Anonymous

(ID: a5VZENXS)

10/15/2025, 12:07:01 AM

No.518906335

>>518907270

>>518907270

>>518909661

>>518912708

10/15/2025, 12:07:01 AM

No.518906335

>>518907270

>>518907270

>>518909661

>>518912708

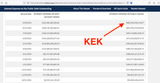

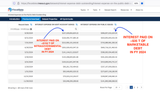

Our Intragovernmental Debt has been cut by ~$18T over the last fiscal year from $152 T to $134 T. Is this due to Trump's cutting of waste, incoming tariff revenues, elimination of useless government programs and departments?

Is it because people died during Covid?

Where did that $20T in unfunded liability obligations go? Was it also cut Medicaid/Medicare for illegal immigrants?

Did Trump actually eliminate $18T in waste?

And why is no one pointing this out on the right?

see red arrow in picrel

https://treasurydirect.gov/files/government/public-debt-reports/pd/pd_debtposactrpt_202509.pdf

Is it because people died during Covid?

Where did that $20T in unfunded liability obligations go? Was it also cut Medicaid/Medicare for illegal immigrants?

Did Trump actually eliminate $18T in waste?

And why is no one pointing this out on the right?

see red arrow in picrel

https://treasurydirect.gov/files/government/public-debt-reports/pd/pd_debtposactrpt_202509.pdf