>>507077953

You know what boggles my mind. How many people killed themselves during the Great depression when they just everybody else were fuck too. So who cares

>>507078302

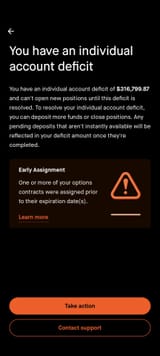

### Early Assignment of Call Options: A Concise Overview

When you sell a call option, you allow someone to buy a stock from you at a set price (the strike price) before a specific date. Early assignment occurs when the buyer exercises this right before the expiration date, which can happen with American-style options.

#### Scenarios of Early Assignment

1. **Covered Call**:

- **Definition**: You own the stock and sell a call option against it.

- **Outcome**: If the buyer exercises the option, you must sell your shares at the strike price.

- **Example**: If the strike price is €50 and the stock is trading at €60, you miss out on the extra €10 per share but keep the premium from selling the option.

2. **Naked Call**:

- **Definition**: You sell a call option without owning the stock.

- **Outcome**: If the buyer exercises the option, you must buy the stock at the market price to sell it at the strike price.

- **Example**: If the strike price is €50 and the stock is at €70, you buy it at €70 and sell it for €50, resulting in a €20 loss per share, though you keep the premium.

#### Reasons for Early Assignment

- **Dividends**: Buyers may exercise options early to receive upcoming dividends.

- **In-the-Money Options**: If the option is significantly in-the-money, the holder may want to lock in profits.

#### Risk Management Strategies

- **Monitor Positions**: Keep an eye on stock prices and market conditions.

- **Consider the Premium**: The premium received can help offset potential losses.

- **Have a Strategy**: Be prepared for assignment, especially with naked calls.

### Conclusion

Understanding early assignment is crucial for options trading. Whether selling covered or naked calls, being informed about the risks and mechanics helps you navigate the

6/12/2025, 9:21:50 AM

No.507076633

>>507076693

>>507076728

>>507076763

>>507076782

>>507076825

>>507076835

>>507076994

>>507077027

>>507077052

>>507077078

>>507077163

>>507077215

>>507077551

>>507077648

>>507077952

>>507077953

>>507078044

>>507078059

>>507078111

>>507078148

>>507078165

>>507078185

>>507078213

>>507078424

>>507078552

>>507078570

>>507078578

>>507078658

>>507078686

>>507078727

>>507079059

>>507079140

>>507079200

>>507079288

>>507080870

>>507084078

>>507084264

>>507084304

>>507084460

>>507084533

>>507084663

>>507085671

>>507085748

>>507085764

>>507085979

>>507087259

>>507087292

>>507087591

>>507087640

>>507088283

>>507088695

6/12/2025, 9:21:50 AM

No.507076633

>>507076693

>>507076728

>>507076763

>>507076782

>>507076825

>>507076835

>>507076994

>>507077027

>>507077052

>>507077078

>>507077163

>>507077215

>>507077551

>>507077648

>>507077952

>>507077953

>>507078044

>>507078059

>>507078111

>>507078148

>>507078165

>>507078185

>>507078213

>>507078424

>>507078552

>>507078570

>>507078578

>>507078658

>>507078686

>>507078727

>>507079059

>>507079140

>>507079200

>>507079288

>>507080870

>>507084078

>>507084264

>>507084304

>>507084460

>>507084533

>>507084663

>>507085671

>>507085748

>>507085764

>>507085979

>>507087259

>>507087292

>>507087591

>>507087640

>>507088283

>>507088695