DIVIDEND CHADS THE TIME IS NOW

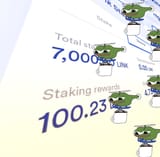

>work for a few years, stack divvie stocks

>get to be a neet forever

>re-invest any excess for continued growth

>hedged for bear markets

>excess liquidity helps you invest in growth during recovery

>DRIPPING into cheap underlying even further enhances gains

get 'em while they're on sale bros

>work for a few years, stack divvie stocks

>get to be a neet forever

>re-invest any excess for continued growth

>hedged for bear markets

>excess liquidity helps you invest in growth during recovery

>DRIPPING into cheap underlying even further enhances gains

get 'em while they're on sale bros