>>60881063

I'm a leaf so maybe our market is as fucked as NYC.

I live in a rent controlled 2 bedroom apartment for 1700/month. Average houses around me are 700k.

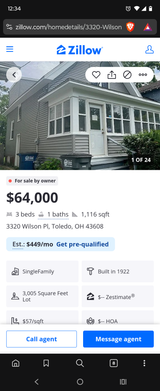

To afford a house, a minimum down payment is 45k, and at 4% interest that's a monthly mortgage of $3583/month. Add on $583/month in property tax, $50 insurance, 1% set aside for maintenance = $583. Your monthly is $4800/month.

That's $3100/month more than what I pay now.

Even if we were to compare buying an apartment vs renting an apartment, similar apartments to buy cost 450k and have $600-1000/month condo fees. $3k-4k/month property tax.

So 22.5k down payment, 4% interest = monthly mortgage of $2339. Plus $600 condo fee, $250/month property tax, 1% set aside for maintenance = $375. Your monthly payment is $3564.

That's $1864 more than what I pay in rent.

Even if I owned an apartment outright with 450k, I still have to pay $685/month. It would have to appreciate substantially year over year to be worthwhile. The condo fee and property tax are certainly only going to increase as well.

I'm better off just investing, with 510k a 4% withdrawal rate entirely covers my $1700/month housing expense.