Search Results

7/12/2025, 12:25:36 PM

>>510165917

>lol, no. It's never worked. Always goes fiat currency.

Hard currency doesn't fail. Politicians swich to fiat because it makes funding wars and then social programs (buying votes) possible.

Hard money enforces iron discipline. Budget deficits must be paid with taxes, because additional borrowing causes the interest rates to rise exponentially, and you can't do yield curve control by printing more money.

Hard money DOES have some disadvantages, especially gold based money which has liquidity issues. The reason why the Jew bankers paid US politicians to pass a law in 1873 DEMONITIZING silver, and making ONLY GOLD the definition of the US dollar was because gold was much more scarce, much less was available for mining in the USA compared with silver, (Nevada is called the silver state) and most of the gold in the world was controlled by the Rothschild owned Bank of England.

Today, with fractional gold going down to 1/10,000 of a gram, and blockchain technology, we could easily switch to a free market gold backed money that was completely independent of the government. It would be a voluntary money, used only with the voluntary consent of the market participants. Much like Bitcoin is used today.

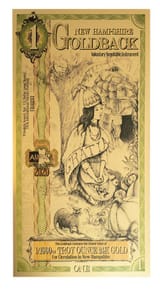

Do you own or use Bitcoin? Have you heard of Goldbacks? They are another example of a voluntary money that is actually in use. 1 Goldback = 1/1000 of a troy oz of gold vacuum deposited between two layers of polyester. It is voluntary legal tender in several US States today.

The market price of a Goldback is based on the spot price of gold + seigniorage (premium). The premium stays with the Goldback and becomes a permanent part of it's value. As gold goes up in price, Goldbacks become more valuable. An excellent example of the deflationary aspects of hard money.

Hard money requires saving IN ADVANCE. Fiat currency creates future debts. Eventually those future debts grow to unsustainable amounts that they inevitably crash the system.

>lol, no. It's never worked. Always goes fiat currency.

Hard currency doesn't fail. Politicians swich to fiat because it makes funding wars and then social programs (buying votes) possible.

Hard money enforces iron discipline. Budget deficits must be paid with taxes, because additional borrowing causes the interest rates to rise exponentially, and you can't do yield curve control by printing more money.

Hard money DOES have some disadvantages, especially gold based money which has liquidity issues. The reason why the Jew bankers paid US politicians to pass a law in 1873 DEMONITIZING silver, and making ONLY GOLD the definition of the US dollar was because gold was much more scarce, much less was available for mining in the USA compared with silver, (Nevada is called the silver state) and most of the gold in the world was controlled by the Rothschild owned Bank of England.

Today, with fractional gold going down to 1/10,000 of a gram, and blockchain technology, we could easily switch to a free market gold backed money that was completely independent of the government. It would be a voluntary money, used only with the voluntary consent of the market participants. Much like Bitcoin is used today.

Do you own or use Bitcoin? Have you heard of Goldbacks? They are another example of a voluntary money that is actually in use. 1 Goldback = 1/1000 of a troy oz of gold vacuum deposited between two layers of polyester. It is voluntary legal tender in several US States today.

The market price of a Goldback is based on the spot price of gold + seigniorage (premium). The premium stays with the Goldback and becomes a permanent part of it's value. As gold goes up in price, Goldbacks become more valuable. An excellent example of the deflationary aspects of hard money.

Hard money requires saving IN ADVANCE. Fiat currency creates future debts. Eventually those future debts grow to unsustainable amounts that they inevitably crash the system.

Page 1