>>106172133

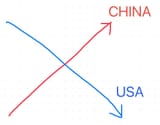

Being the reserve currency would usually still make them rise, even when they themselves isolate. Because the trade between e.g. China and Japan is still in USD and if that trade increases, they need to buy more USD.

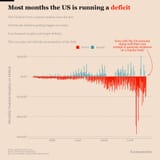

Basically, the USD debts should increase by the same level as the world wide GDP.

Meanwhile any other country, with its own currency, wants to keep its depts in relation to its own GDP.

The problem is, that China isn't interested in this scheme anymore - because the US itself enacted a trade war - so now the USA needs to find its stability in a debt increase relative to its sphere of influence.

Chinas GDP rose by over 200% between 2009 and now, the amount of US treasury bonds they hold, is now the same as 2009. The status as reserve currency can be considered over. The corrections the USA has to do because of this, is what we see now.

btw. You can see on the first graph that after 2008 crisis was over, it went a fair bit below 0, while after CoViD it still kept increasing.