Search Results

ID: PjyTAZ4Y/biz/60520044#60521164

6/19/2025, 2:59:07 AM

>>60521119

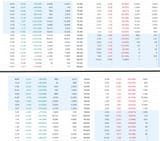

pic is RH stock options from Yahoo/Finance. The top half is for this Friday expiration, the bottom half is next Friday. The further out you go the more uncertainty there is about what the actual stock price will be, so the "risk" and premiums will be higher. The blue shading is In The Money for both calls (left side) and puts (right side). This pic shows a "straddle" with calls on the left and puts on the right, the strike price is in the middle. Compare the call premiums for this Friday and next Friday for a strike of 78 (in the money) and 79 first strike out of the money. If you sell a covered for next Friday strike 79 you will immediately be paid a premium of $251 (the market is closed now, and closed tomorrow, so Friday the prices will change, we are talking theory here. You bought the stock at 30 and current price is 78.58, so if you just sold the stock you make $48.58 x 100 = $4,858 profit. If you sold a call for next Friday and the call is exercised at 79 you also get the $251 premium for a total of $5,109. Look over the numbers, think about it understand, before making a decision. also be sure I did not make any mistakes in my calculations

pic is RH stock options from Yahoo/Finance. The top half is for this Friday expiration, the bottom half is next Friday. The further out you go the more uncertainty there is about what the actual stock price will be, so the "risk" and premiums will be higher. The blue shading is In The Money for both calls (left side) and puts (right side). This pic shows a "straddle" with calls on the left and puts on the right, the strike price is in the middle. Compare the call premiums for this Friday and next Friday for a strike of 78 (in the money) and 79 first strike out of the money. If you sell a covered for next Friday strike 79 you will immediately be paid a premium of $251 (the market is closed now, and closed tomorrow, so Friday the prices will change, we are talking theory here. You bought the stock at 30 and current price is 78.58, so if you just sold the stock you make $48.58 x 100 = $4,858 profit. If you sold a call for next Friday and the call is exercised at 79 you also get the $251 premium for a total of $5,109. Look over the numbers, think about it understand, before making a decision. also be sure I did not make any mistakes in my calculations

Page 1