Anonymous

(ID: 8X1n164q)

7/2/2025, 2:42:14 AM

No.509266213

>>509266275

>>509266826

>>509266873

>>509267490

>>509267498

>>509267634

>>509268079

>>509268104

>>509269028

>>509269920

>>509270004

>>509270028

>>509271850

>>509272085

>>509272681

>>509272899

>>509273671

7/2/2025, 2:42:14 AM

No.509266213

>>509266275

>>509266826

>>509266873

>>509267490

>>509267498

>>509267634

>>509268079

>>509268104

>>509269028

>>509269920

>>509270004

>>509270028

>>509271850

>>509272085

>>509272681

>>509272899

>>509273671

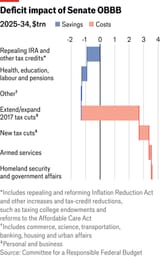

- Makes the 2017 Trump Tax Cuts and Jobs Act permanent, preventing tax increases set to expire.

- Eliminates taxes on tips, overtime pay, and Social Security benefits through 2028.

- Increases the standard tax deduction by $1,000 for individuals, $1,500 for heads of households, and $2,000 for married couples through 2028.

- Raises the State and Local Tax (SALT) deduction cap from $10,000 to $40,000 for incomes up to $500,000, with a 1% annual increase for 10 years.

- Provides a $4,000 standard deduction increase for seniors through 2028.

- Offers a $500 increase in the Child Tax Credit to $2,500 for 2025–2028.

- Creates "Trump Accounts" with a $1,000 government contribution for children born 2024–2028, allowing parental contributions up to $5,000 annually for education, job training, or first home purchases.

- Expands the small business deduction (Section 199A) to 23% and makes it permanent.

- Allows 100% immediate expensing for equipment, machinery, and research & development costs.

- Doubles small business expensing limit to $2.5 million for equipment and property.

- Introduces a tax credit up to $5,000 for donations to scholarship-granting organizations through 2029.

- Expands health savings accounts and codifies Trump-era health coverage flexibility policies.

- Increases the Low-Income Housing Tax Credit to incentivize affordable housing construction.

- Raises the estate tax exemption to protect family farms from taxation.

- Permanently renews Opportunity Zones to drive investment in rural and distressed communities.

- Allocates $46.5 billion for border wall construction and $45 billion for immigration detention facilities.

- Provides $14 billion for deportation operations and funds to hire 10,000 new Border Patrol agents by 2029.

- Imposes a $3,500 fee for family reunification with unaccompanied migrant children and a $1,000 asylum application fee.

- Allows indefinite detention of immigrant children.

1/2

- Eliminates taxes on tips, overtime pay, and Social Security benefits through 2028.

- Increases the standard tax deduction by $1,000 for individuals, $1,500 for heads of households, and $2,000 for married couples through 2028.

- Raises the State and Local Tax (SALT) deduction cap from $10,000 to $40,000 for incomes up to $500,000, with a 1% annual increase for 10 years.

- Provides a $4,000 standard deduction increase for seniors through 2028.

- Offers a $500 increase in the Child Tax Credit to $2,500 for 2025–2028.

- Creates "Trump Accounts" with a $1,000 government contribution for children born 2024–2028, allowing parental contributions up to $5,000 annually for education, job training, or first home purchases.

- Expands the small business deduction (Section 199A) to 23% and makes it permanent.

- Allows 100% immediate expensing for equipment, machinery, and research & development costs.

- Doubles small business expensing limit to $2.5 million for equipment and property.

- Introduces a tax credit up to $5,000 for donations to scholarship-granting organizations through 2029.

- Expands health savings accounts and codifies Trump-era health coverage flexibility policies.

- Increases the Low-Income Housing Tax Credit to incentivize affordable housing construction.

- Raises the estate tax exemption to protect family farms from taxation.

- Permanently renews Opportunity Zones to drive investment in rural and distressed communities.

- Allocates $46.5 billion for border wall construction and $45 billion for immigration detention facilities.

- Provides $14 billion for deportation operations and funds to hire 10,000 new Border Patrol agents by 2029.

- Imposes a $3,500 fee for family reunification with unaccompanied migrant children and a $1,000 asylum application fee.

- Allows indefinite detention of immigrant children.

1/2