>>60787502

>Dude you probably need to learn how blue chippy divvy stocks and high yield saving accounts work. Theres no reason you should keep having to dip in your principal like this.

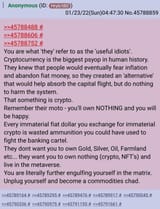

Why would I cash out BTC to buy something yielding 7%? BTC has gone up by an order of magnitude every four years on average. Last time I did the math, it came out to an 80% CAGR from when I bought to the day I crunched the numbers. I'll admit it's been scary as hell. In March 2020 when it dropped below $4,000 I was convinced I was fucked. Problem is, if I sell now, I have to pay 15% to 20% capital gains tax on the amount over about $50K. Dumping enough to generate enough "income" from dividend stocks to live off of would leave me with too little to live off of. Like, $850,000 after taxes, at 7%, gives me $60K/year as "income", which then gets taxed such that I have to pay $12K to the government, so my actual money to live off of is $48K. $12,600 of that goes to health insurance alone, so $35,400 left to pay bills.

If I buy a house, then the numbers are even worse -- the house costs $400,000. That leaves only $450,000 to invest, which is only $31,500 at 7%, with $6000 going to income tax, $12,600 to insurance, so $13,000 per year to spend on everything else -- including property taxes, which can easily be $10K a year nowadays, FFS my mother was paying $15K a year on a $300K property.

I wouldn't mind selling the gold and silver, but it's nice to have shiny rocks around.