Why doesn’t congress just legislate that the Federall Reserve

Must maximize domestic industry and infrastructure building

They’ll handle it from there. Better than dinky tariffs

>>510284926 (OP)

Because we live in the real world

Anonymous

(ID: IhVWtl8P)

7/13/2025, 7:54:57 PM

No.510285073

>>510286365

7/13/2025, 7:54:57 PM

No.510285073

>>510286365

That's not a job for the Federal reserve though. That's a job for Congress and private industry.

Anonymous

(ID: Bbn5VmbI)

7/13/2025, 7:55:01 PM

No.510285079

>>510285315

7/13/2025, 7:55:01 PM

No.510285079

>>510285315

>>510284926 (OP)

Why not peg the dollar to the entire US oil supply to force the dollar to gradually deflate?

But of course, there will be kikes who will argue against that and claim instead the inflation is natural and healthy for paying debt with more debt, somehow.

Anonymous

(ID: Btivwl8T)

7/13/2025, 7:55:32 PM

No.510285125

7/13/2025, 7:55:32 PM

No.510285125

Anonymous

(ID: 2aZWVSz+)

7/13/2025, 7:56:09 PM

No.510285173

7/13/2025, 7:56:09 PM

No.510285173

>>510284926 (OP)

That’s not what the Fed does.

Anonymous

(ID: Btivwl8T)

7/13/2025, 7:58:00 PM

No.510285315

7/13/2025, 7:58:00 PM

No.510285315

>>510285079

>peg the dollar to the entire US oil supply

or to land

specifically, backing treasury-issued US Notes with specified land tracts

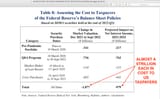

The fed franchises are fucking broke ~$231B now

Anonymous

(ID: Btivwl8T)

7/13/2025, 7:59:30 PM

No.510285439

7/13/2025, 7:59:30 PM

No.510285439

https://archive.4plebs.org/pol/thread/505237484/

^^^ A thread about the NYFed and its ilk now trying to convince the boomers to switch from private Federal Reserve-issued, debt-based Federal Reserve Notes to privately-issued, debt-backed stablecoin tokens. This is going to be priceless to watch. Neither of these currency options benefit the citizens, they only benefit the private issuer. Will boomers sell out once again to the banks to save themselves from a failing system that they created? One last fuck you to the country as they insulate themselves in their private tokens?

And in the next orchestrated crisis, are the boomers’ new asset tokens to become worthless, as the payment platform is the ultimate claimant to any reserve assets in a crisis or bankruptcy?

When is the currency going to be restored to the people? Don't US taxpayers have a right to a debt-free currency issued by their own treasury?

pic rel passed senate but not house

Anonymous

(ID: LuwZ9TLA)

7/13/2025, 8:00:17 PM

No.510285509

>>510286505

>>510289655

7/13/2025, 8:00:17 PM

No.510285509

>>510286505

>>510289655

>>510284926 (OP)

because the federal reserve's mandate is to control inflation and maximize employment, and anything else is communism, and you aren't a Godless pinko commie are you son?

Anonymous

(ID: MomhkijC)

7/13/2025, 8:11:44 PM

No.510286365

>>510287102

7/13/2025, 8:11:44 PM

No.510286365

>>510287102

>>510285073

>>510285049

Getting it passed is one thing sure, but congress already mandates them to maximalize employment and minimize inflation, just give them another task and they’ll do it.

Anonymous

(ID: Btivwl8T)

7/13/2025, 8:12:43 PM

No.510286446

7/13/2025, 8:12:43 PM

No.510286446

With a red sweep, we will be able to see the Federal Reserve Uniparty in full view. Constant gridlock in Congress has concealed the true power of the Federal Reserve Uniparty.

Don’t forget that the right had prior full control for at least a year under Trump’s first term and passed NOTHING in regard to the INSOLVENT, private Fed franchises that are now bankrupting the US Treasury for every last dime they can get (mostly the NYFed).

Why don't we just issue US Notes ONLY for deficit spending? US Notes BENEFIT THE CITIZENS and DO NOT ADD TO our current debt. US Notes could also be digital, only to be used in the US. Why doesn’t Trump ever suggest this? This is already fucking legal. US Notes circumvent the need to borrow our currency from the Federal Reserve, that's fucking why.

Why do ALL of the proposed solutions to our debt only include the bankrupt Federal Reserve?

US NOTES ARE NOT A NOVEL IDEA, THEY JUST DON'T BENEFIT THE FEDERAL RESERVE, WHICH IS WHY US NOTES ARE NEVER MENTIONED DESPITE BEING THE EXACT SOLUTION THAT WE NEED RIGHT FUCKING NOW

Anonymous

(ID: MomhkijC)

7/13/2025, 8:13:13 PM

No.510286505

7/13/2025, 8:13:13 PM

No.510286505

>>510285509

No I’m scared of communist China that’s why

>t. Military industrial complex glowie (literally)

>>510286365

>just give them another task and they’ll do it.

lol

bullshit's getting deep already and only ten posts in

A recent thread:

<<<<——-

https://archive.4plebs.org/pol/thread/504503488/

The now-bankrupt Federal Reserve is building a $2.5 B complex in Washington DC and funding it with borrowed US taxpayer money. The Fed is fucking broke and putting Italian beehives in its extravagant rooftop gardens and building private elevators to VIP dining rooms, yet bloviating about the importance of citizens being able to communicate in a republic. lol

To add to the elitism and absurdity, Elon Musk, with his toothless, empty threats on his way out the door of DOGE, glibly stated, “someone should look into the Fed.”

Really? Is that it? What an absolute fucking joke.

It is fucking amazing that Trump’s economic advisor (Miran) wants to now indebt the US with 100 year TOKENIZED bonds, so we can be skimmed for another fucking century by these insolvent frauds.

https://nypost.com/2025/04/27/business/federal-reserve-blows-2-5b-on-palace-of-versailles-hq/

https://archive.is/fpJ4J

This project DWARFED all other government building projects ever. And the real kicker is the broke-ass Fed is BORROWING this money from taxpayers for the project.

And note: Powell just got caught lying to Congress about this.

Anonymous

(ID: MomhkijC)

7/13/2025, 8:28:14 PM

No.510287755

>>510287872

>>510288166

>>510288427

7/13/2025, 8:28:14 PM

No.510287755

>>510287872

>>510288166

>>510288427

>>510287102

Currency doesn’t come from bartering, it comes from the government, even in Neolithic times (sans bitcoin)

The federal reserve will do anything to keep their license to print money. The aren’t broke, they are the fucking house and you know it.

Anonymous

(ID: Btivwl8T)

7/13/2025, 8:29:05 PM

No.510287824

>>510293443

7/13/2025, 8:29:05 PM

No.510287824

>>510293443

>>510287102

Trump and Miran are trying to circumvent #2 in pic rel with forwards (futures for treasuries).

They are trying to make it so the US can sell its gold without paying down the debt.

Miran and Trump want for the major debt holders to swap their short term bills and notes for 100 yr bonds, they want to indebt Americans for the next century to the Fed (ultimately via tokenization of these treasuries (aka securities))

Reminder:

using cash forces these debt based central banks to serve the citizens

I promote the abolition of the Federal Reserve and to restore the currency back to American citizens. The citizens of each nation HAVE A FUCKING RIGHT TO A DEBT-FREE CURRENCY USED TO FACILITATE COMMERCE. Not for the currency to be hoarded and used to hide the insolvency of the very fucking BROKE ASS Federal Reserve franchise clowns issuing it.

Anonymous

(ID: Btivwl8T)

7/13/2025, 8:29:37 PM

No.510287872

7/13/2025, 8:29:37 PM

No.510287872

>>510287755

>Currency doesn’t come from bartering,

i never said it did

Anonymous

(ID: Btivwl8T)

7/13/2025, 8:31:52 PM

No.510288166

>>510288530

7/13/2025, 8:31:52 PM

No.510288166

>>510288530

>>510287755

>they are the fucking house

no the fucking US TAXPAYERS are the fucking HOUSE, and the US Treasury is their wallet

you have now showed yourself

that was easy and fast

Anonymous

(ID: Btivwl8T)

7/13/2025, 8:33:42 PM

No.510288299

>>510288552

7/13/2025, 8:33:42 PM

No.510288299

>>510288552

The Fed is just a bankrupt contractor that we borrow our currency from that promised to back it with gold

fucking kek

maybe they did have crack back then, b/c that is what you would have to be smoking to believe the bullshit the Fed was promising

Anonymous

(ID: 3ObHqhiD)

7/13/2025, 8:35:08 PM

No.510288407

7/13/2025, 8:35:08 PM

No.510288407

>>510284926 (OP)

kek anon, politicians listen to the bankers, not the other way around.

Anonymous

(ID: QOre1AeG)

7/13/2025, 8:35:24 PM

No.510288427

>>510288587

>>510287755

markets emerged regardless of governance

governments emerged from the end of nomad and start of farmer

you get raided as a nomad, someone steals the kill from your hunt, you pack your shit and move on

farming they know where to find you year round now

but then a second band of raiders come, now you have to explain to them you have nothing because others already took it

they demand you give them your food stores and they'll protect you from the other raiders

bada bing bada boom you have your first government

markets emerge regardless of that interaction and many societies being governed did not invent currencies, some in pre roman uk did though, proud of them

Anonymous

(ID: vzh7Meb1)

7/13/2025, 8:36:15 PM

No.510288498

7/13/2025, 8:36:15 PM

No.510288498

>>510284926 (OP)

congress has no power over the federal reserve. When congress created the fed they made sure of that

Anonymous

(ID: MomhkijC)

7/13/2025, 8:36:37 PM

No.510288530

>>510289181

7/13/2025, 8:36:37 PM

No.510288530

>>510289181

>>510288166

As some other anon said I live in reality. If you can beat them join them, or at least make them serve you better

Anonymous

(ID: Btivwl8T)

7/13/2025, 8:36:56 PM

No.510288552

>>510288766

>>510312348

7/13/2025, 8:36:56 PM

No.510288552

>>510288766

>>510312348

>>510288299

<<<---maybe they did have crack back then, b/c that is what you would have to be smoking to believe the bullshit the Fed was promising

The Federal Reserve Act of 1913 says it will back each $1 Federal Reserve Note in circulation with forty cents of gold.

They don't do this.

The Federal Reserve Act of 1913 says that bankers are to be held personally responsible if they fail.

They are not.

The Federal Reserve Act of 1913 says if a Fed bank is insolvent, it is to become the property of the US.

It doesn’t.

The Federal Reserve Act of 1913 says that insolvent Fed banks shall forfeit their shares in their Regional Fed.

They don’t.

The Federal Reserve Act of 1913 says that it will use its profits to supplement the gold reserve and pay down any US debt.

It definitely doesn’t do this. LOL PIC RELATED

The Federal Reserve has 3 mandates —people now only talk about the dual mandates, which are stable prices and low unemployment—the third mandate is to keep long term interest rates constant.

They don't do this.

The Federal Reserve Act of 1913 says that the Fed will maintain parity of all forms of legal money issued by the US and strengthen the gold reserve.

They don’t do this.

The Federal Reserve Act of 1913 says the Fed Board will audit Fed banks at will.

They don’t do this.

The Federal Reserve Act of 1913 says its by-laws are not to violate US law.

They do.

The Federal Reserve Act of 1913 says that Fed banks cannot discount stocks or commercial paper.

They do.

The Federal Reserve Act of 1913 says each Fed bank will maintain a surplus fund from its profits, up to 40% of its paid-in capital stock.

They don’t do this.

The Federal Reserve Act of 1913 says the Fed Board will supervise Fed banks.

They don’t.

The Federal Reserve Act of 1913 says Fed banks will publish complete details weekly of their assets and liabilities, as well as the nature of their transactions.

They don’t do this.

and

Anonymous

(ID: QOre1AeG)

7/13/2025, 8:37:24 PM

No.510288587

>>510288427

governments are not required for life, markets are

you dont require the relationship with the bandits, you do require one with the people you live with

Anonymous

(ID: Btivwl8T)

7/13/2025, 8:39:24 PM

No.510288766

>>510291279

>>510312348

7/13/2025, 8:39:24 PM

No.510288766

>>510291279

>>510312348

>>510288552

and

The Federal Reserve Act of 1913 says the Fed is required to write off worthless assets on its books.

It doesn’t do this.

The Federal Reserve Act of 1913 says it is to have reserves in gold equal to 35% of its deposits.

It doesn’t do this.

The Federal Reserve Act of 1913 says it will maintain a gold account at the Treasury.

It doesn’t do this.

The Federal Reserve Act of 1913 says the Fed’s franchise will be forfeited if they violate law.

It is not.

The Federal Reserve Act of 1913 says that Federal Reserve Notes will be redeemed for gold.

They’re not.

The Federal Reserve Act of 1913 says Fed bank owners will be held responsible for all regional Fed bank operating expenses, debts and contracts.

They aren’t.

The Federal Reserve Act of 1913 says Fed member banks will not repurchase US treasuries that have maturities greater than six months from their date of purchase.

They do.

The Federal Reserve Act of 1913 says US Treasury yields are to be paid in tax-free gold.

They aren’t.

Gold is mentioned 53 times and on 11/25 pages. The word gold is littered throughout the Federal Reserve Act of 1913, basing one promise after another on GOLD. It was the ONLY reason the legislation passed.

The Federal Reserve Act of 1913 says the Federal Reserve will not pay any income tax, its shareholders will receive a 6% dividend or the yield on a US 10-year treasury (whichever is lower) and also to have all their travel expenses paid.

They did manage to uphold these parts of the Federal Reserve Act of 1913.

Why do we have a Federal Reserve again?

A thread for the above:

https://archive.4plebs.org/pol/thread/378535945/#q378535945

Anonymous

(ID: LWjbxZYw)

7/13/2025, 8:41:59 PM

No.510288978

>>510284926 (OP)

antisemitism has no place in the modern world

Anonymous

(ID: Btivwl8T)

7/13/2025, 8:44:34 PM

No.510289181

7/13/2025, 8:44:34 PM

No.510289181

>>510288530

>If you can beat them join them, or at least make them serve you better

the US economic engine is going to bulldoze right over the bankrupt fucking Fed

the Federal Reserve Note is dying on the world stage and now a threat to national economic security

The now-bankrupt Federal Reserve franchise collateralizes their worthless Federal Reserve Notes with US treasuries (aka securities).

The 12 Fed franchises are now bankrupt and don't have enough collateral to request more fiat. It is being suggested now to take regional Fed shareholder capital or even regional Fed owner’s assets to back their worthless Federal Reserve Notes under Section 2 of the Federal Reserve Act.

Every uncollateralized Federal Reserve Note being issued today is a lien on the assets (and shareholder capital) of the now-bankrupt NYFed's owners, including its largest owner, JPM.

How is JPM making record profits when the NYFed's private franchise ITSELF is ~$130B in the hole?

Why is JPM still being paid dividends when the NYFed is insolvent?

When money replaces actual success, only the sleazy will be rich.

pic related the bankrupt fucking Fed can't even muster printing fucking Federal Reserve Notes, that's how fucking broke they are

this is how bad they are at their ONE FUCKING job, to PROVIDE A FUCKING CURRENCY FOR THE CITIZENS TO USE FOR FUCKING COMMERCE

Anonymous

(ID: 5C1OjtMc)

7/13/2025, 8:44:35 PM

No.510289183

7/13/2025, 8:44:35 PM

No.510289183

>>510284926 (OP)

What do you think the Federal Reserve is? They have no control over that, they control the currency itself and nothing else. Is your question whether the government should legislate that member banks prioritize domestic industry and infrastructure? That has it’s own risks…

Anonymous

(ID: Btivwl8T)

7/13/2025, 8:46:51 PM

No.510289372

7/13/2025, 8:46:51 PM

No.510289372

the broke ass Fed has had a TRILLION in mark to market losses already and will now realize another TRILLION in losses over the next decade

THIS IS HOW SHITTY THE FEDERAL RESERVE IS AT THEIR JOB

Anonymous

(ID: Btivwl8T)

7/13/2025, 8:48:49 PM

No.510289503

7/13/2025, 8:48:49 PM

No.510289503

Anonymous

(ID: leFbbobr)

7/13/2025, 8:50:36 PM

No.510289655

>>510290400

7/13/2025, 8:50:36 PM

No.510289655

>>510290400

>>510285509

Federal reserve isnt capitalist

Anonymous

(ID: b+MlSgWY)

7/13/2025, 8:52:48 PM

No.510289810

7/13/2025, 8:52:48 PM

No.510289810

>>510285049

>Because we live in the clown world

fix for you, newfag, don't need to thank me.

Anonymous

(ID: iu/YrSzg)

7/13/2025, 8:57:08 PM

No.510290168

>>510291035

7/13/2025, 8:57:08 PM

No.510290168

>>510291035

>>510284926 (OP)

that would be a cool rts game. Slum lord vs high tech elite

Anonymous

(ID: 5C1OjtMc)

7/13/2025, 8:59:47 PM

No.510290400

>>510290720

7/13/2025, 8:59:47 PM

No.510290400

>>510290720

>>510289655

That may be, but it’s just a fact that fiat based currency and the ability to control it gives the government a distinct advantage over commodity based currency.

Anonymous

(ID: Btivwl8T)

7/13/2025, 9:03:47 PM

No.510290720

7/13/2025, 9:03:47 PM

No.510290720

>>510290400

>fiat based currency

'fiat' isn't the problem

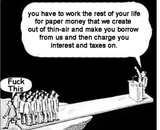

WHO IS ISSUING the 'fiat' IS THE PROBLEM and that the Fed's private fiat IS INTEREST-BEARING is the fucking problem

FIAT, CREDIT-BASED INTEREST-FREE US NOTES ISSUED BY THE US TREASURY WORK FOR THE PEOPLE AND ARE INTENDED TO BE AN INTEREST-FREE TOOL TO FACILITATE COMMERCE

FIAT, DEBT-BASED, USURIOUS, INTEREST-BEARING FEDERAL RESERVE NOTES ARE FUCKING BORROWED FROM THE PRIVATELY-INCORPORATED NY FEDERAL RESERVE FRANCHISE AND ONLY ENRICH THE NYFED’S PRIMARY DEALERS AND THEIR CRONY/POLITICAL ILK AND ENSLAVE THE POPULATION IN BOND DEBT

Fiat is given value BY A NATION'S CITIZENS.

If the nation's treasury is the one issuing it, fiat is not a problem.

I'm all for metals backing, too, we can have US Notes to be metals-backed (could even be fractional)

Anonymous

(ID: Btivwl8T)

7/13/2025, 9:07:28 PM

No.510291035

>>510291582

7/13/2025, 9:07:28 PM

No.510291035

>>510291582

>>510290168

>elite

wtf

STOP using this fucking word

elite (n) - the best of a category, the finest, etc. (i.e. this could also apply to turnips)

elitist (n) - one who thinks they are better than others

There is a difference between the two.

Calling the worst of what humanity has to offer the "elite" is wholly untrue.

Elitist, yes. Elite, no.

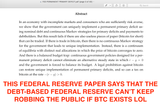

pic rel another anon

Anonymous

(ID: Btivwl8T)

7/13/2025, 9:10:12 PM

No.510291279

7/13/2025, 9:10:12 PM

No.510291279

>>510288766

>The Federal Reserve Act of 1913 says US Treasury yields are to be paid in tax-free gold.

holy fuck imagine the treasury sending you tax free gold to your fucking house for your treasury yield

kek

this will never not be funny

Anonymous

(ID: Btivwl8T)

7/13/2025, 9:12:31 PM

No.510291479

7/13/2025, 9:12:31 PM

No.510291479

Trump, Musk, Visa, and the NYFed's largest primary dealers are working toward a tokenized-asset platform out of the new Texas stock exchange. Trump and Musk have been quietly working with some of the NYFed’s primary dealers and other fintech players to cement a new global, digital platform with DIGITAL WALLETS (which inherently require a DIGITAL ID) after the big banks and the SEC, etc just spent four years calling crypto a scam and killing off any undesired blockchain competition.

https://archive.4plebs.org/pol/thread/499902179

^^^^ITT^^^, I outline how this asset-tokenization scheme is designed and its intended consolidation of Federal Reserve Uniparty power behind the scenes out of public view, as Musk and Trump claim the elimination of corruption and fraud, while eliminating any blockchain competition and simultaneously trying to establish a new need for their digital wallets and digital IDs.

As Trump and Musk superficially criticize the poor accounting, waste and fraud in the US government, they conveniently omit that JPM is the account validator for these fraudulent US government contracts/accounts and they ALSO never admit that the BANKRUPT, private 12 Federal Reserve franchises are the US government’s fiscal agents, cutting the 'untraceable' fraudulent checks.

Instead of identifying and rooting out the real financial entities facilitating this waste and fraud, Musk and Trump actively blame the ballooning debt and deficit spending on everything BUT Fed ‘accommodation’ and QE, while they simultaneously aid the 2008 banking failures in their current looting of our US Treasury via IORB and RRP, their further acquisition of tangible assets and their destruction of the value of our labor and national currency.

pic rel

Musk and his MOTHER privately met with Dimon and 200 of JPM's largest investors in Miami on Thurs Feb 6th, days before he began his 'audits' of the US Treasury and USAID revelations.

Anonymous

(ID: MomhkijC)

7/13/2025, 9:13:46 PM

No.510291582

>>510291796

7/13/2025, 9:13:46 PM

No.510291582

>>510291796

>>510291035

…you aren’t wrong. Thank god for bitcoin

Anonymous

(ID: Btivwl8T)

7/13/2025, 9:16:23 PM

No.510291796

>>510292252

7/13/2025, 9:16:23 PM

No.510291796

>>510292252

>>510291582

>Thank god for bitcoin

Fed wants to kill that off too

BTC provides four functions for the Fed:

1 the destruction of private, non-stablecoin crypto use as a currency

2 a potential global financial crisis

3 BTC market price arbitrage to give one last fleecing to boomers fleeing the Federal Reserve Note

4 normalization and adoption of tokenization

Anonymous

(ID: Btivwl8T)

7/13/2025, 9:17:26 PM

No.510291882

7/13/2025, 9:17:26 PM

No.510291882

Anonymous

(ID: Btivwl8T)

7/13/2025, 9:18:33 PM

No.510291986

7/13/2025, 9:18:33 PM

No.510291986

i'm not gonna flood this thread, but i am going to post my thread series for new anons

Anonymous

(ID: MomhkijC)

7/13/2025, 9:21:30 PM

No.510292252

>>510293626

7/13/2025, 9:21:30 PM

No.510292252

>>510293626

>>510291796

Tell me more about tokenization or where I can find more info

Anonymous

(ID: Btivwl8T)

7/13/2025, 9:22:01 PM

No.510292303

>>510292730

>>510293443

>>510296829

7/13/2025, 9:22:01 PM

No.510292303

>>510292730

>>510293443

>>510296829

Federal Reserve Thread Series Part 1 of 4

https://archive.4plebs.org/pol/thread/489468608

This thread summarizes the first of a series of four recent separate economics papers examining the current insolvency of the 12 regional Federal Reserve franchises.

In this first paper, Kupiec and Pollock show that the Federal Reserve franchises are insolvent if GAAP accounting is used, which the Fed does not use. The Fed is now balancing their books with an imaginary, 'magic' accounting column called 'Deferred Assets' to perpetuate their bankrupting of the US Treasury and the American taxpayer and to hide their losses and now uncollateralized Federal Reserve Notes. These are operating losses, which don't even include the capital losses from marking-to market their now-worthless securities either, further skewing the real price of credit and hampering the Fed's ability to respond to shocks to the economy, as their balance sheet is full and there is no room to move.

The Fed franchises have only become more insolvent since the paper was released, their losses doubling since Jan 2024 to the tune of ~$214 Billion as of this week.

This thread summarizes how the Fed is insolvent, operating illegally, opening itself up for lawsuits and destroying the American economy when it could just roll off its balance sheet and take cash losses like that. Instead, the Fed franchises choose to take cash losses by still paying their owners dividends and paying out interest to NYFed primary dealers via IORB and to MMFs in Reverse Repo transactions.

’Federal Reserve Losses and Monetary Policy’ Jan 2024

Paul H. Kupiec, Senior Fellow, American Enterprise Institute

Alex J. Pollock, Senior Fellow, Mises Institute

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4712022

Anonymous

(ID: Btivwl8T)

7/13/2025, 9:27:09 PM

No.510292730

>>510292793

>>510293443

>>510297181

7/13/2025, 9:27:09 PM

No.510292730

>>510292793

>>510293443

>>510297181

>>510292303

Federal Reserve Thread Series Part 2 of 4

https://archive.4plebs.org/pol/thread/491506260/

This thread summarizes the second of a series of four recent separate economics papers examining the current insolvency of the 12 regional Federal Reserve franchises (aka ‘Fed bank/s’ ITT). This paper uses Ordinary Least Squares (OLS) linear regression analysis to examine how shocks from three variables: federal debt, the Federal Reserve assets and/or real GDP affect CPI (chosen to represent prices and inflation).

Mr. Webster’s paper describes how quickly prices respond to shocks in the above three variables and how quickly a new (often higher) price equilibrium is found and how the rest of the system converges to support this new price equilibrium. This paper seeks to measure how quickly the now-insolvent Fed banks enable or ‘accommodate’ the deficit-ridden US government by purchasing securities and how this accommodation then contributes to inflation and price hikes, as measured by CPI.

The Fed banks’ ‘accommodative’ QE purchases of excess US Marketable Debt make room for even more new debt to be issued and *hopefully* sold. This is called Fed ‘accommodation’ and is now becoming a ‘debt death spiral’, which is when a nation (or corporation) has to issue new debt to raise the funds to pay the interest on its old debt. Unfortunately, this new constant debt issuance floods the economy with new currency, mostly enriching the proximal investment class and exacerbating inflation for the rest of us. These QE policies have also led to the insolvency of the Federal Reserve today, massive capital losses and full balance sheets with no room for the Fed to move, further handicapping the debt-based central bank.

The Myth of Fed Political Independence

Thomas J. Webster, Professor Emeritus, Lubin School of Business, Pace University, New York, NY.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4916388

Anonymous

(ID: Btivwl8T)

7/13/2025, 9:27:46 PM

No.510292793

>>510293443

7/13/2025, 9:27:46 PM

No.510292793

>>510293443

>>510292730

Federal Reserve Thread Series Part 3 of 4

https://archive.4plebs.org/pol/thread/494723606/

This thread summarizes the third in a series of four recent economics papers examining the current insolvency of the 12 regional Federal Reserve franchises.

The third paper explores options for reformation or replacement (abolition!) of the insolvent Fed. The paper begins with a historical analysis that chronicles the Fed’s many past policy failures & their respective crises & how the Fed’s response to said crises further enabled Fed accommodation of $trillions in deficit spending by Congress. The Fed’s four ‘prescriptive’ rounds of QE purchases of US treasuries & MBSs have now resulted in hundreds of billions of embarrassing Fed capital losses & ZERO remittance to the US Treasury since October 2022. But, somehow the Fed is still able to pay out dividends to its shareholders and able to pay out interest on Reserve Balances (IORB) to banks & interest on reverse repo transactions to money market funds (MMFs).

This paper has broad rule recommendations that aim to rein in the Fed & reduce both manipulation & subsidies by Fed market interference. However, these rule recommendations do not address the inflation and recessions already caused by the Fed’s monetary policies. These monetary policy shortcomings could be directly addressed by 1) the abolition of the Fed(!), 2) free banking & 3) commodity-backed money. This paper loosely represents a coalition of conservative groups & their suggestions on how to fix the insolvent Federal Reserve. It examines the current system of borrowing the Fed's private currency, the Federal Reserve Note, & how we can return the role of currency issuance back to the US Treasury, & thus back to the people.

Project 2025 Mandate for Leadership: The Conservative Promise (April 2023)

Chapter 24: ‘Federal Reserve’

Paul Winfree (& additional contributors)

https://static.project2025.org/2025_MandateForLeaders

Anonymous

(ID: Btivwl8T)

7/13/2025, 9:29:21 PM

No.510292921

7/13/2025, 9:29:21 PM

No.510292921

The third paper was weak, but the first of its kind to suggest the abolition of the Fed. One of the paper’s shortcomings detailed in an excerpt from the Part 3 of 4 thread:

*************** I pause the thread here to point out another egregious error right in the middle of the economic paper being examined. As I have noted before in past threads, such high school-tier errors are so bad that it looks as though these economics papers are not even proofread at all.

Picrel is the error and the following text is what I think the author was trying to convey:

>If government issues too much paper currency, then citizens will doubt the gold peg and turn in their paper for gold from their banks, and these Tier 2 banks, in turn, will then redeem that same paper from the US Treasury and drain the government’s gold

Please feel free to correct me if I am missing something.

To make such an egregious error in the most important sentence in the entire paper begs the question, was it on purpose, mocking the public or are they trying to trick the public into turning in their gold again lololol?

The error in pic related is an example that NO ONE is watching or correcting these people. This author worked for Trump as an economic advisor in his first term. These are the people running the show. This is who we have to rely on to fix things and that is not good. This is why we must be vigilant even more so now, not to just let them install whatever fuck they think b/c THEY ARE THE SAME PEOPLE THAT GOT US HERE IN THE FIRST PLACE.

Anonymous

(ID: UBqoHFDP)

7/13/2025, 9:31:52 PM

No.510293147

7/13/2025, 9:31:52 PM

No.510293147

>>510284926 (OP)

Because Israel has blackmail of our politicians raping, torturing, and sacrificing kids.

Anonymous

(ID: Btivwl8T)

7/13/2025, 9:35:28 PM

No.510293443

7/13/2025, 9:35:28 PM

No.510293443

>>510292303

>>510292730

>>510292793

<<<<---this will be part 4 of 4

this paper is by Miran, who is now trump's economic advisor

this is who is suggesting the century bonds and wants to use our gold proceeds to buy forward swaps to pay down the debt lol

this was mentioned in these posts above:

>>510287824

>>510287102

Anonymous

(ID: Btivwl8T)

7/13/2025, 9:37:51 PM

No.510293626

>>510293922

>>510297596

7/13/2025, 9:37:51 PM

No.510293626

>>510293922

>>510297596

>>510292252

The NYFed’s primary dealers and their ilk want to tokenize all asset classes so they remain in a top, untouchable tier of shareholders that takes no risk and always gets paid.

pic related: JPMC is JPM, the largest owner of the NYFed private franchise

The NYFed-ilk BlackRock and Citadel have just opened a new exchange in Texas, where there are no capital gains on metals.

So, they are likely looking to have some con that involves switching from one asset class token to another (from treasuries tokens to MBS tokens to metals tokens) via blockchain asset tokens, then leaving with their gold assets with no capital gains.

These asset tokens would also allow fractional ownership, so they can fleece even the poorest investor.

Central banks are now acquiring gold to back their own currencies, NOT to convert from gold to digital, but to give them a seat at the NYFed/BIS/IMF TOKENIZED ASSET table

the global pie is getting bigger for these classists, as they sell each of their own nation's future productivity, making the domestic pie much smaller for each citizen.

Anonymous

(ID: Rhx1o4jI)

7/13/2025, 9:40:43 PM

No.510293851

7/13/2025, 9:40:43 PM

No.510293851

>>510284926 (OP)

The stated reason is to keep politics out of currency creation. The real reason is to keep Goyim hands off currency creation. As long as Jews control the money supply, they control everything or close to it.

Anonymous

(ID: Btivwl8T)

7/13/2025, 9:41:26 PM

No.510293922

>>510293981

7/13/2025, 9:41:26 PM

No.510293922

>>510293981

>>510293626

>The NYFed’s primary dealers and their ilk want to tokenize all asset classes so they remain in a top, untouchable tier of shareholders that takes no risk and always gets paid.

the clearinghouse (in this case, the token platform) is the ultimate claimant in any bankruptcy or crisis

>what is safe harbor?

Anonymous

(ID: Btivwl8T)

7/13/2025, 9:42:20 PM

No.510293981

7/13/2025, 9:42:20 PM

No.510293981

>>510293922

>>The NYFed’s primary dealers and their ilk want to tokenize all asset classes so they remain in a top, untouchable tier of shareholders that takes no risk and always gets paid.

<<<--safe harbor

Anonymous

(ID: Btivwl8T)

7/13/2025, 9:50:32 PM

No.510294679

7/13/2025, 9:50:32 PM

No.510294679

Anonymous

(ID: Btivwl8T)

7/13/2025, 9:51:55 PM

No.510294813

7/13/2025, 9:51:55 PM

No.510294813

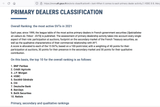

and the new Clarity act introduced makes the SEC and the CFTC the rule makers for any digital assets used internationally

pic rel

Anonymous

(ID: Btivwl8T)

7/13/2025, 9:54:32 PM

No.510295028

7/13/2025, 9:54:32 PM

No.510295028

this is all just the frauds and failures of 2008 fleeing their bankrupt Federal Reserve Note to their new system of debt-backed stablecoins also issued by the broke ass Fed

Anonymous

(ID: Btivwl8T)

7/13/2025, 9:55:32 PM

No.510295113

>>510295298

7/13/2025, 9:55:32 PM

No.510295113

>>510295298

A reminder, Federal Reserve Notes are what are being issued to worthless oblivion and

>the US dollar is a fucking UNIT

We need to AGAIN issue debt-free, Treasury-issued US Notes like we did before (and during) the bloodsucking, obsolete Federal Reserve. We need to AGAIN issue debt-free US Notes that are pegged to a basket of commonly-used weighted commodities, distributed by a series of state banks.

We can:

1 nationalize Fed banks

OR

2 dissolve Fed and have a series of state banks

OR

3 issue US Notes simultaneously AGAIN and eventually recycle worthless Federal Reserve Notes out of circulation

OR

4 YOU CAN RIGHT NOW: use cash/barter/stack/use credit unions/use cold wallets, these five things IMMEDIATELY transfer power directly to the people

USE CASH, NO MATTER WHAT COUNTRY YOU ARE IN, cash IMMEDIATELY puts the power in the hands of the people.

Real paper cash:

>is permissionless

>is private

>is anonymous

>has no transaction fees

>works in power outages

>doesn’t need the internet

>don't need to be a coder to use it

>doesn't depend on another party having a device

>everyone knows exactly how much they have

>has no transaction limits or thresholds for reporting

>money laundering is harder with physical cash, due to transport

>is inclusive, it does not see race

>is harder to use in ransoms

>can’t be hacked

>don’t need to remember a password to use it

>IS the ultimate in payment platforms

>using cash helps people to save money and budget

>puts the power directly in the hands of the people

>keeps the currency near the REAL goods and services

>less paperwork

>is face to face, not face to screen

>makes government theft harder

>using cash forces the debt-based Federal Reserve to serve the citizens

Boycott businesses that do not take cash.

NEVER USE YOUR PHONE TO PAY.

Barter is the real torpedo to these fucking clowns.

Anonymous

(ID: Bzc0sBMq)

7/13/2025, 9:57:25 PM

No.510295298

>>510295583

7/13/2025, 9:57:25 PM

No.510295298

>>510295583

>>510295113

I appreciate your effort post.

Anonymous

(ID: Btivwl8T)

7/13/2025, 10:00:26 PM

No.510295583

7/13/2025, 10:00:26 PM

No.510295583

>>510295298

yw

the current tech trend is for citizens to not hold or own information or organize it or remember it

they also do not store it on their own computers, but in a foreign cloud that tracks all changes in real time

they only have instantaneous ACCESS to information

people are not being conditioned to retain info or organize it for themselves

tptb are now waiting for anyone with a high amount of intellect and knowledge to die off, then they will just be left with the malleable, dumbed-down 'instantaneous access' population that can't put two and two together

the people already have the power to stop any tyranny by SIMPLY USING CASH AND LEAVING YOUR PHONE AT HOME sometimes

these two simple things destroy these type of surveillance plans

you already have the fucking power

it is YOU that chooses to continue using the grid to your own detriment

you already have the power right now

you have agency still

they just need your consent to implement it wholly, then having agency won't even matter

Anonymous

(ID: Btivwl8T)

7/13/2025, 10:01:23 PM

No.510295662

7/13/2025, 10:01:23 PM

No.510295662

the great irony here, is the more cash the public uses, the more it forces the Fed franchises to hold the interest-free fiat as liabilities (aka CIC cash in circulation) and FORCES THE FED TO SERVE THE CITIZEN

Anonymous

(ID: Btivwl8T)

7/13/2025, 10:05:01 PM

No.510295948

7/13/2025, 10:05:01 PM

No.510295948

>>510287102

>And note: Powell just got caught lying to Congress about this.

<<<----lol

Anonymous

(ID: Btivwl8T)

7/13/2025, 10:07:28 PM

No.510296149

7/13/2025, 10:07:28 PM

No.510296149

<<<---17fucking91

why we shouldn't have a Federal Reserve debt-based central bank

Anonymous

(ID: Btivwl8T)

7/13/2025, 10:16:04 PM

No.510296829

7/13/2025, 10:16:04 PM

No.510296829

>>510292303

>$235 Billion in losses as of this week.

updated amount for all Fed franchises in the hole, with the NYFed being the most in the hole

do note the Atlanta Fed has turned positive using the Fed's magic accounting skills

Anonymous

(ID: MljZFxEn)

7/13/2025, 10:18:35 PM

No.510297059

7/13/2025, 10:18:35 PM

No.510297059

>>510284926 (OP)

Tariffs are objectively working so well even CNN and NBC and other liberal networks are admitting to it. You are fucking stupid if you think they aren't. We now have imperical evidence of tariffs bringing in massive surplus. I'm tired of stupid people not understanding how tariffs work and how they IMPROVE domestic industry.

Anonymous

(ID: Btivwl8T)

7/13/2025, 10:19:45 PM

No.510297181

7/13/2025, 10:19:45 PM

No.510297181

>>510292730

>constant debt issuance floods the economy with new currency, mostly enriching the proximal investment class and exacerbating inflation for the rest of us.

in pic rel they admit this

Anonymous

(ID: MomhkijC)

7/13/2025, 10:24:26 PM

No.510297596

>>510298092

7/13/2025, 10:24:26 PM

No.510297596

>>510298092

>>510293626

Thank you for bringing this to my attention anon

Anonymous

(ID: Btivwl8T)

7/13/2025, 10:30:06 PM

No.510298092

>>510298325

7/13/2025, 10:30:06 PM

No.510298092

>>510298325

>>510297596

we need to issue US Notes again for the citizens by the citizens

they can be backed by metals, too

Look at pic related, we issued SIX types of notes SIMULTANEOUSLY for our currency needs. We can issue debt-free US Notes simultaneously with Federal Reserve Notes (only for deficit spending and to be only used in the US). We can then slowly recycle Federal Reserve Notes out of circulation, pay down our debt and not issue any new debt.

The US Dollar will be around long after the Federal Reserve is gone. The world is rejecting the Federal Reserve Note, not the US Dollar. The US Dollar is a UNIT. The US Dollar will ALWAYS exist, it is not fucking ISSUED, it is a unit of measurement.

Anonymous

(ID: MomhkijC)

7/13/2025, 10:32:46 PM

No.510298325

>>510298446

7/13/2025, 10:32:46 PM

No.510298325

>>510298446

>>510298092

I’m all for us notes (that will be the day…)

But precious metals? What’s wrong with crypto (state issued, capped at birth)

Anonymous

(ID: Btivwl8T)

7/13/2025, 10:34:06 PM

No.510298446

7/13/2025, 10:34:06 PM

No.510298446

>>510298325

an energy intensive currency is the very LAST thing we need lol

Anonymous

(ID: Btivwl8T)

7/13/2025, 10:36:18 PM

No.510298619

7/13/2025, 10:36:18 PM

No.510298619

cold wallets are good

pic rel is a power point made for the fed

guess which side the fed wants for its blockchain

Anonymous

(ID: MomhkijC)

7/13/2025, 10:50:31 PM

No.510299749

7/13/2025, 10:50:31 PM

No.510299749

Well when this thread dies know that I love you anon, you’ve given me things to think about I thought I had retired from thanks to anons like you telling me about BTC in 2010

Anonymous

(ID: Btivwl8T)

7/13/2025, 10:51:16 PM

No.510299796

7/13/2025, 10:51:16 PM

No.510299796

There is not a country on Earth that practices free market capitalism. The debt-based Federal Reserve is a con, plain and simple. God only knows what true capitalism, real price discovery and sovereign nations trading with each other in a free market would be like. Imagine sovereign nations issuing their own currencies. God only knows where we would be today, had the Federal Reserve and the IRS (both created in 1913, btw) never been created. No orchestrated booms and busts, no crony State Capitalism, no corporate tax subsidies, no failing IPOs, no QE, no counterfeiting Central Banks, no metal market rigging, no derivatives, no endless war financing. Only states were supposed to impose an income tax. We are so far from free market capitalism, it is staggering. This is the Federal Reserve Uniparty

Anonymous

(ID: Btivwl8T)

7/13/2025, 10:52:30 PM

No.510299900

7/13/2025, 10:52:30 PM

No.510299900

much love to all anons and God bless this board

Anonymous

(ID: MomhkijC)

7/13/2025, 10:53:19 PM

No.510299956

7/13/2025, 10:53:19 PM

No.510299956

Silver it must be

Anonymous

(ID: tFV/gGfF)

7/13/2025, 10:57:24 PM

No.510300304

>>510300520

>>510303369

7/13/2025, 10:57:24 PM

No.510300304

>>510300520

>>510303369

>>510284926 (OP)

Oh a schizo thread.

Anonymous

(ID: Btivwl8T)

7/13/2025, 11:00:10 PM

No.510300520

7/13/2025, 11:00:10 PM

No.510300520

Anonymous

(ID: Btivwl8T)

7/13/2025, 11:02:30 PM

No.510300704

7/13/2025, 11:02:30 PM

No.510300704

The NY Fed's Quantitative Easing (QE) counterfeiting scheme:

NYFed buys treasuries (and MBSs) outright from (only) NYFed primary dealers by creating reserves out of thin air, which seditiously undermines Congress’ sole power to regulate our currency. This is QE.

NY Fed’s primary dealers then take those reserves and earn Interest on Excess Reserves aka IOER (now called IORB) on them at the NYFed, interest which IS PAID IN CASH to the primary dealers--cash, which they DO MAKE INTEREST ON, this is their counterfeiting scheme (also, every penny paid in interest (cash) to the primary dealers for excess reserves also reduces the Fed’s remittance to the US Treasury).

The NYFed used QE to bail themselves out during the financial collapse of 2008 and is how its primary dealers have been effectively counterfeiting our currency ever since.

the Fed NEVER paid out interest before fucking 2007/8

Anonymous

(ID: Btivwl8T)

7/13/2025, 11:04:59 PM

No.510300921

7/13/2025, 11:04:59 PM

No.510300921

First:

US Gold Notes and US Silver Notes are interest-free, metals-backed, NON-fiat notes that could be issued by the US Treasury TODAY.

US Notes are interest-free, fiat notes that could be issued by the US Treasury TODAY, they can also be metals-backed and were intended to be used as a tool for the citizens to trade.

Federal Reserve Notes are DEBT-BASED, fiat notes issued out of thin air by the privately-incorporated, now-BANKRUPT Federal Reserve 12 regional franchises and are currently bankrupting the US Treasury.

All of the above are ALL DENOMINATED IN US DOLLARS (aka $US), which is a fucking UNIT.

And secondly, there are FOUR ways currency is created in the US:

1 Congressionally-approved Public Issues treasuries for deficit spending via the issuance of marketable US treasuries sold by the NYFed’s primary dealers aka Debt Held by the Public (now ~$35 T)

2 Intragovernmental Debt GAS securities (aka ‘Unfunded Liabilities’) that are created/issued for currency to run public agencies (over $152 T now) and ARE PURCHASED WITH YOUR PAYROLL TAXES

3 The commercial tier 2 depository banking sector, it makes small loans in which only the interest remains in the banking system after the loan is paid back (the principal and repayments are destroyed when the loan is repaid) —this can remain when the Fed is dissolved

4 QE, this is fucking counterfeiting by the now-insolvent NYFed's primary dealers since 2008 via IOER (now called IORB) and we pay all sorts of interest on this, increasing every day with raising rates

Anonymous

(ID: Btivwl8T)

7/13/2025, 11:25:29 PM

No.510302424

>>510302878

>>510303141

7/13/2025, 11:25:29 PM

No.510302424

>>510302878

>>510303141

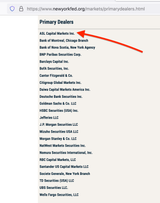

The NYFed runs the fucking planet, make no mistake about it.

<<<——— the international banking cartel driving humanity into the ground

>private owners of the NYFed, aka shareholders aka primary dealers

>privately-incorporated company

>market makers for US treasuries

>used to be 46, now there are 24

>Five-time felon JPM is the largest

Behold, people! The failures of 2008 on fucking QE steroids.

>24 nation-less financial corporations destroying the planet with national indebtedness, purposeful arbitrage and false scarcity

<<<<----also, NYFed fulfilled its diversity requirement by adding a new Primary Dealer, ASL Capital Markets, owned by an Arab banker (a minority-owned business), been in business three years and now issuing our currency

Anonymous

(ID: Btivwl8T)

7/13/2025, 11:31:06 PM

No.510302878

>>510303141

>>510303141

7/13/2025, 11:31:06 PM

No.510302878

>>510303141

>>510303141

>>510302424

The Bank Of International Settlements (BIS) is the head of all debt-based central banks (and founded by JPM) and was created in 1930 under the Versailles Treaty to get money from Germany for all the nasty shit they did in WWI.

The Federal Reserve and the Bank of England existed way before the BIS, the BIS morphed into their central clearing house and check-kiting hub for the first fractional-reserve, fiat, debt-based central banking schemes run in a few countries and then expanded from there to installing its central banks in over sixty countries.

Pic related

Note Iran, Iraq, Cuba, Syria, North Korea, Afghanistan, and Venezuela are NOT on the list lol

Note China IS ON THE LIST

>China begged to be in the basket of currencies under the IMF and BIS in 2015 and the yuan was finally used in 2017

>only took the NYFed four years to get China bent over the table

>Damn

Note Ukraine is NOT on the list, as it was a 2014 freshly-installed regional NYFed bank branch, it was still on probation

Russia is looking to get off the list.

The NYFed is similar to a space ship in sci-fi movies that hovers over nations and sucks up all the resources, slowly orbiting the planet.

Note that the NYFed and the Fed Board of Governors were just added as separate entities on this list

Anonymous

(ID: Btivwl8T)

7/13/2025, 11:34:05 PM

No.510303141

>>510303238

7/13/2025, 11:34:05 PM

No.510303141

>>510303238

>>510302878

An India anon’s thread on the NYFed’s primary dealers:

https://archive.4plebs.org/pol/thread/419352960/

<<<<——this thread shows the SAME primary dealers in all of the debt-based central banks listed in the image in

>>510302878, which reads just like the list of the NYFed’s primary dealers as seen in

>>510302424

Anonymous

(ID: Btivwl8T)

7/13/2025, 11:35:17 PM

No.510303238

>>510303270

7/13/2025, 11:35:17 PM

No.510303238

>>510303270

>>510303141

>SAME primary dealers in all of the debt-based central banks

some examples

Anonymous

(ID: Ab37G7pZ)

7/13/2025, 11:35:21 PM

No.510303244

7/13/2025, 11:35:21 PM

No.510303244

Anonymous

(ID: Btivwl8T)

7/13/2025, 11:35:49 PM

No.510303270

7/13/2025, 11:35:49 PM

No.510303270

>>510303238

>>SAME primary dealers in all of the debt-based central banks

Anonymous

(ID: Btivwl8T)

7/13/2025, 11:36:35 PM

No.510303332

7/13/2025, 11:36:35 PM

No.510303332

kek

Anonymous

(ID: MomhkijC)

7/13/2025, 11:36:58 PM

No.510303369

7/13/2025, 11:36:58 PM

No.510303369

>>510300304

I remember your kind

Every successful project in history has had its critics

Anonymous

(ID: JLWKZXbR)

7/13/2025, 11:37:03 PM

No.510303378

7/13/2025, 11:37:03 PM

No.510303378

>>510284926 (OP)

The fed is building me a house right now. Oh you aren't getting one?

Anonymous

(ID: PIgZrbT5)

7/13/2025, 11:39:03 PM

No.510303529

>>510304064

7/13/2025, 11:39:03 PM

No.510303529

>>510304064

Bump

You've been making these threads for years, anon.

So I want to say thank you for your tireless effort and constancy.

Keep at it, never give up!

Anonymous

(ID: Btivwl8T)

7/13/2025, 11:43:47 PM

No.510303897

7/13/2025, 11:43:47 PM

No.510303897

Anonymous

(ID: Btivwl8T)

7/13/2025, 11:46:08 PM

No.510304064

>>510304408

7/13/2025, 11:46:08 PM

No.510304064

>>510304408

>>510303529

we are all in this together, use cash as much as possible

Anonymous

(ID: PIgZrbT5)

7/13/2025, 11:50:31 PM

No.510304408

>>510305099

7/13/2025, 11:50:31 PM

No.510304408

>>510305099

>>510304064

I do. One of the few things I'm grateful for about german boomers is their stubborn refusal to transition non-cash transactions.

Anonymous

(ID: Btivwl8T)

7/13/2025, 11:50:48 PM

No.510304436

7/13/2025, 11:50:48 PM

No.510304436

debt-based central banks are going to become a thing of the past

currency issued in the form of debt, as we have today, is doomed to fail (as it is now)

once a currency is used as an investment, it is no longer useful as a currency

the treasury market globally will become meaningless

nations will begin to use their own debt-free sovereign currencies issued by their treasuries

the Fed will eventually be dissolved

the US Treasury will issue debt-free US Notes again

Currency backed by labor (productivity and services) makes a nation strong

Currency backed by debt makes a nation slaves

Anonymous

(ID: Btivwl8T)

7/13/2025, 11:59:36 PM

No.510305099

7/13/2025, 11:59:36 PM

No.510305099

>>510304408

yes, cash really serves the citizens, even when it is issued by a debt based central bank

this highlights the ultimate importance of fiat value given by the mutual cooperation of citizens

if fiat is issued by the treasury of a nation it is not a problem

it is a problem (such as the Federal Reserve Note) when it is borrowed from a private banking franchise

Why doesn't DOGE ever mention the debt, the Fed or interest paid to issue our own fucking currency?

It seems to me that Trump is cutting spending to be able to pay the interest with ease and take the limelight off the enormous debt interest payments.

Imagine how much money we would save IF WE ISSUED OUR OWN FUCKING CURRENCY.

musk, trump, dimon, karp, thiel, lonsdale all want:

-face to screen, never face to face

-no anonymity

-a permissioned currency

Trump is also beholden to these banks for his funding.

There is more and more accumulating evidence of Trump working IN THE INTERESTS OF THE NYFED AND NOT THE PEOPLE.

Anonymous

(ID: Jg4cvMPz)

7/14/2025, 12:01:33 AM

No.510305264

7/14/2025, 12:01:33 AM

No.510305264

>>510284926 (OP)

Because the pedophile blackmail mafia likes the way things are.

Anonymous

(ID: Btivwl8T)

7/14/2025, 12:24:17 AM

No.510307003

>>510308936

7/14/2025, 12:24:17 AM

No.510307003

>>510308936

>tech/greed/narcissism/corruption destroys humanity one person at a time

>people are surprised when the world turns into a superficial shithole loaded with people of low integrity, no skills and no standards

Watch as the Federal Reserve Uniparty owns, datamines, monetizes, surveils, and profits from every transaction on the globe:

today, most people are either:

corrupt (they are actively profiting)

compromised (someone is blackmailing them)

complicit (not outwardly doing anything illegal, but looking the other way so they may get theirs)

or

cowardly (they are too spineless to speak up)

We have all been living a horrible lie that only benefits those entities that issue the currency (24 international banks aka the NYFed's primary dealers) and those financial firms that they choose to fund.

This century-long, usurious scheme leads to a grotesque elitist class, inequality, misallocation of capital, and market rigging. This constant skimming by the privately-incorporated Federal Reserve Uniparty leaves the citizens downtrodden and constantly in need of new loans and taxes. Until the Fed has been abolished, we will ALL continue to devolve.

>just a slow, quiet descent into GLOBAL mediocrity, poverty and crime

>The NYFed, and its primary dealers — 24 private, nation-less, financial corporations, destroying the planet with national indebtedness, purposeful arbitrage and false scarcity

Anonymous

(ID: 1uAMZ8Eu)

7/14/2025, 12:34:20 AM

No.510307769

7/14/2025, 12:34:20 AM

No.510307769

>>510284926 (OP)

>Why doesn’t congress just legislate that the Federall Reserve

Anonymous

(ID: U+YR4yRL)

7/14/2025, 12:35:23 AM

No.510307855

7/14/2025, 12:35:23 AM

No.510307855

>>510284926 (OP)

>Why doesn’t congress just legislate that the Federall Reserve

Because the Federal Reserve is independent and the US isn't.

Anonymous

(ID: Btivwl8T)

7/14/2025, 12:46:51 AM

No.510308613

7/14/2025, 12:46:51 AM

No.510308613

NYFed is .org, not.gov, lol

Anonymous

(ID: Qha+Ih0Q)

7/14/2025, 12:51:07 AM

No.510308936

>>510309273

7/14/2025, 12:51:07 AM

No.510308936

>>510309273

>>510307003

There are those as well that know its mathematical fate and are decoupling from the combine as it destroys itself for th nth time in the histories they manage to salvage from all the rubble

Anonymous

(ID: Btivwl8T)

7/14/2025, 12:55:34 AM

No.510309273

7/14/2025, 12:55:34 AM

No.510309273

>>510308936

eastern europe (pic rel) is ripe for fleecing by NYFed banks

big US money is moving to europe and asia

they are looking for ASSETS HELD OUTRIGHT

1 assets not held with debt (like pic rel)

and

2 companies that don't hold debt as assets

Anonymous

(ID: Btivwl8T)

7/14/2025, 12:58:10 AM

No.510309447

>>510309617

>>510309884

7/14/2025, 12:58:10 AM

No.510309447

>>510309617

>>510309884

The current destruction and subversion of the United States by the Federal Reserve using:

-QE to counterfeit our currency and undermine its value

-MBSs to acquire land and buildings

-Congressional Public Issues for deficit spending to destroy the futures of the nation and the youth

-the Intragovernmental Debt system to skim off of GAS treasuries and the non-marketable government securities of US savings bonds, SLGSs (special securities issued for states and cities) and large government retirement funds such as the Thrift Savings Fund (managed by BlackRock), etc.

-their repo casino to pawn treasuries and undermine long term investment

-reverse repos to pay MMFs to NOT invest in the US economy

-metal market rigging via paper contracts to keep the prices of silver and gold low

-margin loans to fund risky hedge funds and family offices that endanger our global economy

-FX market rigging to check kite at their other implemented debt-based central banks

-the US taxpayer to fund the Ukraine war and steal its resources

-their authority to undermine innovation in crypto

-inflation to destroy the middle class

-interest rate hikes to kill off more small banks

-China investment to undermine the US and global stability

-regional bank vulnerability to target entire sectors

-its clout to protect its largest primary dealer, JPM, from prosecution for aiding and abetting sex trafficking at the highest levels of government, industry and finance PICREL

-their Sect 13.3 emergency powers to misallocate capital, reward failure and acquire assets during their avoidable, engineered crises using SPV (Special Purpose Vehicle) LLCs

-conflation of their increasingly-WORTHLESS Federal Reserve Note with the US Dollar (which is a fucking UNIT), thus destroying the value of a US Dollar on the world stage & threatening our global economy & national security

We need to dissolve the Fed, nationalize its twelve regional Federal Reserve bank franchises & AGAIN ISSUE debt-free US Notes.

Anonymous

(ID: Btivwl8T)

7/14/2025, 1:00:03 AM

No.510309617

>>510309704

7/14/2025, 1:00:03 AM

No.510309617

>>510309704

>>510309447

>MBSs to acquire land and buildings

<<<<---These MBS tranches (bought using QE) are held outright by the NYFed (NYFed acts as both note holder and MBS investor, multiple CUSIPs in each tranche, hundreds of properties in each CUSIP). If the mortgagor defaults (which 99% of them do/already have, which is why the NYFed bought them from their primary dealers in the first place), the deed then belongs to the Fed, who then either sits on the property (affecting housing values and skewing the housing market) or gives it to one of its triparty dealers to be rented (REITs) or to be picked over in foreclosure court. The NYFed now owns ~30% of all mortgaged homes, this was illegal before 2008.

The primary dealers that own the NYFed and the financial firms they choose to fund and that also make real estate purchases for the NYFed (i.e. BlackRock, Blackstone, Carlyle Group, American Homes 4 Rent) want to own all the properties, then the US government can become their customer through housing assistance; in this way, they form a closed loop of both supplier and customer, keeping the general public from owning any property, while profiting.

Under the guise of Covid, the NYFed and its ilk bought single family homes (MBS) and Commercial Mortgage-Backed Securities (CMBS), too, such as apartment buildings, trailer parks, nursing homes, offices, strip malls, warehouses, student housing, and RV parks and are keeping these real assets in their privately-incorporated LLCs (aka Special Purpose vehicles (SPVs)).

Update pic related to ~$2.2T

The purchase of these distressed properties by the NYFed causes false scarcity and false demand, which drive up housing (and rental) prices and prevents young and upcoming families from buying, fixing up and investing in these properties, as well as stopping new families from putting down roots in a community.

Anonymous

(ID: Btivwl8T)

7/14/2025, 1:01:05 AM

No.510309704

7/14/2025, 1:01:05 AM

No.510309704

>>510309617

>If the mortgagor defaults (which 99% of them do/already have, which is why the NYFed bought them from their primary dealers in the first place), the deed then belongs to the Fed,

Anonymous

(ID: Qha+Ih0Q)

7/14/2025, 1:03:24 AM

No.510309884

>>510310188

>>510310200

7/14/2025, 1:03:24 AM

No.510309884

>>510310188

>>510310200

>>510309447

>We need to dissolve the Fed

Ill tell you how

Anonymous

(ID: Btivwl8T)

7/14/2025, 1:07:22 AM

No.510310188

7/14/2025, 1:07:22 AM

No.510310188

Anonymous

(ID: Qha+Ih0Q)

7/14/2025, 1:07:32 AM

No.510310200

>>510310598

7/14/2025, 1:07:32 AM

No.510310200

>>510310598

>>510309884

By taking the pledge of the zero factor. Temple monetas has wore many faces but always rests on the same deception. Take no part in its profits, or desire its many favours. Infinite money is the sinews of war, and my have they gotten good at making sides in a puppet show. Become the individual that heralds the end of the age of the banker wars

Anonymous

(ID: Btivwl8T)

7/14/2025, 1:12:53 AM

No.510310598

7/14/2025, 1:12:53 AM

No.510310598

>>510310200

>Infinite money is the sinews of war, and my have they gotten good at making sides in a puppet show

this

Anonymous

(ID: Btivwl8T)

7/14/2025, 1:28:17 AM

No.510311685

7/14/2025, 1:28:17 AM

No.510311685

The Fed Reserve’s Board of Governors are nominated by the President and confirmed by the Senate. The Fed’s Board of Governors is a neutered and ineffective regulatory body, and under regulatory capture by the NYFed.

The 12 Federal Reserve Regional branches are the public franchisors, public franchisors which sell private franchisee stock to private banks in their region.

The private banks buy stock in their regional Fed franchise, private stock which earns dividends of 6% annually.

The NYFed is the largest and most powerful regional Federal Reserve branch franchise. It conducts all trading for the Federal Reserve and is custodian for its assets. Its biggest shareholders are the private big banks, aka the primary dealers, that issue our currency in the form of bond debt, who are the market makers for these US treasuries and since 2008 have been using those treasuries and QE to counterfeit our currency.

The Fed likes to confuse the publicly-appointed Fed Board of Governors with the privately-incorporated shareholders of the 12 regional Fed franchises, so people don’t realize we are paying private banks to borrow our own currency at interest.

Pic related

going to workout afk

Anonymous

(ID: gHKgLNMG)

7/14/2025, 1:37:08 AM

No.510312348

7/14/2025, 1:37:08 AM

No.510312348

>>510288552

>>510288766

This. The Federal Reserve has no right to exist.

Anonymous

(ID: Btivwl8T)

7/14/2025, 1:38:36 AM

No.510312475

7/14/2025, 1:38:36 AM

No.510312475

a bump before i begin workout

Anonymous

(ID: oZiwmrvV)

7/14/2025, 1:51:03 AM

No.510313455

7/14/2025, 1:51:03 AM

No.510313455

>>510284926 (OP)

The Federal Reserve isn't even part of the US government. It's its own private sector.

Anonymous

(ID: Btivwl8T)

7/14/2025, 2:14:00 AM

No.510315173

7/14/2025, 2:14:00 AM

No.510315173

7/13/2025, 7:53:02 PM

No.510284926

>>510285049

>>510285079

>>510285173

>>510285509

>>510288407

>>510288498

>>510288978

>>510289183

>>510290168

>>510293147

>>510293851

>>510297059

>>510300304

>>510303378

>>510305264

>>510307769

>>510307855

>>510313455

7/13/2025, 7:53:02 PM

No.510284926

>>510285049

>>510285079

>>510285173

>>510285509

>>510288407

>>510288498

>>510288978

>>510289183

>>510290168

>>510293147

>>510293851

>>510297059

>>510300304

>>510303378

>>510305264

>>510307769

>>510307855

>>510313455