Anonymous

(ID: nTh0STtr)

8/28/2025, 2:13:50 AM

No.60859243

>>60859253

>>60859294

>>60859313

>>60859340

>>60859446

>>60859457

>>60859517

>>60859549

>>60859587

>>60859679

>>60859785

>>60859901

>>60859984

>>60860117

>>60861047

>>60861089

>>60861417

>>60861426

>>60861751

>>60862118

401K's are a boomer scam

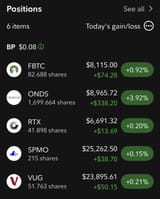

I don't understand how people can "retire" and live off $500K - $1M.

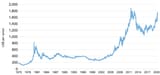

Boomer stonk divvies are great, until they're not and you're down 30%+ of your entire fucking "retirement" because trumpf decided he needs moar cofveve tarriffs.

It's literally the exact same scam as crypto steaking.

>B-but I'm earning $20K - $40K completely passive!!!! Y-you're aktchually the midwit!!

>Market tanks and you lose 5 years of "passive" income and now your passive income is also gradually reduced

Thanks for playing

Boomer stonk divvies are great, until they're not and you're down 30%+ of your entire fucking "retirement" because trumpf decided he needs moar cofveve tarriffs.

It's literally the exact same scam as crypto steaking.

>B-but I'm earning $20K - $40K completely passive!!!! Y-you're aktchually the midwit!!

>Market tanks and you lose 5 years of "passive" income and now your passive income is also gradually reduced

Thanks for playing