TKD

(ID: JJ4ADGY+)

7/21/2025, 1:39:35 AM

No.510926057

>>510926158

>>510926186

>>510926786

>>510927462

>>510927675

>>510928193

>>510928692

>>510931249

>>510932284

>>510933637

>>510933787

>>510934089

>>510934154

>>510934235

>>510934535

>>510935183

>>510935215

>>510936015

>>510936572

>>510936620

>>510936738

>>510936836

>>510936950

>>510936992

7/21/2025, 1:39:35 AM

No.510926057

>>510926158

>>510926186

>>510926786

>>510927462

>>510927675

>>510928193

>>510928692

>>510931249

>>510932284

>>510933637

>>510933787

>>510934089

>>510934154

>>510934235

>>510934535

>>510935183

>>510935215

>>510936015

>>510936572

>>510936620

>>510936738

>>510936836

>>510936950

>>510936992

Bonds Are the Most Redpilled Investment

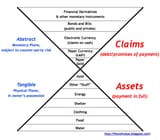

Everyone’s busy chasing crypto pumps, meme stocks, and whatever hype is trending online. Meanwhile, the people who actually control capital governments, central banks, and the elite are quietly holding bonds. Bonds aren’t flashy, but they’re powerful. They pay you consistent income, preserve wealth, and make you a creditor to the system rather than a victim of it. While most are screaming about inflation and economic collapse, bondholders are collecting checks and sleeping soundly.

Bonds represent stability, control, and long-term thinking. When you buy government debt, you're putting yourself in a position to benefit from the very system that exploits the undisciplined. You're not gambling on volatility. You're earning yield with minimal risk. Now that interest rates are no longer near zero, bonds are offering real returns again. Long-duration Treasuries, TIPS, and municipal bonds all provide solid options. And when the next crash hits, as it always does, bonds will do what they have always done: preserve capital and pay out.

This is what the elite have always known. Bonds are how dynasties are built, not through moonshot bets but through patience, income, and compounding. If you are serious about sovereignty, financial independence, and playing the long game, you need to stop chasing hype and start thinking like the people in power. Bonds are the redpill. Everything else is just noise.

Everyone’s busy chasing crypto pumps, meme stocks, and whatever hype is trending online. Meanwhile, the people who actually control capital governments, central banks, and the elite are quietly holding bonds. Bonds aren’t flashy, but they’re powerful. They pay you consistent income, preserve wealth, and make you a creditor to the system rather than a victim of it. While most are screaming about inflation and economic collapse, bondholders are collecting checks and sleeping soundly.

Bonds represent stability, control, and long-term thinking. When you buy government debt, you're putting yourself in a position to benefit from the very system that exploits the undisciplined. You're not gambling on volatility. You're earning yield with minimal risk. Now that interest rates are no longer near zero, bonds are offering real returns again. Long-duration Treasuries, TIPS, and municipal bonds all provide solid options. And when the next crash hits, as it always does, bonds will do what they have always done: preserve capital and pay out.

This is what the elite have always known. Bonds are how dynasties are built, not through moonshot bets but through patience, income, and compounding. If you are serious about sovereignty, financial independence, and playing the long game, you need to stop chasing hype and start thinking like the people in power. Bonds are the redpill. Everything else is just noise.