Anonymous

(ID: qKNUJXRw)

9/19/2025, 6:40:39 AM

No.60961034

>>60961091

>>60961117

>>60961204

>>60962063

>>60962291

>>60964882

>>60964908

>>60965507

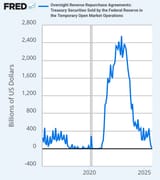

$2B in Subprime Car Loans defaulted today under Tricolor, a usurymaxxing firm giving ultrahigh interest loans to illegal immigrant and Blaxicans.

Not enough buyers for the debts. Contagion likely. Debtmaxxers win.

Not enough buyers for the debts. Contagion likely. Debtmaxxers win.