>>513106534

You can't tell me these bankers understood the fruits of their policies. None of them would rather live in modern London, NYC, Chicago, etc than 1920s London, NYC, Chicago etc.

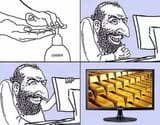

Fiat currency is one thing. Rule by fiat - government decree. The government declares that this piece of paper has value. That's fine. The problem is the continuous inflation in the amount of currency. So basically no one can save money because money is continuously becoming more plentiful and therefore becoming less demanded.

Short sighted politicians can short term buy voters by showering them in money. Especially the poor stupid voters that don't save money to begin with.

But back to the outset. This produces a ghetto. No one saves, poor people multiply, a culture where no one cares about saving up money takes over. Who cares about saving money? The government will just bail us out anyway. This rewards the worst people and punishes the best. People who blow through all their earnings on immediate gratification get bailed out by the government. People who would save up money to invest in something big and long term - like a farm or a factory? Their savings are constantly losing value.

Long term result: ghetto, unproductive, deindustrialized society, full of crime and rebellion. Not exactly what those genius bankers would want, I would think. And probably pretty easy for an actually competent industrialized society to conquer.

We keep acting like all these systems that are destroying us were designed to do so on purpose. Even though they are centuries old. Maybe the designers didn't realize what the long term consequences would be.

8/15/2025, 11:08:12 AM

No.513095845

[Report]

>>513096115

>>513096262

>>513096301

>>513096704

>>513096847

>>513097086

>>513097512

>>513098009

>>513098183

>>513099069

>>513099208

>>513099600

>>513104620

>>513108879

8/15/2025, 11:08:12 AM

No.513095845

[Report]

>>513096115

>>513096262

>>513096301

>>513096704

>>513096847

>>513097086

>>513097512

>>513098009

>>513098183

>>513099069

>>513099208

>>513099600

>>513104620

>>513108879