Anonymous

(ID: Kf0qHOOv)

8/14/2025, 8:15:52 AM

No.60789211

>>60789216

>>60789238

>>60789262

>>60790589

>>60792405

>>60792553

>>60792774

>>60792795

Rent vs Own

lol7.jpg

md5: 5428036b... 🔍

say you have 3 million and live in a coastal state (more expensive)

would you rather:

>spend ~40k a year renting a decent place

>Keep 2.96mil in your assets

OR

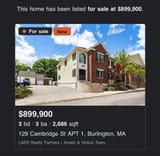

>spend ~800k on house + 8k/yr on fucking taxes

>keep remaining 2.18 mil in assets?

Assuming the living quality is about the same. And Why?

would you rather:

>spend ~40k a year renting a decent place

>Keep 2.96mil in your assets

OR

>spend ~800k on house + 8k/yr on fucking taxes

>keep remaining 2.18 mil in assets?

Assuming the living quality is about the same. And Why?