Anonymous

(ID: liRjfalV)

8/26/2025, 2:09:13 PM

No.60850906

>>60850917

>>60850922

>>60850930

>>60850935

>>60850942

>>60851529

>>60851541

>>60851643

>>60851648

>>60851758

>>60853438

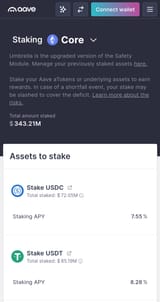

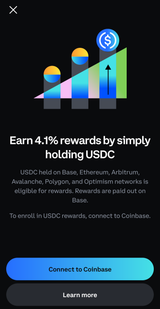

Thinking about throwing some USDC into AAVE for yield. Is it actually safe or are there hidden risks im not seeing? like smart contract exploits, depeg risk, liquidation issues, whatever. Don't wanna get rugpulled just for a few % APY. Anyone here doing it long term?