>>28600867

>It's basically renting until you're 50 anyways except you have to fix everything.

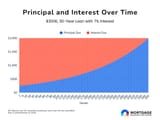

Simpleminded ignorant logic. Sure, you have to pay a lot upfront, and pay for everything that breaks, but unlike renting, all of the money you spend on your house is money that comes back to you eventually. How so? Plot twist of the century: you can sell your house in the future, even if you still owe money on it, all that happens is that the bank of your buyer talks to the bank that owns your mortage, they pay each other the difference, and you get what's left over.

And so long as you don't live in some future disaster area (like the entire state of Florida for instance) you will make money as well since home and land appreciate in value. Home ownership is a way to take your biggest expense as a human being in the US, your rent, and making it work for you. There's a reason why home ownership has traditionally been a ticket into middle class living regardless of background. I can sell the house in 10 years, put a down payment on another one with the proceeds, AND buy the fun car you're talking about without breaking a sweat, Unless the "fun" car you're talking about is some meme supercar nonsense like a Lotus, in which case you're far stupider than just defending paying rent to a landlord makes you out to be.