Anonymous

(ID: y/hwMrA/)

8/5/2025, 5:28:16 AM

No.512260158

>>512260875

>>512262308

>>512264510

>>512264649

8/5/2025, 5:28:16 AM

No.512260158

>>512260875

>>512262308

>>512264510

>>512264649

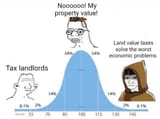

Take the georgepill

Land value taxes obliterate the ability of landlords to extort your hard earned wages.

This is not a property tax. Property taxes tax the value of the building and disincentivize growth. Land value taxes only tax the land value.

When real estate prices rise, is it because the buildings got magically better? No, it's because the land value increased.

That land value is the wealth generated by the productivity of the country and belongs to everyone, but landlords capture that value through extortion.

For example, take a landlord with a sharecropping farm. The landlord extorts the hard earned wealth that the tenants create. What gives him this power? Private ownership of land values.

If the landlord was taxed at exactly the amount he could lease his land to the tenants, then he can no longer make any money from extortion. He cannot pass the tax onto his tenants, because then they'd leave due to being unable to afford to live on the land.

That tax revenue can then be redistributed as UBI.

Sharecropping never ended. Today, people either rent or own their housing. When you rent, you pay the land rent to your landlord every month. When you buy, you pay an enormous land value sum to the previous owner for the right to extort rent on the land - even if you never rent it out. You're already paying the land value tax, it just goes to the landlord instead of society.

If land rent values are taxed at (ideally) 100%, then people will no longer be enslaved by modern sharecropping.

This is why no matter who you vote for, nothing gets better. Land values keep rising, and so rent rises, then land gets owned by an ever decreasing amount of people. The landlords extort out all the wealth the country generates.

Henry George developed Georgism, which describes this new system. Singapore is one of the best examples of his ideas being put into practice. They're not fully Georgist, but much of their economic policy is inspired by Georgism. It's a big reason why they're so wealthy.

This is not a property tax. Property taxes tax the value of the building and disincentivize growth. Land value taxes only tax the land value.

When real estate prices rise, is it because the buildings got magically better? No, it's because the land value increased.

That land value is the wealth generated by the productivity of the country and belongs to everyone, but landlords capture that value through extortion.

For example, take a landlord with a sharecropping farm. The landlord extorts the hard earned wealth that the tenants create. What gives him this power? Private ownership of land values.

If the landlord was taxed at exactly the amount he could lease his land to the tenants, then he can no longer make any money from extortion. He cannot pass the tax onto his tenants, because then they'd leave due to being unable to afford to live on the land.

That tax revenue can then be redistributed as UBI.

Sharecropping never ended. Today, people either rent or own their housing. When you rent, you pay the land rent to your landlord every month. When you buy, you pay an enormous land value sum to the previous owner for the right to extort rent on the land - even if you never rent it out. You're already paying the land value tax, it just goes to the landlord instead of society.

If land rent values are taxed at (ideally) 100%, then people will no longer be enslaved by modern sharecropping.

This is why no matter who you vote for, nothing gets better. Land values keep rising, and so rent rises, then land gets owned by an ever decreasing amount of people. The landlords extort out all the wealth the country generates.

Henry George developed Georgism, which describes this new system. Singapore is one of the best examples of his ideas being put into practice. They're not fully Georgist, but much of their economic policy is inspired by Georgism. It's a big reason why they're so wealthy.