>>60861364 (OP)

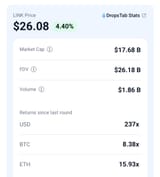

A partnership between Chainlink and the U.S. government might initially seem bullish, but it could lead to increased regulatory scrutiny over the broader crypto ecosystem. Government involvement often brings tighter compliance requirements, and investors may fear that this association puts Chainlink under a regulatory spotlight. This uncertainty can lead to short-term sell-offs as traders react defensively to perceived risks, especially if the government partnership introduces Know Your Customer (KYC) or other restrictive measures that conflict with the decentralized ethos of crypto.

Additionally, such partnerships often focus on using Chainlink’s technology—its oracle infrastructure—rather than the token itself. If the U.S. government or associated institutions use Chainlink’s services without needing to hold or spend LINK tokens (e.g., via enterprise pricing, subsidies, or middleware), there may be little direct demand for LINK. This disconnect between adoption of the technology and utility of the token can cause investors to reassess LINK’s value, leading to price declines.

Lastly, the crypto community tends to value decentralization and censorship resistance. A high-profile partnership with a centralized government entity could be perceived as Chainlink compromising its principles, especially if it leads to Chainlink nodes being selectively whitelisted or governed. This could reduce community trust and deter decentralized finance (DeFi) projects from relying on Chainlink, pushing demand down and negatively impacting the token’s price.