Search Results

ID: jp2HRqs9/biz/60584596#60586893

7/6/2025, 10:17:28 AM

This might seem odd but let me give you a perspective from a poor country:

1) We had a stock market bubble in the last 25 years and it never recovered to those levels again

2) Our government bonds had a haircut (bankruptcy) in the last 20 years

3) Local banks offer investment products to normies with insane fees and almost zero real returns

4) Local banks do not offer access to normal ETFs and other index funds. People don't even know what they are.

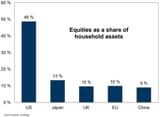

The result is that most people's investment is real estate not stocks or bonds. It's an overcrowded trade so buying a home is absolutely not worth it from a purely financial point of view. Maybe that's why nobody is having kids.

1) We had a stock market bubble in the last 25 years and it never recovered to those levels again

2) Our government bonds had a haircut (bankruptcy) in the last 20 years

3) Local banks offer investment products to normies with insane fees and almost zero real returns

4) Local banks do not offer access to normal ETFs and other index funds. People don't even know what they are.

The result is that most people's investment is real estate not stocks or bonds. It's an overcrowded trade so buying a home is absolutely not worth it from a purely financial point of view. Maybe that's why nobody is having kids.

Page 1