>>24505233

Your framing overstates how strictly Keynes opposed stimulus in recovery. While Keynes supported austerity after full recovery, he was pragmatic: until full employment returned, stimulus remained justified.

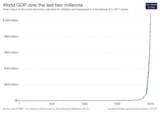

Saying “Keynes' goal was to make the periods of economic growth more modest” doesn’t fully capture Keynes’ view. Keynes didn’t want to suppress growth, he wanted to avoid unsustainable booms that would result in busts. His aim was stability, not mediocrity. There are examples of post-recession stimulus which are justified.

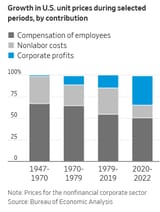

Also, in reference to your equations, you state that M is relatively constant, which is rarely the case when fiscal or monetary stimulus is applied. Further, you conflate fiscal stimulus (Keynesian policy) with changes in V (a monetarist concept). Keynesian stimulus generally involves increases in G (government spending) rather than assuming V will increase. Also, you ignore the liquidity trap scenario Keynes was concerned with, where V collapses, and monetary policy becomes ineffective, thus justifying fiscal stimulus.

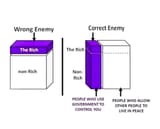

Further, your use of the phrase "meth head economics" betrays that your criticisms on this topic are ideologically motivated rather than genuine. You are operating from a fear based position, and in doing so, you mischaracterize real Keynesian theory. Your argument is more accurately directed against politicians or policymakers who misuse Keynesian tools (I.E., stimulate even during booms for political gain) rather than Keynes himself or responsible Keynesian economists.

Next, your statement that "Economists actually generally support higher interest rates as being conducive to greater economic output..." confuses long-run capital formation logic with short-run macroeconomic management. In classical models, higher interest rates can encourage savings, increasing capital stock. However, in Keynesian models, higher interest rates dampen investment and reduce aggregate demand, especially when the economy is below potential. Empirically, very high interest rates depress investment, especially by small and medium enterprises. The idea that higher savings automatically lead to more investment assumes Say’s Law (supply creates its own demand), which Keynes explicitly rejected (Keynes wins the day here).

In short, you have caricatured. Keynesianism, ignoring the conditionality and discipline Keynes advocated. You conflated fiscal stimulus with changes in monetary velocity. Your overzealous opposition to Keynes also led you to overlook real-world scenarios (like liquidity traps, hysteresis, and output gaps) where stimulus can still be productive after recessions. And lastly, you misused classical savings-investment logic in a context that requires short-run demand-side analysis, not long-run supply-side dynamics.

While you do have a kernel of valid concern, it is enmeshed in an almost hysterical bias which leads you to overgeneralize and become sloppy in your overall economic framework.