Anonymous

(ID: 9LFTWO3o)

10/16/2025, 10:33:27 PM

No.61132425

>>61132432

>>61132438

>>61132550

>>61132594

>>61132604

>>61132945

>>61132952

>>61133012

>>61133065

>>61133111

>>61133217

>>61133453

>>61134079

>>61134099

>>61134122

>>61135308

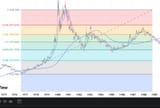

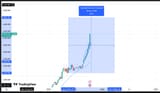

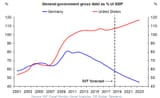

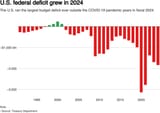

How bad will the rugpull be?