife).

xxloligroyper1488

!!LflHQRKcdXi

(ID: K4SCWIs9)

7/19/2025, 3:00:21 AM

No.60655087

tastytrade did a $50 dollar deposit bonus and these fucks didnt pay out

Anonymous

(ID: Vzrq09AK)

7/19/2025, 3:05:14 AM

No.60655125

Anonymous

(ID: jtEjv6SO)

7/19/2025, 3:15:13 AM

No.60655182

>>60655194

>>60655202

>>60655300

Webull Canada is going to give me CAD$10K for free once my transfer goes through

Does the US have a bunch of transfer promos like this? Why are brokers givng out free cash?? I kinda get it if it was managed investing with 1% fees but no they're self-directed accounts

xxloligroyper1488

!!LflHQRKcdXi

(ID: K4SCWIs9)

7/19/2025, 3:18:01 AM

No.60655194

>>60655182

I got 100 from schwab, 150ish from webull, and am supposed to get 50 from tastytrade

xxloligroyper1488

!!LflHQRKcdXi

(ID: K4SCWIs9)

7/19/2025, 3:19:38 AM

No.60655202

>>60655219

>>60655182

they loan out your cash and equities

Anonymous

(ID: lxmPC09R)

7/19/2025, 3:20:55 AM

No.60655211

karaoke night

Anonymous

(ID: jtEjv6SO)

7/19/2025, 3:23:53 AM

No.60655219

>>60655202

Webull is giving 1.5% interest on uninvested cash so I actually like that, still bad compared to just buying a cash high-interest / money market ETF but better than

Loaning shares out I guess I can really fuck over brokers if I'm just transferring out $1M of SPY or something? Barely any money they can get from loaning, never mind that I'll prob wont be selling so no commission fees either lmao

Why do people even rob banks when banks will give out literally free money

Anonymous

(ID: lxmPC09R)

7/19/2025, 3:36:34 AM

No.60655262

>>60655273

Anonymous

(ID: ++cZgP5r)

7/19/2025, 3:39:24 AM

No.60655273

>>60655262

>jellyroll lost 200 lbs

dietroll?

Anonymous

(ID: JqCgCx4V)

7/19/2025, 3:44:26 AM

No.60655300

>>60655327

>>60655182

How does the transfer work? Can I transfer some of my scotia itrade to it and get a cash % back?

Anonymous

(ID: jtEjv6SO)

7/19/2025, 3:51:17 AM

No.60655327

>>60655334

>>60655300

im transferring from TD and Wealthsimple and yeah thats basically it, transfer in-kind and it'll just transfer your portfolio as is (do not pick the in cash/sell everything option lol) -> just triple check before you submit the transfer

The redflagdeals thread for it is active but the actual title doesnt mention the 2% cashback since it came after the initial promos -> you can look under the OP's post under community notes for more details, or the more recent discussions

https://forums.redflagdeals.com/webull-webull-deposit-transfer-earn-bonuses-up-10k-possibly-existing-users-only-referral-bonus-up-10k-2767651/

I had scotia before when they were charging me $24.99 per trade fuck that

After I hit around $100K with scotia I transferred to CIBC for a 1% promo cashback back then, transferred to Wealthsimple for the free iphone15 promo (if u transfer 100k into them) and then to TD when I had ~$150K for another 1% promo but I'm going to transfer prematurely (and not get that 1% promo) since Webull is offerring better and my portfolio went up a lot more so I can get $10K Webull, instead of $1K from TD

I really dont get it, they are just giving free money. I'm ditching Webull after the 1 year hold and prob moving back to CIBC or Wealthsimple whoeveer has a better transfer promo after Webull promo

Anonymous

(ID: JqCgCx4V)

7/19/2025, 3:53:31 AM

No.60655334

>>60655365

>>60655327

Holy, way too much reading

I just want to transfer a few stocks in my scotia itrade though, does that work? Or does it have to be whole portfolio?

Anonymous

(ID: jtEjv6SO)

7/19/2025, 4:01:15 AM

No.60655365

>>60655372

>>60655334

Yes this is possible but I'm not sure what the process is with Webull. It's a pain to do partial transfers since you have to list out each stock, instead of just clicking 1 option (in-kind)

Frankly, I didn't even check if there was that option. I do remember seeing 1) in-kind , 2) in cash, 3) ??? I didnt even look at the 3rd box maybe that was the partial transfer option ???

Seems more trouble than it's worth, I just did in-kind and will be transferring everything so I can get CAD$10K

you'll get 2% of whatever you transfer so it's easier to just do the whole thing

If ur scared abotu Webull being chinese, they're still CIPF insured and really the actual custodian is CI Financial, Webull is just the front (just like how moomoo canada is actually just an IBKR reskin). Whatever data the Chinese get from me, it won't be worth $10K lol

Anonymous

(ID: JqCgCx4V)

7/19/2025, 4:03:23 AM

No.60655372

>>60655365

Alright cool. Thanks.

Anonymous

(ID: M177mxaJ)

7/19/2025, 4:14:42 AM

No.60655403

>>60655487

PDYN sisters, what happened?

I'm wondering if I should sell on Monday and rebuy on a dip or if this train is continuing.

Anonymous

(ID: FiAYjTL4)

7/19/2025, 4:15:25 AM

No.60655407

Anonymous

(ID: jtEjv6SO)

7/19/2025, 4:36:32 AM

No.60655487

>>60655403

i dunno bout short term swings but based on what we just saw on TSMC, and of course NVDA's metrics

ai is surprisingly not a bubble yet lmao

the bubblesayers will eventually be right after they miss out on more multibaggers

once we start to see ai waste solutions (lol cielo) or other bullshit ai, then it'll start to be a bubble after those things pump like SPACs

Anonymous

(ID: 1GD26dJd)

7/19/2025, 4:45:11 AM

No.60655513

>>60655525

>>60655571

Really though, how do we get that retarded schizo to fuck off from the /bant/ thread for good? He's holding the entire thread hostage.

Anonymous

(ID: jtEjv6SO)

7/19/2025, 4:48:34 AM

No.60655525

>>60655551

>>60655513

youll miss him when hes gone

just like tinny

even DFV/roaringkitty said tinny's name out loud multiple times in his livestreams, the only way i can remember that schizo now that he's not with us

Anonymous

(ID: 1GD26dJd)

7/19/2025, 4:55:02 AM

No.60655551

>>60655561

>>60655803

>>60655944

>>60655525

No, I really won't miss him. He's ruined /bant/smg/ and turned it into his personal mentally ill blog. He acts like a cutesy little kid until he goes on a mentally ill tirade and threatens to come to where you live and physically attack you. He's literally the worst person I have ever interacted with.

Anonymous

(ID: jtEjv6SO)

7/19/2025, 4:58:18 AM

No.60655561

>>60655672

>>60655731

>>60655731

>>60655803

>>60655551

bant smg was going to die eventually from attrition

someone either blows up their account, or makes enough to just quit and enjoy lyfe

im going to miss the flags tho

Anonymous

(ID: kFoULV1I)

7/19/2025, 4:59:30 AM

No.60655564

>>60654923

>he didn't fight for his state in the brutal maine/new Hampshire winter hockey war

Anonymous

(ID: kFoULV1I)

7/19/2025, 5:01:24 AM

No.60655571

>>60655665

>>60655513

Thats the price you pay to be able say nigger at will

xxloligroyper1488

!!LflHQRKcdXi

(ID: K4SCWIs9)

7/19/2025, 5:05:18 AM

No.60655579

>>60655597

>>60655900

Why are you guys so worked up over the epstein client list? It doesnt exist, ok? let it GO! and even if it did, it wouldnt be anyone important. and if it was, it wouldnt be anyone you know, and if it was, it wouldnt be anyone in this thread, and if it was, it wouldnt be me, OK?

Now please, stop asking about it, OK?

Anonymous

(ID: fXsKgp6V)

7/19/2025, 5:13:08 AM

No.60655597

>>60655579

I can honestly say that I do not care if or who high ranked us politicians fucked or didn't. How this should reflect on crypto is beyond me too. Crypto is beyond that realm It is only that dumb people keep making it a melt

Anonymous

(ID: D6Gylp29)

7/19/2025, 5:20:32 AM

No.60655616

>futures

Anonymous

(ID: ZxTq+K+P)

7/19/2025, 5:23:02 AM

No.60655621

>>60655687

>>60655900

>>60654207 (OP)

CHEVRON TAKES EXXON FOR MOST VALUABLE OIL COMPANY WORLDWIDE FOR WEEKEND CLOSE

Anonymous

(ID: JqCgCx4V)

7/19/2025, 5:38:44 AM

No.60655665

>>60657680

>>60655571

Stop being dumb. People like him remind me of what internet was like back in the day. Go to reddit if you dont like it.

Anonymous

(ID: IIJvJrQP)

7/19/2025, 5:38:52 AM

No.60655666

>>60654321

I always loved these

Anonymous

(ID: ++cZgP5r)

7/19/2025, 5:40:57 AM

No.60655672

>>60655561

>bant smg was going to die eventually from attrition

noone is interested is pedo shit, or SBSW. Its cancer.

Anonymous

(ID: Vm+eFtSh)

7/19/2025, 5:45:40 AM

No.60655687

>>60656044

>>60657212

Anonymous

(ID: bSaGiCq+)

7/19/2025, 6:02:42 AM

No.60655731

Anonymous

(ID: NboO9mJD)

7/19/2025, 6:23:15 AM

No.60655803

>>60655815

>>60655834

>>60655551

>>60655561

Are we all back on /biz/ again?

Anonymous

(ID: ++cZgP5r)

7/19/2025, 6:28:36 AM

No.60655815

>>60655863

>>60655803

>Are we all back on /biz/ again?

No, go back.

xxloligroyper1488

!!LflHQRKcdXi

(ID: K4SCWIs9)

7/19/2025, 6:34:34 AM

No.60655834

>>60655803

there was some sort of psyop to get me back. 90% off-topic porn posts w/ OP always being gross giantess. I dont know why they wanted me back here so bad

Anonymous

(ID: R5RcdwaZ)

7/19/2025, 6:44:51 AM

No.60655863

>>60655885

>>60655815

I was here before you, nigger

Anonymous

(ID: ++cZgP5r)

7/19/2025, 6:48:49 AM

No.60655885

>>60658949

>>60655863

No. Now go back. This is the non pedo freak /smg/

Anonymous

(ID: +JODd7Cq)

7/19/2025, 6:50:29 AM

No.60655898

>>60654322

Stage 3 or 4, top in 2026

Anonymous

(ID: +JODd7Cq)

7/19/2025, 6:52:08 AM

No.60655900

>>60655914

>>60657215

>>60655579

Whether it exists or not is irrelevant, its a smokescreen to something else

>>60655621

I have IEZ and IEO to take advantage of tight oil supply (i dont care what spot is)

Anonymous

(ID: j5o/AVLD)

7/19/2025, 6:56:31 AM

No.60655914

>>60655964

>>60655900

yeah i mean so bibi allegedly uses war to stay in power and that seems to be popping off so uhh yknow

Anonymous

(ID: j5o/AVLD)

7/19/2025, 6:58:33 AM

No.60655929

>>60655971

also, i caved. bant sucks

did leaf forex guys move back here? CHFJPY

Anonymous

(ID: j5o/AVLD)

7/19/2025, 7:01:48 AM

No.60655944

add the flags

>>60655551

nigger you were advocating sharty after the hack cmon now.

VJ222

Anonymous

(ID: +JODd7Cq)

7/19/2025, 7:06:52 AM

No.60655964

>>60655914

Middle East is always troubled, and Israel and Iran always seem to be in focus. Thats what caused the energy crisis in the 80s

Anonymous

(ID: +JODd7Cq)

7/19/2025, 7:08:35 AM

No.60655971

>>60655981

>>60655929

>did leaf forex guys move back here

I wonder if youre referring to me? I had a few months of success on my account where I traded it from 200 to 300, then got greedy on PMs and blew me ass back down to $25 so I'm taking a break. Currently -$800 on forex across 3-4 years

Anonymous

(ID: j5o/AVLD)

7/19/2025, 7:12:48 AM

No.60655981

>>60655989

>>60655971

i don't know what do you think of CHFJPY

Anonymous

(ID: +JODd7Cq)

7/19/2025, 7:19:05 AM

No.60655989

>>60656015

>>60656023

>>60655981

Its the classic carry trade to exploit interest rate differentials, when you want decent returns outside of bonds, and arent bullish on equities. Usually high end traders would also use a forward contract to hedge downside risk.

Like, is there a reason you'd be bullish or bearish on one side right now? People seem pretty bullish, and I want to stack materials/producers right now (separately, AUS is a good proxy for China's economy, it goes up when theyre building shit, coal too)

I have ideas, but I'm not good at executing on macro

xxloligroyper1488

!!LflHQRKcdXi

(ID: K4SCWIs9)

7/19/2025, 7:30:14 AM

No.60656015

>>60655989

>differentials

Anonymous

(ID: j5o/AVLD)

7/19/2025, 7:35:38 AM

No.60656023

>>60655989

so i don't even probably have margin to do that but was looking at a long januaryish? i can't remember. anyways i though of it again recently, instead i just did ITM FXY puts which i've since rolled out, but the idea was people were still thinking about "yen carry" even though most of the positioning was squeezed out but the short stance on swissy remained, and given swissy has the same carry trade but the leverage hasn't been squeezed out yet, that could be a spicy trade. haven't seen sentiment change the entire time since, people still think yen carry is squeezeable while ignoring franc while momentum is even in favor now, making it maybe look like a better entry than it even was before

Anonymous

(ID: 4U6VO3iD)

7/19/2025, 7:39:38 AM

No.60656033

>>60656045

My stocks are bangin', my options either crabin' or BANGIN', and my boomer funds crawl along with low beta like they should.

FUCK the weekend though waste of my goddamn time

Anonymous

(ID: mUTXn8mV)

7/19/2025, 7:41:58 AM

No.60656039

I am once again asking you faggots why you aren't invested in mining stocks?

I'm up 2.5x over the past 6 months.

I'm probably going to 10-20x over the life of the cycle.

Your metals will do a 3x MAYBE.

Mining stocks are a leveraged play on metals and if you're young you should be doing higher risk, more reward plays like that instead of buying "safe" boomer plays like buying physical metals.

In 2 years from now don't say I didn't warn you when literally everyone on /cmmg/ has already retired.

Anonymous

(ID: mUTXn8mV)

7/19/2025, 7:43:04 AM

No.60656044

Anonymous

(ID: UVtnzh03)

7/19/2025, 7:43:09 AM

No.60656045

>>60656033

weekends are for crypto

Anonymous

(ID: 26LAhLto)

7/19/2025, 8:28:00 AM

No.60656159

OOOOOOOOOOOOOOOOOOOOOF

another appointee by Trump, sucks to be at fault yourself.

Anonymous

(ID: OhniNkYB)

7/19/2025, 9:12:55 AM

No.60656256

>>60656261

>>60654863

I'c rather bleed for him than bleed for Israel. He may be a pseudo-European Asian and I may be a pseudo-European African, but that man is my BROTHER.

Anonymous

(ID: UVtnzh03)

7/19/2025, 9:17:42 AM

No.60656261

>>60656256

the life of a single israelis is not equivalent to the fingernail of a domesticated furry waifu

Anonymous

(ID: VM49SXt5)

7/19/2025, 9:18:34 AM

No.60656262

>>60656276

>>60658080

>>60654207 (OP)

I have a question for pic related anon.

I’m 34 and my Roth IRA is 100% VTI. I was thinking of adding SCHD, but I checked out your QQQI and now my noggin is joggin about allocations for dividend income.

Is there any reason to start adding SCHD/QQQI to my Roth or should I wait until I’m closer to retirement?

Why did you include them and could you put them in a taxable account?

Anonymous

(ID: UVtnzh03)

7/19/2025, 9:25:15 AM

No.60656276

>>60656280

>>60656297

>>60656262

>schd

nigga are you retarded

the only point of dividend funds is hedging against tech degeneracy, if you're a degenerate doing 80+% tech then hedging a bit with schd makes sense, but why for the love of god (unless you're 60+) would you ever invest in it over an index fund unless you hate money

Anonymous

(ID: U1c8VaoM)

7/19/2025, 9:26:46 AM

No.60656280

>>60656289

>>60656276

money come in smile go up. not much different than sandp if your income is sub 60 a year.

Anonymous

(ID: UVtnzh03)

7/19/2025, 9:29:57 AM

No.60656289

>>60656280

so we're in agreement, 5% dividend appreciation vs 20% stonk growth means dividend investors are retarded

Anonymous

(ID: 26LAhLto)

7/19/2025, 9:32:59 AM

No.60656297

>>60656332

>>60656276

He does not want to "think about money". That's why he goes the divident route. Less votality, less "angst", less panic.

Anonymous

(ID: UVtnzh03)

7/19/2025, 9:47:56 AM

No.60656332

>>60656389

>>60656297

but if thats the case just get VOO or if you're young SCHG and get even more money why go with consistently subpar selections, dividend investing has value if you're hedging against growth but why would anyone build a portfolio around it

Anonymous

(ID: t0UiuMIh)

7/19/2025, 10:05:30 AM

No.60656389

>>60656402

>>60656332

That’s precisely why the FUCK I ASKED ABOUT his allocation to QQQI/SCHD.

I wanted to know his personal philosophy in that choice

My god.

>just get VOO

I’m 100% VTI

Anonymous

(ID: UVtnzh03)

7/19/2025, 10:08:13 AM

No.60656402

>>60656454

>>60656389

>100% vti

in a bull market?

Anonymous

(ID: XXvnDPT+)

7/19/2025, 10:33:20 AM

No.60656454

>>60656402

No that’s just the fucking allocation I’ve always had. Since 2020

Anonymous

(ID: 26LAhLto)

7/19/2025, 10:34:36 AM

No.60656460

With 5 shares, I'm now OFFICIALLY a SRPT investor and potential baggie.

Anonymous

(ID: 26LAhLto)

7/19/2025, 10:48:11 AM

No.60656495

Yo what, Civ VI Platinum for free on Epic Store

Anonymous

(ID: EgarwY/d)

7/19/2025, 11:20:06 AM

No.60656577

>>60656592

>>60657094

Having listened to Dave Ramsey in the past I never even considered the possibility of car payments.

But just as a curiosity I examined the possibility of financing a $60k car in the most safe terms possible - $25k down and only 24 months repayment schedule.

The initial payment + balloon are the entire car's cash value. The 24 months of monthly payments is essentially only the interest - an extra $9k.

Why are people doing this to themselves.

Anonymous

(ID: RHQfpUbL)

7/19/2025, 11:27:12 AM

No.60656592

>>60656695

>>60656577

In europe cars cost 20-25 k

And they are better than us gas guzzling shitboxes

Here are some popular investing scams you should avoid :

1) Gold / silver: When you 'invest' in gold through the stock market, you dont actually own any gold. You simply pay for exposure to its price fluctuations. Even if they were historically as inflation hedges, these metals have lost that role to crypto. So invest in crypto instead of boomer rocks.

2) Dividends: Unless you can throw literally half a million in a dividend etf, you are losing money. And if you can afford to do that, you have beat the game already.

3) Yieldmax etfs: Gigantic scam. You basically pay to receive 1/3rd of the income you can make from selling covered calls on the stocks and missing on their upside. So you are literally paying to get ripped off.

4) Bonds: Nobody, even governments or institutions buy bonds for profit. They buy them for political leverage or if they are literally required by law to do so. Guess how much political leverage, you, the retail trader have. Buying bonds is guaranteed loss.

Anonymous

(ID: YjN/bWbW)

7/19/2025, 12:05:44 PM

No.60656695

>>60656592

A base 80hp vw golf sets you back 20k anon.

A normal practical car with 150+hp and climate control is min. 30-40k.

Median income is at around 26k net in goymany.

Buying a new car, even the smallest ones is now a luxury.

Anonymous

(ID: FX518Av6)

7/19/2025, 12:16:31 PM

No.60656708

>>60656778

>>60657151

>>60656615

>2) Dividends: Unless you can throw literally half a million in a dividend etf, you are losing money. And if you can afford to do that, you have beat the game already.

why lie?

time and time its been proven that compounding over a long time is the superior strategy.

you're talking bullshit too about the cc funds. ccs are as old as the hills. the only thing new about these funds is retail has access to them.

Anonymous

(ID: AeBBFycK)

7/19/2025, 12:37:52 PM

No.60656746

>>60656778

>>60656615

I would like the most rabid of anons to hack on this guy's points because I think they're very poignant (particularly the precious metals one) but I'm not yet informed to fully agree with him.

I think it'd be a nice diversion for the slow, weekend /smg/.

Anonymous

(ID: KiT7t/M0)

7/19/2025, 12:54:22 PM

No.60656778

>>60656912

>>60658449

>>60658548

>>60656615

>>60656708

>>60656746

There’s a bit more nuance to dividends, it’s not really an all or nothing situation. Traditionally dividends have been seen as evidence that a company is profitable, and paying a healthy dividend has helped to boost the share price as well. That’s all changed a bit in the modern era of tech firms running on enormous P/E ratios, or even a loss. For them a dividend signals that they’ve got nothing better to do with their cash, no growth-generating areas to invest it in, so if they started to pay out in any significant quantity then it might bring their share price crashing back down to earth. In this sort of environment dividends have become something which you only really get from boomerish stocks, more traditional industries without obvious prospects for rapid expansion. Inevitably that means you’re sacrificing some upside potential for a steadier payout, but that doesn’t mean that you can’t get good share price performance as well. I bought shares in a mismanaged company which was paying a 5%-odd dividend. They sorted their shit out and the price went up by about 30. The dividend payment fell to about 3%, but that still meant that by the time I sold I was getting more than my initial buy in in dividends each year.

I will say as well that a high dividend can be a big warning sign - it means that the share price might have tanked recently, or the management is making large payouts to try to push it up, so there’s a good chance that it won’t be sustainable and they’ll have to cut it before long. What you want from dividends is not big payouts now from a static company, it’s moderate and sustainable payouts from a growing one. Like in my example above, when the share price goes up so will your dividend yield compared to how much you invested in the first place.

Anonymous

(ID: kfccKvDf)

7/19/2025, 1:53:11 PM

No.60656912

>>60656778

>What you want from dividends is not big payouts now from a static company, it’s moderate and sustainable payouts from a growing one.

I just want some fucking dividends. I’m gonna buy schd close to retirement and it’s all just going to fucking work out

Anonymous

(ID: VV3bfLQX)

7/19/2025, 2:49:58 PM

No.60657094

>>60657179

>>60656577

i financed my 30k car over 3 years for 3.99% interest with $0 down

i had the cash to buy, but im glad i pay by cash since i 3x'd the cash while financing

i needed a car regardless and a used car for a 20k came with 50k km mileage so it was better to just buy a new car for 30k

2023 was unfortunately still fked for the used car market, maybe still fked now, my 2009 shitbox was dying and i didnt want to risk getting stranded

Anonymous

(ID: 26LAhLto)

7/19/2025, 3:01:13 PM

No.60657122

I think I'm going to buy some Crypto on Coinbase, stake it to earn interest and short the same Crypto as CFD on a broker and collect 10% interest there too.

Anonymous

(ID: W85hsald)

7/19/2025, 3:14:16 PM

No.60657151

>>60658461

>>60656708

Source on this chart because everything I've seen shows the opposite. I suspect it is a surviorship bias and the 90% of high yields that blew up aren't included

Cc starts blow up too btw neither one of these strategies is optimal for the growth/compounding stage

Anonymous

(ID: KqXw0qqh)

7/19/2025, 3:20:12 PM

No.60657179

>>60657195

>>60657094

thats gay. the high iq individual gets the biggest payday loan possible or as many as possible and and buys a lot of weed and hookers and with the last pennies some rope. this way its literally free money that some moron gave you as they have too much and felt a strong urge to spend it on literally anything

Anonymous

(ID: 7s7xNpTa)

7/19/2025, 3:21:02 PM

No.60657182

>>60657394

>>60654207 (OP)

>virginia

>"professional services"

kek glowies lmao even

Anonymous

(ID: VV3bfLQX)

7/19/2025, 3:26:36 PM

No.60657195

>>60657179

it s hard to have high iq, i do low iq plays jnstead since i just have to dumb myself down

anyways the car is than 10% of my nw so it doesnt affect my gains that much anymore

There's no point in gambling your money on stocks and options if you're waging and just starting out.

You're risking a months salary for what? a few hundred profit at most?

divvies are the way to go

Anonymous

(ID: hNnTPPs/)

7/19/2025, 3:28:10 PM

No.60657202

>>60658459

>>60657197

My goal is to park enough money for at least 2k a month in dividend income.

Once I have enough stacked I'll start selling way otm covered calls to retard algos, generating even more revenue while keeping my hoard safe.

This is the only investment where you get excited when it's red to add more to your stack.

Some of my SCHD sub $27 buy orders went through on friday and I wasn't worried about catching knives or whatever.

If you can only put a few thousand towards investing this is the way to go, nothing else will generate meaningful wealth for you at this point imo.

You guys are right about the yieldmax shit though.

Anonymous

(ID: KqXw0qqh)

7/19/2025, 3:30:47 PM

No.60657207

>>60657197

theres no jobs in this shithole so i will gamble for a living

Anonymous

(ID: W85hsald)

7/19/2025, 3:33:12 PM

No.60657210

>>60657219

>>60657224

>>60657197

Take it from someone who did the div thing from age 20-30, its a waste. You dont need the income, go compare the total return to spy or voo. If I could redo it I'd go qqq or schg. My yoc is great and also, it doesnt matter.

Anonymous

(ID: ZxTq+K+P)

7/19/2025, 3:33:40 PM

No.60657212

>>60655687

THE HOUSE OF ASSAD HAS FALLEN JOHN LENNON

Anonymous

(ID: ZxTq+K+P)

7/19/2025, 3:35:35 PM

No.60657215

>>60655900

Well if its tightly regulated and not tight on supply then those are not going to keep up

Anonymous

(ID: W85hsald)

7/19/2025, 3:36:16 PM

No.60657219

>>60657210

To add a caveat if their is a lost decade divies will outperform but in all likelihood you have only 1 lost decade in 30 years investing. Optimizing for maybe 1/3 of the period does not make sense, I do see the value in doing this after 20 years tho

Anonymous

(ID: hNnTPPs/)

7/19/2025, 3:39:11 PM

No.60657224

>>60657228

>>60657685

>>60657210

These are revenue generating assets not just stocks.

I am getting $100 a month by doing literally nothing and risking very little.

Eventually you can start genuinely supplementing or replacing your income entirely.

You can split the dividends up, reinvest 50% and put the other 50% in VOO etc if you want.

Why wait when you can start the snowballing now?

Anonymous

(ID: W85hsald)

7/19/2025, 3:40:42 PM

No.60657228

>>60657234

>>60657224

Because if you just bought voo and traded it for divs in 20 years you'd have more, even with a tax hit

Anonymous

(ID: hNnTPPs/)

7/19/2025, 3:42:11 PM

No.60657234

>>60657240

>>60657228

VOO is too expensive to get covered call income from compared to schd or spyi.

Anonymous

(ID: W85hsald)

7/19/2025, 3:43:33 PM

No.60657240

>>60657274

>>60657328

>>60657234

Cc its a hit to total return long term unless you do like 5 delta and then what's the point

Anonymous

(ID: hNnTPPs/)

7/19/2025, 3:53:11 PM

No.60657274

>>60657292

>>60657240

if schd doesn't hit $30 by september i will consneed to your strategy hows that

Anonymous

(ID: W85hsald)

7/19/2025, 3:56:56 PM

No.60657292

>>60657274

Both work well enough, you can still make a good retirement off schd,im just trying to save you from the mistake I made. I still hold those divies but I stopped adding more to it until im closer to the endgame

Anonymous

(ID: R5RcdwaZ)

7/19/2025, 4:07:02 PM

No.60657328

>>60657346

>>60657240

>Cc its a hit to total return long term

Thats not true

Anonymous

(ID: W85hsald)

7/19/2025, 4:11:35 PM

No.60657346

>>60657377

>>60657328

It is, eventually you blow up. As I said earlier with 5 delta you can avoid this but then fees will eat up the tiny premium, or if you manually do it its very labor intensive and is poor $/hour unless you have a huge stack

Anonymous

(ID: R5RcdwaZ)

7/19/2025, 4:19:38 PM

No.60657377

>>60657382

>>60657346

.15-.25 is fine if you sell 30-45 days out and at relative peaks on the line. Its literally retard proof, time is on your side. How are you fucking this up? Are you selling like a week out

Anonymous

(ID: W85hsald)

7/19/2025, 4:21:02 PM

No.60657382

>>60657388

>>60657377

It can work for years yes but if you try to do that for 20 years straight you blow up

Anonymous

(ID: 26LAhLto)

7/19/2025, 4:22:05 PM

No.60657386

>>60658889

Bitcoin Cash? More like Bitcoin Crash, amirite?

Anonymous

(ID: R5RcdwaZ)

7/19/2025, 4:22:43 PM

No.60657388

>>60657403

>>60657382

What does “blow up” mean to you. If you do it right the only downside is capping your gains if something suddenly moons, and even then, you just roll out until it settles down

Anonymous

(ID: IIJvJrQP)

7/19/2025, 4:25:45 PM

No.60657394

>>60657182

I live in southwest Virginia, those glowies pay for our stuff.

Anonymous

(ID: W85hsald)

7/19/2025, 4:28:28 PM

No.60657403

>>60657426

>>60657388

In this context, blowing up would be underperforming the underlying. You cant just "roll out" indefinitely, eventually you hit a bad streak

Anonymous

(ID: Yvk0lvSK)

7/19/2025, 4:28:29 PM

No.60657404

Buy SBSW

Anonymous

(ID: R5RcdwaZ)

7/19/2025, 4:33:56 PM

No.60657426

>>60657466

>>60657403

If you implement this for years on an index tracking fund or index beating stock, it would take a lot more than one bad options sale that you cant roll out to underperform over the same time horizon. You would have already locked in years worth of additional gains. Capping gains with contracts once does not mean blowing up your acct. you can just immediately buy back in if you want the underlying back in your folio

Anonymous

(ID: W85hsald)

7/19/2025, 4:42:08 PM

No.60657466

>>60657478

>>60657426

There is literally tons of content on this and specifically why it doesnt really work. probably explains it better than me so I would recommend playing devils advocate and look into it

Anonymous

(ID: R5RcdwaZ)

7/19/2025, 4:46:30 PM

No.60657478

>>60657466

Link specifically what youre referencing if youre going to defer the argument, then

Anonymous

(ID: W85hsald)

7/19/2025, 4:52:08 PM

No.60657490

>>60657561

Anonymous

(ID: 8CmZ7Z+d)

7/19/2025, 5:03:21 PM

No.60657533

What’s the play Monday gang?

Reminder to hop in XYZ & Alphabet Class C it’s as easy as ABC

Anonymous

(ID: PzO9g9iX)

7/19/2025, 5:06:08 PM

No.60657546

>>60657569

>>60657585

>>60657945

Bunch of my covered calls got exercised.

What do you guys think about picking up a couple thousand UVIX? probably just sell out of the money calls on them too

Anonymous

(ID: R5RcdwaZ)

7/19/2025, 5:09:36 PM

No.60657561

>>60657574

>>60657604

>>60657490

Nothing this guy is saying is wrong. Wielded by a fucking retard trying to use ccs as a divvy replacement or worse, the actual engine of returns, without looking at or considering any price action, ccs will be implemented the wrong way and arbitraged against the wrong phenomena. Anyone that believed covered calls and covered call ETFs are equivalent implementations of this strat basically automatically disqualify themselves from discussion. Im not saying this guy is saying that, hes obviously intelligent, but people parroting this video may be getting that takeaway. Selling covered calls at any point in time on your stock regardless of recent price action is a great way to underperform in exactly the way hes suggesting. The strat requires that you slightly time the market and sell calls at a local maximum when it is less likely for your underlying to moon in 15-25 days. The entire strength, however, is that you dont need to guess perfectly, because theta bails you out.

He said it himself right at the start, at 2:03:

>unless options are overpriced

thats exactly when you sell them

Anonymous

(ID: W85hsald)

7/19/2025, 5:11:34 PM

No.60657569

>>60657546

I think April was the high and svix will do better tho I would not buy it, too risky

Anonymous

(ID: R5RcdwaZ)

7/19/2025, 5:12:30 PM

No.60657574

>>60657604

>>60657561

In addition, my credentials are that i successfully sold covered calls on fucking SOXL from 2020-2022 and was not exercised once. I almost got caught in the final moon mission to 70 but rolled it out successfully and sold at like 60 or something

Anonymous

(ID: EgarwY/d)

7/19/2025, 5:15:17 PM

No.60657585

>>60657546

Buy it as a hedge?

I don't do stuff like that but I saw people on twitter buying puts on high yield corporate junk bonds? That must be an ETF

It was apparently the cheapest way to hedge against a crash

Anonymous

(ID: W85hsald)

7/19/2025, 5:21:41 PM

No.60657604

>>60657633

>>60657561

>>60657574

>Goalposts

moved

>Market

timed

>Data

short term and anecdotal

Yea, im thinking its cope time

Anonymous

(ID: O//t3kQg)

7/19/2025, 5:27:02 PM

No.60657632

>>60657197

I'm risking a months salary for a 10x dumb nigger

Anonymous

(ID: R5RcdwaZ)

7/19/2025, 5:27:29 PM

No.60657633

>>60657604

>unless options are overpriced

I accept your concession

Anonymous

(ID: O//t3kQg)

7/19/2025, 5:43:18 PM

No.60657672

>>60656615

>yieldmax

>gigantic scam

Yes but this is clown market, the only winning move is to be a retard

Anonymous

(ID: O//t3kQg)

7/19/2025, 5:45:56 PM

No.60657680

>>60655665

Fuck off schizo anon the jap poster is a man and he will never love you

Anonymous

(ID: D6Gylp29)

7/19/2025, 5:46:00 PM

No.60657681

henlo mister jerome

please rate cuts soon

or i will ngmi

thank you mister jerome

Anonymous

(ID: mvk2RwGA)

7/19/2025, 5:47:37 PM

No.60657685

>>60657689

>>60657224

Nigger you have invested 50k + to make 100 a month. I have a literal eurofag 12 k poortofolio and I make 100 per week selling 1 put. Dividends suck unless you put a million in them and get 3k a month.

Anonymous

(ID: hNnTPPs/)

7/19/2025, 5:50:09 PM

No.60657689

>>60657699

>>60657707

>>60657685

are you retarded? I posted my positions several times. it only took around 13k for $100 a month. at 50k you should be well over 500

Anonymous

(ID: 4hnKbsF9)

7/19/2025, 5:52:49 PM

No.60657699

>>60657713

>>60657689

>10% yield

You are investing in a ponzi scheme

Anonymous

(ID: RHQfpUbL)

7/19/2025, 5:55:50 PM

No.60657707

>>60657713

>>60657689

13 k invested in hood can net you 5 times that a month from covered calls

You just have to push some buttons

Anonymous

(ID: hNnTPPs/)

7/19/2025, 5:57:17 PM

No.60657713

>>60657765

>>60657801

>>60657699

spyi is not the same as a yieldmax shitter

>>60657707

yes and then you lose 20% when it dumps

Anonymous

(ID: RHQfpUbL)

7/19/2025, 6:16:48 PM

No.60657765

>>60657713

You have unrealized losses when your divvy etf pays out as well. Plus you have 0 upside because its a fucking divvy etf.

Look, dividends have their place, and that's when you retire. You cannot contribute to your portfolio anymore due to not working, and now you want your portfolio to sustain you. But investing in dividends in your growth phase is like giving 80% of your salary to a pension fund.

Anonymous

(ID: D6Gylp29)

7/19/2025, 6:20:12 PM

No.60657782

>>60657803

I was at the grocery store earlier this morning and there were several workers putting out the produce for the day... and they were discussing their latest investments in the stock market.

Anonymous

(ID: EgarwY/d)

7/19/2025, 6:22:57 PM

No.60657798

>>60658252

>>60658279

>trade wars

>sanctions

>Chinese economy quietly imploding under the surface

>even the EU now imposing sanctions on Chinese banks

mfw people think there is not going to be any kind of retaliation or pushback whatsoever

Anonymous

(ID: VtGvE7BJ)

7/19/2025, 6:23:47 PM

No.60657801

>>60657713

Sell csps and get paid to buy the dip I'm up 35% ytd

Anonymous

(ID: VtGvE7BJ)

7/19/2025, 6:24:47 PM

No.60657803

>>60658088

>>60657782

Did you score any juicy inside info?

Anonymous

(ID: 324M410S)

7/19/2025, 6:36:05 PM

No.60657842

>>60657942

anyone know if there any good sources of historical SPY IV term structure data? barchart only seems to have forward looking, and won't let me fuckin download it for some reason.

Anonymous

(ID: p2/0xSNe)

7/19/2025, 6:40:57 PM

No.60657857

Mister jerome release the epstein files now!!!!!!!

Anonymous

(ID: W85hsald)

7/19/2025, 7:00:45 PM

No.60657942

Anonymous

(ID: j5o/AVLD)

7/19/2025, 7:01:20 PM

No.60657945

Anonymous

(ID: j6RyMatF)

7/19/2025, 7:01:55 PM

No.60657949

>>60658060

>>60658224

Can any leafs give advice on Fairfax? I was advised to be careful of this one because it's owned by an Indian tycoon and it seems too good to be true. It's the 24th holding in Vanguard's FTSE Canada fund, it resembles Berkshire and I can't find any negative information about it. It's either this or CSU for my TFSA.

Anonymous

(ID: jtEjv6SO)

7/19/2025, 7:28:13 PM

No.60658060

>>60658189

>>60657949

is fairfax doing any ai shit because you got the whole venture exchange and you're picking a credit rating company at this time

im trimming my ai d______s position and theres still plenty other shit with upside after that to buy after

even intermap on venture still has lots of juice left (prob hit $10 if it ends up winning potentially $200m contract from indonesia that no one else is positioned to win because it was such an obscure product/tech that no one wanted to develop until ai gave it a breakthrough)

yes im investing through a tfsa and fhsa too

Anonymous

(ID: ++cZgP5r)

7/19/2025, 7:32:42 PM

No.60658080

>>60656262

Study the different ETFs, which sector/market they focus on. Fees can eat away at any potential gain limiting your growth. All sectors in the market go through cycles, the market also goes through cycles. These cycles matter less when you are young, but when you are near/at/in retirement a down cycle can affect your portfolio/retirement income until it recoves (depending on how much you have - if you have more than enough then a normal down cycle is not concerning). At 34 you have time to invest, learn, and make adjustments for your needs. When you are young its good to stick with the most stable growth ETFs. ETF help spread risk. You can also invest in several ETFs like VOO, SPY, SCHD at any percentage you want and monitor growth of each every every year and direct more or less money into ones you prefer. I suggest you consider a small amount into certain newer stocks that have potential as their rapid growth can dramatically increase your portfolio. You monitor the growth of those companies and sell some of that stock and invest more into your ETFs for save keeping and more growth. For a taxable account growth stocks non div ETFs are best to avoid getting taxed which helps kill your gains. If you need money you can always sell some stock then pay capital gains if needed. You will learn how it all works along the way.

Anonymous

(ID: D6Gylp29)

7/19/2025, 7:34:43 PM

No.60658088

>>60658126

>>60657803

One of them lost like $1k

Anonymous

(ID: jtEjv6SO)

7/19/2025, 7:36:54 PM

No.60658092

>>60658127

>>60657197

risking a months salary thats the easiest way to make gains

ppl get stuck in 6-fig hell because they cant risk years of salary, they end up only putting 10% of their portfolio in high reward plays coz theyre pussies and put the rest in VTI only

Anonymous

(ID: VtGvE7BJ)

7/19/2025, 7:46:28 PM

No.60658126

>>60658174

>>60658088

What did he gamble his months salary on?

Anonymous

(ID: hNnTPPs/)

7/19/2025, 7:46:28 PM

No.60658127

>>60658148

>>60658092

or easiest way to lose it

Anonymous

(ID: 5W/lpcbp)

7/19/2025, 7:50:35 PM

No.60658144

>>60658281

>>60658297

>>60655018

Damn, the kraken legend is true

Anonymous

(ID: jtEjv6SO)

7/19/2025, 7:51:09 PM

No.60658148

>>60658127

it's a months salary how much could you possibly lose

Anonymous

(ID: D6Gylp29)

7/19/2025, 7:56:05 PM

No.60658174

>>60658126

idk I didn't stick around that long, I had shopping to do and wanted to get home

Anonymous

(ID: j6RyMatF)

7/19/2025, 7:58:26 PM

No.60658189

>>60658270

>>60658060

I don't think they're doing any AI bullshit, no. I just need a few reliable Canadian stocks alongside half VFV because Canadian index funds don't perform well enough. I just started investing a few weeks ago now that I've graduated university and before I was using one of my bank's mutual funds which was taking me for a fool robbing me with a 2% MER. How are you picking out these AI stocks? One of the only other sources I'm using are the boomers over at the Financial Wisdom Forum which influenced me to buy some CGO after it dipped, but was probably a bad decision since their earnings have been dropping for the past two years. And if you could bear with me being so new could you please tell me why it would be a bad idea to pick a credit rating company now? I plan on investing in BMO too.

Anonymous

(ID: NafqocWW)

7/19/2025, 8:03:48 PM

No.60658216

>>60658477

Where can I buy minute-to-minute trading data on all S&P companies for the last six months?

Anonymous

(ID: YqpKqEvZ)

7/19/2025, 8:05:35 PM

No.60658224

>>60657949

if you are a burger be careful as this may count as a PFIC

Anonymous

(ID: KqXw0qqh)

7/19/2025, 8:11:39 PM

No.60658252

>>60657798

this is bullish

Anonymous

(ID: jtEjv6SO)

7/19/2025, 8:14:53 PM

No.60658270

>>60658189

>How are you picking out these AI stocks?

they get shilled to me, even PNG.V was shilled here back in 2020 (although it did crash then had to recover) and i just verify which one has a good value and already making profit

PNG.V is too late but even that has a ttm pe of ~50 meaning it's actually profitable and not burning cash (i.e. diluting on shareholders just to pay rent). unfortunately it's too expensive now, basically a 1 billion market cap already, better to find something that's still cheap, easier for company to go from 100 million market cap to 500 million market cap (5x), rather than 1 billion to 5 billion; after all a $100 million contract is probably easier to win compared to a $1 billion contract, or whatever their ai solutions is expected to win (maybe quantity over quality)

you just buy when it's cheap, just dont get into ai companies that can be easily replaced, e.g. liquid cooling ai solutions for data centers lol i forgot the name but one ticker that dealt with that got heemed when amazon just decided to develop their own solution

Anonymous

(ID: p2/0xSNe)

7/19/2025, 8:15:51 PM

No.60658279

>>60657798

>a race to the bottom from all sides is bullish

Anonymous

(ID: jtEjv6SO)

7/19/2025, 8:15:54 PM

No.60658281

>>60658144

how did u say kr*ken without getting spam filter wtf i tried to post bout kr*ken png.v but couldnt until i took out kr*ken

Anonymous

(ID: 26LAhLto)

7/19/2025, 8:20:56 PM

No.60658297

>>60658144

THIS IS A JANNY

Anonymous

(ID: jtEjv6SO)

7/19/2025, 8:23:05 PM

No.60658305

kraken

Anonymous

(ID: KqXw0qqh)

7/19/2025, 8:23:37 PM

No.60658309

tard hours

Anonymous

(ID: jtEjv6SO)

7/19/2025, 8:24:05 PM

No.60658312

>>60655018

Damn, the kraken legend is true

Anonymous

(ID: 26LAhLto)

7/19/2025, 8:36:47 PM

No.60658354

kraken

Anonymous

(ID: j5o/AVLD)

7/19/2025, 8:52:14 PM

No.60658431

>>60658511

he sel

>Roblox today announced the appointment of Naveen Chopra as its new Chief Financial Officer, effective June 30, 2025.

Anonymous

(ID: KGNiX1DO)

7/19/2025, 8:55:01 PM

No.60658449

>>60656778

This is the main reason SCHD is nice. The screener has lots of "quality" proxies as well, low debt, fcf, etc.

It goes down, but I'd fundamentally trust it to maintain value in a proper crash.

Anonymous

(ID: KGNiX1DO)

7/19/2025, 8:58:10 PM

No.60658459

>>60657202

IV is too shit on schd to make ccs attractive, least to me.

Anonymous

(ID: FX518Av6)

7/19/2025, 8:58:20 PM

No.60658461

>>60657151

stocks for the long run chpt 12 Outperforming the Market The Importance of Size, Dividend Yields, and Price/Earnings Ratios

Anonymous

(ID: VtGvE7BJ)

7/19/2025, 9:01:56 PM

No.60658477

>>60658216

Just wire me 5k and I'll mail the info over

Anonymous

(ID: UVtnzh03)

7/19/2025, 9:10:41 PM

No.60658511

>>60658431

>jeet C suite

time to short

Anonymous

(ID: SMJENTzy)

7/19/2025, 9:12:01 PM

No.60658519

is robinhood still good?

Anonymous

(ID: FX518Av6)

7/19/2025, 9:16:53 PM

No.60658548

>>60658560

>>60656778

are you a indian bot? you write like one. reads like all bullshit you pulled out of chatgpt with a lazy prompt. some of these companies have paid dividends for decades which you can compound to enormous amounts. reinvesting dividends to purchase more shares pumps growth of your portfolio and increase the future value of any dividends you own at present. you can compound further with ccs csps which is seldom discussed in smg. this is all tortoise and hare stuff. however 3rd world / zoomer biz can't handle facts and just wants to get rinsed by their fav tiktok kol.what a ghetto this website has become.

Anonymous

(ID: GAL4fA6V)

7/19/2025, 9:19:03 PM

No.60658560

>>60658573

>>60658548

How the fuck are you making $ on schd ccs with 0 iv?

Anonymous

(ID: FX518Av6)

7/19/2025, 9:22:39 PM

No.60658573

>>60658560

sell it on nvda then. make your own divvie and reinvest it into the underlying. same concept

Anonymous

(ID: 26LAhLto)

7/19/2025, 9:30:05 PM

No.60658607

>>60658675

Internet Computer computer!

Anonymous

(ID: 8CmZ7Z+d)

7/19/2025, 9:44:35 PM

No.60658675

>>60658607

Valuable insight thanks anon

XYZ, GOOGL, GAMB, OSCR, AT (Ashetad Technology)

Get in on these this week!

Anonymous

(ID: 5+Q9mOxB)

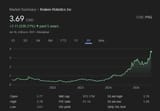

7/19/2025, 10:00:10 PM

No.60658754

>>60658790

>>60658803

>>60658805

>>60659928

At what price do you foresee NVIDIA at 1-2 years? I'm starting to disdain all my dividend stocks, I'm not gonna mmmmmaaaakeee iiiittt FUAAAAAK

Anonymous

(ID: kkrPJZAi)

7/19/2025, 10:02:58 PM

No.60658765

>>60658861

>>60658887

>>60656615

this also roth iras are a waste of time.

Anonymous

(ID: 8CmZ7Z+d)

7/19/2025, 10:09:08 PM

No.60658790

>>60658754

Its going to be the first $10T marketcap company, about 2.5X from current ATH prices

Anonymous

(ID: Oj/PE95P)

7/19/2025, 10:11:36 PM

No.60658803

Anonymous

(ID: 5kt+C63p)

7/19/2025, 10:11:40 PM

No.60658805

>>60658754

30%+ CAGR maybe more, no sign of it stopping yet, people calling it a bubble are going to miss out on another 1 to 2 years of gains

Anonymous

(ID: 26LAhLto)

7/19/2025, 10:25:22 PM

No.60658861

>>60658887

>>60658765

T30 or something here. And I'm thinking about becoming a farmer, got land etc. EU gonna support me. I'm not gonna scam them though.

Merchant I'll be on the markets.

Anonymous

(ID: 26LAhLto)

7/19/2025, 10:32:03 PM

No.60658887

>>60658765

>>60658861

Shit, could also be T20. I'm gonna fuck it up in that case. Military won't take me anymore, though Navy would be nice.

Let's hope it's T30.

Anonymous

(ID: 3AumRfPV)

7/19/2025, 10:32:15 PM

No.60658889

>>60658915

>>60657386

More like shitcoin trash

Anonymous

(ID: 26LAhLto)

7/19/2025, 10:40:12 PM

No.60658915

>>60658889

GOT EEEEEEEEEEEM

Anonymous

(ID: AYHORmMZ)

7/19/2025, 10:46:08 PM

No.60658949

Anonymous

(ID: xfDolCTz)

7/20/2025, 12:40:03 AM

No.60659396

>>60659976

>>60660084

>>60661194

Bitcoin crashing and bringing down MSTR is gong to be biblical. Peter Schiff will get the last laugh

Anonymous

(ID: 84n9Z7NF)

7/20/2025, 12:42:24 AM

No.60659406

>>60654931

Pretty much nailed it

Anonymous

(ID: D6Gylp29)

7/20/2025, 12:45:46 AM

No.60659415

>>60660457

>futures

Anonymous

(ID: BkgAcSD+)

7/20/2025, 12:48:43 AM

No.60659431

>>60659493

>>60659703

can any /smg anons help me out? started out investing in SPY, VT, SWPPX, RSP, UNH, and BRK-B. a majority of my portfolio is in SWPPX and VT, but I don't feel like I own anything. im relegating my involvement to Vanguard and State Street. I heard an anon say for accounts below 100k (im at 50k for stocks (poorfag I know, but I have real estate and other investments)) should just pick 5 stocks and stick with them for growth. but do any of you try and mimic the top 15-20 holding of SP500 fund and actually hold the stocks in there? "VOO and chill" reminds me of the scene from boiler room where the average joe gets scammed by the investing group.

instead of SPY id do like 7% MSFT, 6%AAPL, 6% NVDA, etc going up until stock #20 and then filling the rest with RSP. that way I actually own equities

Anonymous

(ID: kkrPJZAi)

7/20/2025, 12:50:47 AM

No.60659442

>futures

Anonymous

(ID: ++cZgP5r)

7/20/2025, 1:09:31 AM

No.60659493

>>60659431

Look at the top 10 holdings in each ETF. Let's say specifically VOO, if you buy apple, microsoft, google.....you are making your own 'ETF' of the top 10 stocks in VOO. If you buy VOO you buy all the stocks they buy. You can someone else's ETF or make your own and rebalance it your self from time to time (adding more of one stock vs another). Or you can buy several ETFs, some 'cash' in a treasury ETF, a bond or two at 4.3%, maybe a little in a few high risk high growth stocks. You will read endless debate about the 'best' approach when there are many approaches that will work for you. I can tell you how many times I read people can't be the market (ETF), my portfolio performance measure says I average 50%/year since I started, about 460% total so far. You may do better, or worse, its a learning process, invest do not gamble and you are better off than 99% of people.

Anonymous

(ID: D6Gylp29)

7/20/2025, 1:24:20 AM

No.60659537

think i'm gonna start DCAing into scratch off tickets

Anonymous

(ID: MAKre5w7)

7/20/2025, 1:30:17 AM

No.60659552

>>60660763

>>60654679

You're upset because of your little white pp and unseasonedfood

Anonymous

(ID: ++cZgP5r)

7/20/2025, 1:39:04 AM

No.60659596

>futures

Anonymous

(ID: F0zOW//k)

7/20/2025, 2:01:45 AM

No.60659703

>>60659431

1. Unless you have specialized knowledge in a specific business/field, it's better to stick with tech. This is not to say other industries are bad, they just require more research. Tech trends can be picked up through osmosis, especially if you personally use the products. Similarly, unless you have an inside track on a specific company, it's better to stick with large/mega cap for most of your portfolio.

2. Pick companies you won't sell in and out of for 5 years or more. If you are like most of retail, you invest a set percentage of your salary every week. So smart DCA-ing is your only approach. By sticking to a small number of stocks over a long period, you are achieving diversification through time.

3. That said, it's fine to have a few speculative investments, like small cap companies or crypto. Just understand that they are riskier, require more of your attention, and keep the amount small enough so that you won't cry over losing it.

4. Do keep investing in an ETF. Even riskier leveraged ETFs are fine as long as your time horizon is sufficiently lengthy, and you have the stomach to keep investing even when the market is down. In fact, investing more when the market is ugly is crucial to winning with leveraged ETFs. You have to be positioned before the run.

5. If an investment goes down because of macroeconomics (the entire market is down), power through it. Hold, and invest even more. Buy the dip. If the VIX is high, buy. If sentiment is down even though the business is still great, buy. Conditions based on emotions fluctuate all the time.

Anonymous

(ID: jtEjv6SO)

7/20/2025, 2:37:47 AM

No.60659844

smallcaps you have the advantage as retail, you can go in and out instantly without having to worry about liquidity, if you picked a company thats actually profitable and growing you get to dump on institutions when they can only START buying in when it's over $100m market cap

Anonymous

(ID: jtEjv6SO)

7/20/2025, 2:42:42 AM

No.60659860

smallcap tickers you and i already missed out on

TSSI

ZDC.V

PNG.V

IMP.TO (-> this one maybe still has upside to $10 even after 10x but hard to commit to with a large position at this point)

theres fewer and fewer, many that had their run might still have a 2x or 3x left in them since the ai bubble hasnt really started yet until we see people speculating on ai smallcaps with no actual business, so far the ones i pointed out above have actual fundamentals (but too late, prob only 2x or 3x left in them and thats if ai bubble is in full force)

it's not a bubble until russell 2000 is also overbought, it is not even the beginning

Anonymous

(ID: UVtnzh03)

7/20/2025, 2:49:19 AM

No.60659875

>>60660280

Any of you melanin enriched degenerates do pre ipo stocks? What platform do you use, hiive, forge?

Anonymous

(ID: jtEjv6SO)

7/20/2025, 3:12:14 AM

No.60659928

>>60658754

>1751468197171841.png

you are a disgrace

Anonymous

(ID: jfHqn/Lp)

7/20/2025, 3:25:01 AM

No.60659976

>>60659396

Keep investing in your western companies that are going to stagnate by being gutted with indians

Anonymous

(ID: rgh87j2Y)

7/20/2025, 3:52:25 AM

No.60660079

>>60661081

Andy Byron did nothing wrong

Anonymous

(ID: Mp1n+oDW)

7/20/2025, 3:53:46 AM

No.60660084

>>60660118

>>60659396

>Bitcoin crashing and bringing down MSTR is gong to be biblical.

Sure, but wouldn't it make sense to just lock in a gain during a very obvious bubble and move it somewhere you care about later?

Anonymous

(ID: llW3BI8W)

7/20/2025, 4:05:19 AM

No.60660118

>>60660121

Anonymous

(ID: Mp1n+oDW)

7/20/2025, 4:06:08 AM

No.60660121

Anonymous

(ID: ZBjAw0KU)

7/20/2025, 4:14:16 AM

No.60660146

Nextdoor (KIND) already migrating ticker symbol over on my options.

Anonymous

(ID: ++cZgP5r)

7/20/2025, 4:14:44 AM

No.60660150

>>60660212

Anon, Thank you for your application. We strive to uphold the highest professional standards at our company. As I am sure you are aware, we receive many applications from highly qualified candidates. Unfortunately, I am busy swallowing loads from the CEO so I am unable to review your application, therefore your appliction is automatically declined.

Anonymous

(ID: qnppKw2W)

7/20/2025, 4:40:06 AM

No.60660212

>>60660150

That's quite the automated "away from office" email.

Anonymous

(ID: IIJvJrQP)

7/20/2025, 5:15:24 AM

No.60660280

>>60659875

I liked SeedInvest, unfortunately they got purchased by startengine which is far shittier. So far only made $ on one. Gatsby got bought out by EToro I think it was, made me a little sumtin.

Anonymous

(ID: jtEjv6SO)

7/20/2025, 5:15:29 AM

No.60660281

>>60660306

>>60660381

i almost thought i stumbled into the next JXN when screening for absurd metrics like PE less than 1 but then i saw

>5 million market cap

>Headquarters: Hong Kong

lmao

what the fk is this shit

Anonymous

(ID: Mp1n+oDW)

7/20/2025, 5:23:24 AM

No.60660306

>>60660321

>>60660281

>what the fk is this shit

Nothing about this company makes sense at all. It probably isn't going to pull off a RGC.

Anonymous

(ID: jtEjv6SO)

7/20/2025, 5:28:31 AM

No.60660321

>>60660306

it's basically OPTI from what i see

i remember late 2020 early 2021, OPTI had the same "crazy" setup where it was going to get a billion$$ contract and it even had an sec filing but obviously that ended up being a scam

some anons OPTIscammes still made money off it but so did some people off cielo waste garbage don lmao

>https://www.sec.gov/Archives/edgar/data/1705402/000121390025040294/ea0240865-6k_agmgroup.htm

well i mean this is why you can't just take what the company says at face value, you need a third-party industry expert validating them

not gonna bother, the most i can prob reasonably risk is maybe $2K-$5K so it won't have much impact to me even if it 10x's

i'd rather just keep the money in a play that'll "only" give me a 2x or 3x that is at least a legit business with multiple third-party sources (big public customers) that give them contracts..

interesting to keep in my watchlist and see how much i miss out on for not gambling

Anonymous

(ID: jtEjv6SO)

7/20/2025, 5:31:38 AM

No.60660330

god it feels so shit trying to ride Intermap up for the remaining potential upside to $10 though even if they do get a huge contract (Indonesia), this shit was already 10x from like last year

but at the same time I scoffed at TSSI also being a 10x last year even if Dell could potentialyl give them much more business that overwhelms their market cap, so it still went like 5x more from $4, but i skipped it lmao coz i was too obsessed with something else (basically a value trap in hindisght)

Anonymous

(ID: CwC/Dw0K)

7/20/2025, 5:34:52 AM

No.60660339

And most of that "healthcare" are HR admins and nurses from Haiti.

Anonymous

(ID: jtEjv6SO)

7/20/2025, 5:36:46 AM

No.60660342

>>60660381

it's a pump n dump, that volume is $400K+ for an obscure 5m market cap company, if i wanted to believe my confirmation bias, it looks like some whale is setting up for some money laundering

and why does wealthsimple let me try to trade this in my tfsa lmao what teh fuck

fk reminds me of those chinese green tech tickers pump n dumps, i dont need to play these shit, i can make money without gambling

Anonymous

(ID: +JODd7Cq)

7/20/2025, 5:49:14 AM

No.60660381

>>60660416

>>60660281

>>60660342

When Elon bought Twitter, he facilitated the transaction via a holding company. It was publicly listed and had a nominal $10 share price and no business activity. I was allowed to buy options so I dropped $50 on calls. Nothing happened, their transaction went, and I lost money. Kek

Anonymous

(ID: ysOXiD6d)

7/20/2025, 6:01:31 AM

No.60660411

>>60660414

>>60660426

I got junk mail today with an offer for a personal loan. It doesn't list an interest rate on the loan, but does list numbers -- $21,000 loan, $371 payment per month, 5 year repayment term. This maths out to a 2.4% interest rate.

That's lower than even bonds are. I'm seriously tempted to pursue this to see if I can actually get them to give me the loan, then just dump it all in bonds or a HYSA for risk free money. Seems stupid not to do it, if it's legit. Plus hey, extra credit score pumping is always nice.

Anonymous

(ID: mSdt12ir)

7/20/2025, 6:02:47 AM

No.60660414

>>60660411

Just wait for a better offer. Rates will be negative next year.

Anonymous

(ID: jtEjv6SO)

7/20/2025, 6:03:46 AM

No.60660416

>>60660381

yeah im not gonna buy but i do miss when more ppl just shilled random tickers + pump n dumps to look into and learn from every weekend back in 2020

wow SUNW got delisted into SUNWQ, even those scams you could make some money just riding the pump n dump, pure gambling

really the market right now feels so tame in comparison, we're probably in like 1997-equivalent right now, it's too tame to be 1999

Anonymous

(ID: ++cZgP5r)

7/20/2025, 6:08:13 AM

No.60660426

>>60660438

>>60660411

Its common to give loans a name, like "2.1%" loan but its actually 20% or more. Read the fine print. Its a scam.

Anonymous

(ID: ysOXiD6d)

7/20/2025, 6:10:45 AM

No.60660438

>>60660472

>>60660426

Oh, I'm sure it's a scam. I'll have to call them to figure out what the scam is, though, there's no details on the letter. It's probably just a "oh, you don't actually qualify for that loan, here's the loan you do qualify for" deal though.

Still though, if I could get the loan they put on the advert, putting it in bonds at 4.5% returns would net about $1300 over 5 years. Which would be neat.

Anonymous

(ID: MVArTwnp)

7/20/2025, 6:14:23 AM

No.60660453

>>60654236

I can smell the bed wench off her from a mile away. She loves white men.

Anonymous

(ID: aAbANAsg)

7/20/2025, 6:15:42 AM

No.60660457

Anonymous

(ID: ++cZgP5r)

7/20/2025, 6:20:40 AM

No.60660472

>>60660491

>>60660438

>I'll have to call them

The mailer is a retard test, who is dumb enough to contact them to find out more. If you do, they mark you as a target, your name gets on "retard" lists and you will get flooded with more similar junk mail, and will likely be targeted with jeet scams saar. Scammers are not looking for smart people, they are looking for senior citizens with alzheimers who cant reason and give away all their money. If you think you can outsmart them, they have a ton of lawyers who wrote the loan contracts and if you sign it what is going to be your excuse when you get raped and credit destroyed? Gee your honor I was looking to take advantage of them, but I did not understand the contract I signed. Into the trash it goes.

Anonymous

(ID: mSdt12ir)

7/20/2025, 6:25:24 AM

No.60660491

>>60660503

>>60660472

I always ask them to send me more paperwork so i always have stuff to use at the fireplace.

Anonymous

(ID: 8CmZ7Z+d)

7/20/2025, 6:25:57 AM

No.60660495

Alphabet & XYZ its as easy as ABC

Anonymous

(ID: ++cZgP5r)

7/20/2025, 6:29:12 AM

No.60660503

>>60660771

>>60660491

>so i always have stuff to use at the fireplace.

I once watched a vid on how to take all that junk mail and make it into long lasting paper logs for the fire place, so I see your point.

Anonymous

(ID: hNnTPPs/)

7/20/2025, 7:21:14 AM

No.60660607

>>60660610

i still think schd is gonna shoot up

Anonymous

(ID: U1c8VaoM)

7/20/2025, 7:22:35 AM

No.60660610

>>60660620

>>60660607

why? It's not even suppose to do that.

Anonymous

(ID: hNnTPPs/)

7/20/2025, 7:28:00 AM

No.60660620

>>60660610

the way they rebalanced will benefit quite a bit if rates get cut

Anonymous

(ID: Oj/PE95P)

7/20/2025, 8:45:20 AM

No.60660733

wtf happened to RIMM

Anonymous

(ID: X5NNGXkC)

7/20/2025, 8:59:02 AM

No.60660763

>>60659552

lol. lmao even.

Anonymous

(ID: Mp1n+oDW)

7/20/2025, 9:04:25 AM

No.60660771

>>60660503

Junk mail tends to create lots of cresote so it's better to use as firestarters.

Anonymous

(ID: EgarwY/d)

7/20/2025, 9:47:13 AM

No.60660864

>>60662176

Anonymous

(ID: RITkNzdd)

7/20/2025, 10:21:50 AM

No.60660947

why do we hate TSLA all the sudden...?

Anonymous

(ID: +0pk54cU)

7/20/2025, 10:36:05 AM

No.60660966

>>60660973

I outperformed the S&P in this account by only holding the S&P

love those magic charts from interactive brokers

Anonymous

(ID: rGJ6yVE4)

7/20/2025, 10:36:45 AM

No.60660967

Any news from AI dashcams anon? Also

>QXO

>LCID

>KIND

One of these will surely pump next week r-right?

Anonymous

(ID: EgarwY/d)

7/20/2025, 10:39:42 AM

No.60660973

>>60660976

>>60660966

Are you a Euro?

The USD stopped declining and maybe even strengthened a bit recently, so we gain more

This is a lot of cope however since I'm down like -15% YTD on currency alone even though everything I own has gone up

Anonymous

(ID: +0pk54cU)

7/20/2025, 10:41:30 AM

No.60660976

>>60661011

>>60660973

yeah the etf is in eur, but that shouldn't matter, right? unless the blue line is in USD for some reason

maybe it is

Anonymous

(ID: p6eLza82)

7/20/2025, 10:55:14 AM

No.60661011

>>60661027

>>60660976

The ETF is in EUR, but all of the companies earning money in there do so in dollars. I bought and index fund in EUR and was in the red for weeks while the S&P was growing all the time - turns out that the euro was strenghtening at about the same proportion as the S&P, so it was entirely up to currency difference.

If you buy with a strong Euro and sell with a stronger dollar you're doing a convoluted version of currency hedging.

Anonymous

(ID: +0pk54cU)

7/20/2025, 11:02:49 AM

No.60661027

>>60661011

but value is value, the ETF I hold should have the same value in euro as the S&P in euro - unless IBKR ignores the "main account currency" setting for this chart, and it would just match if I were to switch that to usd

Anonymous

(ID: 26LAhLto)

7/20/2025, 11:28:26 AM

No.60661081

>>60660079

Epstein did nothing wrong.

Anonymous

(ID: KqXw0qqh)

7/20/2025, 12:06:00 PM