Anonymous

(ID: 1h3RHEXJ)

10/15/2025, 4:25:24 PM

No.518954121

>>518954413

>>518956072

>>518956138

>>518956191

>>518956213

>>518956261

>>518956305

>>518956384

>>518956711

>>518956841

>>518956957

>>518956965

>>518957009

>>518957047

>>518957059

>>518957195

>>518957595

>>518958048

>>518958289

>>518958594

>>518958611

>>518958640

>>518958696

>>518958864

>>518959078

>>518959161

>>518959385

>>518959499

>>518959769

>>518959822

>>518959952

>>518960571

>>518960673

>>518960963

>>518961529

>>518961748

>>518962616

>>518962841

>>518963861

>>518964785

>>518964944

>>518965141

>>518965194

>>518965250

>>518965447

>>518966171

>>518966335

>>518966664

>>518968389

>>518968499

>>518968573

>>518969327

>>518970525

>>518971308

>>518971595

>>518971715

>>518972935

>>518974182

>>518974669

>>518974717

>>518974822

>>518974828

>>518975070

>>518976002

>>518976275

>>518976572

>>518977259

>>518977351

>>518979159

>>518979806

>>518981792

>>518983425

>>518983503

>>518986639

10/15/2025, 4:25:24 PM

No.518954121

>>518954413

>>518956072

>>518956138

>>518956191

>>518956213

>>518956261

>>518956305

>>518956384

>>518956711

>>518956841

>>518956957

>>518956965

>>518957009

>>518957047

>>518957059

>>518957195

>>518957595

>>518958048

>>518958289

>>518958594

>>518958611

>>518958640

>>518958696

>>518958864

>>518959078

>>518959161

>>518959385

>>518959499

>>518959769

>>518959822

>>518959952

>>518960571

>>518960673

>>518960963

>>518961529

>>518961748

>>518962616

>>518962841

>>518963861

>>518964785

>>518964944

>>518965141

>>518965194

>>518965250

>>518965447

>>518966171

>>518966335

>>518966664

>>518968389

>>518968499

>>518968573

>>518969327

>>518970525

>>518971308

>>518971595

>>518971715

>>518972935

>>518974182

>>518974669

>>518974717

>>518974822

>>518974828

>>518975070

>>518976002

>>518976275

>>518976572

>>518977259

>>518977351

>>518979159

>>518979806

>>518981792

>>518983425

>>518983503

>>518986639

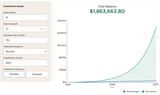

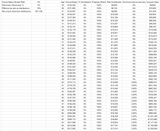

>investing a mere $100 a week into stocks will make you a multimillionaire by retirement age

>this is the AVERAGE return

You didn't listen to all the demoralization shills and piss your 20s away did you anon?

>this is the AVERAGE return

You didn't listen to all the demoralization shills and piss your 20s away did you anon?