Search Results

7/25/2025, 7:39:21 AM

>>511296444

Yes this is the overall Bessent-Vought et al. strategy

(while I understand and comprehend it/what their plan is) personally I don't think it's going to work

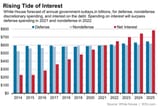

Interest on the debt is already tsunami-ing everything in sight

also, continuing to enable and encourage the central bank is never a good thing

Yes this is the overall Bessent-Vought et al. strategy

(while I understand and comprehend it/what their plan is) personally I don't think it's going to work

Interest on the debt is already tsunami-ing everything in sight

also, continuing to enable and encourage the central bank is never a good thing

7/6/2025, 10:41:34 AM

>>509638340

>memeflag 5 pbtid

Read my other posts on thread. The 'optimism' of the 1990s decade/Clintonism *was the Bullshit*

with that came the "promise of the internet" (which was kaboshed with the Dot Com Bust 2001 and has been validated now 2025 with palantir-ization / Social Credit-izing of everything)

The 1970s was peak of the west, everything since then—thanks primarily to post-1970s Financialization of the global economy (+ consequent segregation of the Real Economy of goods-services commodities into a finite ratmaze that never expands or benefits)—has been an enshittification of industrial society and daily existence. Globalism, neoliberalism, multiculturalism, and many other societal and geopolitical factors have played into and contributed to this environment

However one views it, global debt has grown to over 330 trillion dollars continuing to exponentially expand (with GDP far outpaced by it)

Interest Payments on government debt are one of the Brick Wall factors, but even more concerning (archive link upthread) is that no one wants to buy the debt. The end is near for the Golden Road of unlimited debt issuance and our debt-based illusory Tower of Babel + accompanying industrial society

>memeflag 5 pbtid

Read my other posts on thread. The 'optimism' of the 1990s decade/Clintonism *was the Bullshit*

with that came the "promise of the internet" (which was kaboshed with the Dot Com Bust 2001 and has been validated now 2025 with palantir-ization / Social Credit-izing of everything)

The 1970s was peak of the west, everything since then—thanks primarily to post-1970s Financialization of the global economy (+ consequent segregation of the Real Economy of goods-services commodities into a finite ratmaze that never expands or benefits)—has been an enshittification of industrial society and daily existence. Globalism, neoliberalism, multiculturalism, and many other societal and geopolitical factors have played into and contributed to this environment

However one views it, global debt has grown to over 330 trillion dollars continuing to exponentially expand (with GDP far outpaced by it)

Interest Payments on government debt are one of the Brick Wall factors, but even more concerning (archive link upthread) is that no one wants to buy the debt. The end is near for the Golden Road of unlimited debt issuance and our debt-based illusory Tower of Babel + accompanying industrial society

6/28/2025, 8:13:05 AM

>>508935728

Inflation is the overall effect of the *tandem* gigaexpansion of fiscal(gov spending) and monetary(treasury + central bank "moneyprinting") policies, that have now reached a rubicon. For the United States—issuer of the world's default reserve debt note fiat currencyu denomination USD and treasuries—Interest Payments on its debt now outstrips all discretionary spending.

The lions share of U.S. gov budget, goes to interest payments

Any 'nice cycles' are over with. The U.S. has about 4 more years and $12T of $2T-annum deficits before total default, but the system isn't going to last even that long. Global debt aka bond market will implode before the end of this year.

a prescient December 2019 panel six years ago, on the future of this post-Bretton Woods global system:

https://www.youtube.com/watch?v=SMHQaxd5N-Q

Inflation is the overall effect of the *tandem* gigaexpansion of fiscal(gov spending) and monetary(treasury + central bank "moneyprinting") policies, that have now reached a rubicon. For the United States—issuer of the world's default reserve debt note fiat currencyu denomination USD and treasuries—Interest Payments on its debt now outstrips all discretionary spending.

The lions share of U.S. gov budget, goes to interest payments

Any 'nice cycles' are over with. The U.S. has about 4 more years and $12T of $2T-annum deficits before total default, but the system isn't going to last even that long. Global debt aka bond market will implode before the end of this year.

a prescient December 2019 panel six years ago, on the future of this post-Bretton Woods global system:

https://www.youtube.com/watch?v=SMHQaxd5N-Q

Page 1