>>60907151

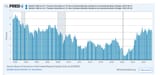

Bond yields rising in this environment is not good. Traditionally US bonds are thought of as an ultra-safe investment - they're a flight to safety during uncertainty (see covid or the 2008 financial crisis for an example, when yields significantly dropped). When yields drop, that means more people are buying bonds. Conversely, this usually means a slowdown in the stock market because people are transitioning out of volatile stocks and into lower-performing US bonds.

But when bond yields rise, that means fewer people actually want to buy them, and they're considered a riskier investment. The higher yields rise, the higher the assessed risk. Risk of what? Stuff like debt default, uncertainty about Fed policy management, inflationary pressures, whatever. Why does this matter? Because the US government ITSELF pays its own debt based on bond yields. And when yields go up, so does the interest rate on government debt.

So what happens if the national debt continues increasing exponentially while bond yields simultaneously continue going up? A vicious cycle of bonds becoming more and more risky while government debt becomes more and more expensive to pay off, ending in a real-deal financial crisis that would make the Great Depression look like the 1980s.