Search Results

6/11/2025, 5:03:45 AM

>>81457143

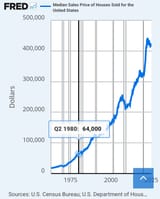

Yes, but you get a mortgage loan which is less than the S&P 500 growth, and make money off the difference, meanwhile the house still appreciates to 6x its value since 1980. Houses aren't supposed to appreciate in real terms.

Hence they are ~1.6x their value in real terms since 1980, which is a difficult entry price because real median wages are probably 1.3x that of 1980, and less than that for entry level jobs. Bringing down housing prices would bump real median wages by about 13% because they're a large part of inflation. It's not a disaster, but it is a policy failure.

Yes, but you get a mortgage loan which is less than the S&P 500 growth, and make money off the difference, meanwhile the house still appreciates to 6x its value since 1980. Houses aren't supposed to appreciate in real terms.

Hence they are ~1.6x their value in real terms since 1980, which is a difficult entry price because real median wages are probably 1.3x that of 1980, and less than that for entry level jobs. Bringing down housing prices would bump real median wages by about 13% because they're a large part of inflation. It's not a disaster, but it is a policy failure.

Page 1