>>63911748

No

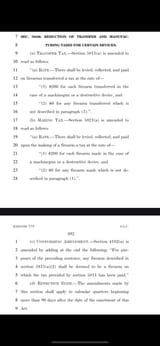

>SEC. 112029. MODIFICATION OF TREATMENT OF SILENCERS.

(a) In General.--Section 5845(a) is amended by striking ``(7) any

silencer'' and all that follows through ``; and (8)'' and inserting

``and (7)''.

(b) Transfer Tax.--Section 5811(a) is amended to read as follows:

``(a) Rate.--There shall be levied, collected, and paid on firearms

transferred a tax at the rate of--

``(1) $5 for each firearm transferred in the case of a

weapon classified as any other weapon under section 5845(e),

``(2) $0 for each firearm transferred in the case of a

silencer (as defined in section 921 of title 18, United States

Code), and

``(3) $200 for any other firearm transferred.''.

(c) Making Tax.--Section 5821(a) is amended to read as follows:

``(a) Rate.--There shall be levied, collected, and paid upon the

making of a firearm a tax at the rate of--

``(1) $0 for each silencer (as defined in section 921 of

title 18, United States Code) made, and

``(2) $200 for any other firearm made.''.

(d) Effective Date.--The amendments made by this section shall

apply to calendar quarters beginning more than 90 days after the date

of the enactment of this Act.